Global foreign direct investment flows sank to their lowest level in 15 years in 2020 as the Covid-19 pandemic pummelled the world economy, according to the Organisation for Economic Co-operation and Development.

Global FDI fell by 38 per cent from the previous year to $846 billion, the Paris-based organisation said in a report.

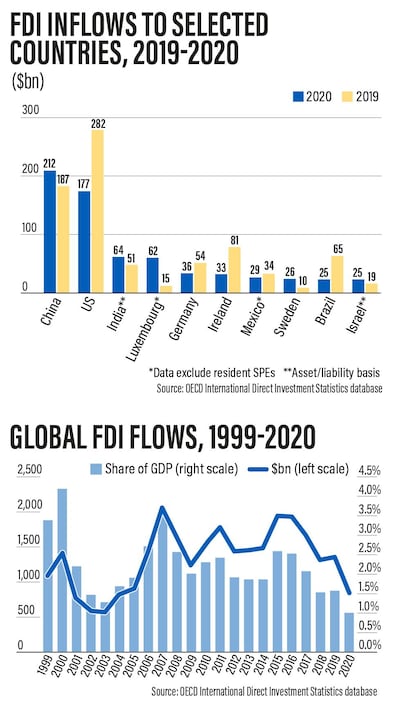

This represented only 1 per cent of the world's gross domestic product, the lowest level since 1999.

“This decrease represents the lowest level of equity flows in OECD countries seen since 2005, mostly resulting from major divestments from Switzerland and the Netherlands, for example, sales of existing stakes in companies in these two countries by foreign parents and large decreases in FDI flows in the US and other OECD countries,” the report said.

OECD economies contracted by 4.9 per cent in 2020, the largest drop since 1962, as GDP slowed to 0.7 per cent in the fourth quarter.

Almost all countries in the OECD suffered a contraction in output last year, ranging from 3.5 per cent in the US to 9.9 per cent in the UK.

China, one of the few big economies to grow last year, overtook the US as the top FDI destination after large parts of the world’s No 1 economy were shut down due to the pandemic, the report said.

China and the US received FDI flows worth $212bn and $177bn, respectively. Apart from resident special-purpose entities, India and Luxembourg were the next largest recipients.

Luxembourg, the US and Japan were the largest sources of FDI outflows, according to the report.

The US remained largely stable last year while the FDI outflows of Japan and China declined.

The OECD expects a rebound in cross-border merger and acquisition activity – that began in the second half of last year and continued in the first quarter of this year in advanced economies – to boost FDI flows this year.

“Many companies turned to international transactions, emboldened by lower borrowing costs, an expected drop in acquisition prices and rosier prospects, with vaccines becoming available,” the report said.

It said this could boost FDI equity flows this year, unless the large divestments, which affected net FDI equity flows in a strong way last year, continue.

Last year, cross-border M&A transaction values were driven by a few large deals in specific sectors, the report said. More deals took place in the healthcare and technology sectors than in previous years.

FDI inflows to the OECD region declined by 51 per cent last year, partly because of significant divestments from Switzerland and the Netherlands, it said.

Outflows from the OECD area fell by 48 per cent to 2005 levels because of major divestments by companies in the Netherlands.

FDI inflows to non-OECD economies in the G20 fell by 9 per cent, driven by a rebound in China and India later in the year. FDI outflows across a number of non-OECD G20 economies dropped by 49 per cent, the data showed.

The OECD said last month that the social and economic disruption wreaked by the pandemic offered governments the opportunity to reset policy and put their countries on a more sustainable and inclusive path.

The global policy forum, which works with 100 countries around the world, said leaders could now address challenges such as income equality and regional economic divides, deliver a vibrant recovery and promote high-quality growth.

The International Monetary Fund raised its global economic forecast for a second time because of rapid Covid-19 vaccination campaigns and fiscal and monetary support provided by governments and central banks.

However, it warned policymakers about wider income gaps and an uneven recovery as richer countries rebound at a faster pace from the pandemic.

The global economy is now set to expand by 6 per cent this year, greater than an earlier forecast of 5.5 per cent, the Washington lender said in its latest World Economic Outlook in April.