For the past 50 years, anyone getting their hands dirty on a car would know the name Haynes. Martin Gurdon talks to a giant of motoring literature John Haynes is an unlikely giant of English literature. As an author and publisher, he's been responsible for books that have touched and probably improved the lives of a huge number of people, but they aren't self-help manuals. No, he's the father of that hardy perennial of the motoring man - and sometimes woman - the Haynes car manual, which this year turns 50.

If you want an English-language car DIY book, it will almost certainly be one of his. Today's cars are a lot more complex than they were in 1960, when Haynes first set up shop in the UK, but generally they don't break as much, nor do they need frequent between-servicing maintenance, so whilst European demand for repair manuals has declined to some extent ( although Haynes sold more than one million in Britain last year) he believes sales in the US and Australia are better than ever. In the outback, or rural Texas, being able to change a wheel bearing or repair a drive shaft could be a life-saving skill.

Elsewhere, the bonnet-up dad-ritual of fixing the car at the weekend, which survived well into the 1970s, has largely disappeared. This has led to a change of emphasis in his books about which bits to fix. "People might not take cars to pieces in the way they used to," says Haynes, "but they still need to know about things like taking a door trim to pieces to fix an electric window motor, so we concentrate more on stuff like that."

The economic downturn has also has also led to an increase in demand from people prepared to have a go at fixing something they'd previously paid someone else to tackle. Based in the English county of Somerset, complete with its own car museum, Haynes' publishing empire is a big business, having sold 150 million manuals to date. But the company owes its existence to its founder's rather isolated colonial childhood in 1950s Ceylon (now Sri Lanka), and his lack of sporting prowess as an English boarding school pupil.

"Dad was a tea planter, and the world I grew up in was very different," says Haynes, now 71. He and his brother didn't mix with the local children, who were separated by cultural and language barriers. "When we were about nine and 10, my brother and I used to ride round the tennis court on our bicycles. I remember once about 200 local children came to watch." John Haynes' father would sometimes take him round the tea plantation in a sit-up-and-beg Morris 8 saloon. "I suspect that was the only entertainment I'd have had all afternoon. In some respects, I was a very lonely little boy."

This singular childhood, where parental quality time often involved cars, helped forge a lifelong passion for them, and by the time Haynes arrived as a boarder at the Sutton Valence School in the English county of Kent, he'd spent years pasting pictures of exotic American models into scrapbooks ("although I'd never actually seen the cars," he says). Here he showed a flair for art, but not rugby, so instead of forcing him to endure regular scrum batterings, Haynes was allowed to spend the time building an Austin 7 Special, which involved the popular, late-1950s practice of buying a 1920s or 30s Baby Austin, often for £5 or less, throwing away its coachwork and replacing it with a new, lightweight body.

When it was finished, Haynes took his housemaster's wife for a trip round the school field in his creation, and was mortified when it leaked oil over her pale summer dress; although she'd just smiled, said the ride had been fun, and that she had every confidence he could fix the problem. He did, sold the car for a fat profit then decided to produce a book showing how he'd made it, using self-drawn illustrations. Having advertised this in MotorSport magazine, he sold the lot in 10 days. Later, after enrolling as an officer in the Royal Air Force, Haynes developed the idea and spent many off-duty hours writing early versions of his car repair books. By 1960, he was a fully fledged publisher with a London office, but found he wasn't busy enough.

"You can't hurry business - it goes at its own pace, and I was a bit lonely in London, so I rejoined the RAF." By the mid-60s this led to a posting to Aden, Yemen. "I was in charge of air movements. It was a terrific job; then I was transferred to RAF Harrogate, where I looked after computer printouts. I'd get requests for 1,000 hangers, but they were for coats, not aircraft. I was bored out of my tiny mind."

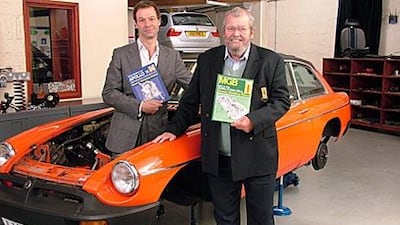

Leaving the RAF again meant buying out his commission and forfeiting his pension. "My dear mother, bless her socks, was horrified." This apparently impulsive decision turned out to be a good one, and in 1967 Haynes produced a manual for the MGB sports car, which has had an enduring appeal. "It's never been out of print," he says proudly. "We still sell about 150 a month in Britain, and twice that in America."

These are sales many struggling novelists could only dream of, and have been driven by this iconic car's very particular market. The youngest B is now pushing 30, and most have gone through several hands. These cars frequently move on every two or three years, but often, the manuals bought for them don't, because they've become tatty and oil stained. This means Haynes can sell new ones to new owners.

People sometimes live vicariously through his books. When Haynes' Porsche 911 manual appeared in the US, sales exceeded the number of actual cars by about 50 per cent. He reckons that people who couldn't afford a Porsche could at least buy a manual, which revealed their fantasy's inner secrets. Haynes is relinquishing the day-to-day running of the business to son John (known, for obvious reasons, as 'J'), but will remain on the board. Although working for the family firm could almost be something J had been born into, he did spend time in banking before working with his dad.

"My crib was a packing case next to a printing press, because mum was very involved with the business too," says Haynes Junior. He's been a driving force behind the ultra-familiar Haynes manual typeface and exploded diagrams being applied to mugs and T-shirts, and the format is being used for books on men's health, cooking for blokes and even chicken keeping. If you want to know how to take a Second World War Spitfire fighter aeroplane to bits, Haynes has a manual with every last flap and aileron stripped bare.

"We've always stuck to the fundamental principle of taking something apart to show how it works," says J. Turning a profit from publishing has never been tougher, and it's been Haynes' good fortune to have come up with an instantly recognisable idea that can be applied to an infinite number of things and has never really gone out of fashion. "The [manual] is one of few books you could hold up at one end of a room and people would know what it was," says J.

Still, it's the versions used to fix cars that are clearly the ones where his dad's passion still lies. "I love cars," he says simply. "They're in my genes." motoring@thenational.ae Haynes manuals are stocked by Magrudy's and Kinokuniya, Dubai Mall.