The White House announced that the UAE has committed to a $1.4 trillion investment framework in the US related to artificial intelligence infrastructure, semiconductors, energy and manufacturing.

The announcement of the framework – which will be over a period of 10 years – follows a series of meetings between US and UAE officials, led by Sheikh Tahnoon bin Zayed, Deputy Ruler of Abu Dhabi and National Security Adviser, that began on Monday.

According to a news release from US President Donald Trump's administration on Friday, in addition to the investment framework, Emirates Global Aluminum “plans to invest in the first new aluminium smelter in the United States in 35 years, which would nearly double US domestic aluminium production”.

The White House also said that Abu Dhabi's sovereign wealth fund ADQ and Orion Resource Partners have agreed to a $1.2 billion mining partnership to secure supplies of critical minerals as part of the investment.

XRG, an international lower-carbon energy and chemicals investment company launched by Adnoc, would be solidifying its commitment to US natural gas production and exports, according to the White House.

“First and importantly, today’s announcement builds on the $1 trillion already under active investment by the UAE in the US,” Danny Sebright, president of the US-UAE Business Council, told The National.

“Today’s new commitments in the fields of energy, AI and infrastructure showcase the UAE’s view that investments in the US not only provide a stable, reliable and safe return on investment, but that the UAE also believes that new investments in these sectors hold the keys to further advancement of some of the most future facing technologies in the world.”

The investment framework announcement comes at the tail end of Sheikh Tahnoon's week-long visit to Washington, where he met Mr Trump, CIA director John Ratcliffe, Commerce Secretary Howard Lutnick and National Security Adviser Mike Waltz.

He also met Big Tech executives including Microsoft chief Satya Nadella and Nvidia founder Jensen Huang, as well as BlackRock chief Larry Fink.

The latter meeting on Wednesday followed a development concerning the AI Infrastructure Partnership (AIP), an artificial intelligence consortium backed by Abu Dhabi-based technology company MGX.

The AIP endeavour seeks to raise up to $100 billion to enhance the future of AI to develop new data centres and increase the capabilities of existing centres in the US and partner countries.

Nvidia and xAI also announced this week they would be joining the endeavour.

Sheikh Tahnoon's visit came a week after Dr Sultan Al Jaber, Minister of Industry and Advanced Technology and Adnoc chief executive, spoke on the need to invest in the US because of its energy and infrastructure access.

“This is where we see huge opportunities for the UAE to further invest and deepen partnerships with the US across multiple sectors, including the energy-AI nexus,” he said during the CERAWeek by S&P Global energy conference in Houston, Texas.

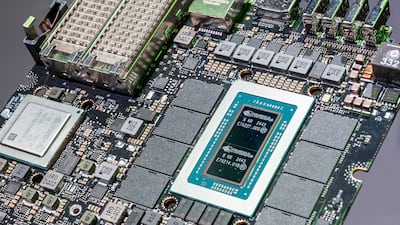

The UAE was expected during this week's meetings to make a push for the US to change its recently implemented AI Diffusion Rule, which made it more difficult for countries like the Emirates, Saudi Arabia, India and others to obtain powerful CPUs and GPUs needed for AI development.

That rule, implemented in the final days of former president Joe Biden's administration, sought to protect US technology from being used for AI development in China, but Microsoft and Nvidia have criticised the export rules as counterintuitive and harmful to US companies.

A source at Nvidia told The National that the rules will make it harder for various countries, many of them US allies such as the UAE, to build capacity for “non-frontier AI use cases”.

Frontier AI is a term used to describe highly capable AI models and technology that could pose severe risks to public safety. “This would capture a lot of GPUs that are included in gaming and other applications like health care and scientific research that don't have anything to do with frontier AI,” the source said.

It is not yet clear if the Trump administration will loosen or completely eliminate the chip export rules, but the UAE's visit definitely drove home the message about the country's AI ambitions.

“One of the things they [UAE] consistently hammer upon … is that if you want to lead in artificial intelligence, you have got to be leading in energy production,” US Vice President JD Vance said at American Dynamism Summit on Tuesday.

The UAE, the Arab world’s second-largest economy, has made significant investments in recent years in artificial intelligence.

In 2019, the country was among the first in the world to open a university dedicated to AI: the Mohamed bin Zayed University of Artificial Intelligence.

And last year, Microsoft announced a $1.5 billion investment in UAE AI and cloud company G42. Microsoft also opened its first Middle East AI for Good Lab in the UAE in Abu Dhabi that same year.

The UAE has also created several large language models, including Jais. Jais Chat, a mobile app iteration of Jais, also made a major impact in the country, as it uses both Arabic and English.

As the country continues to focus on diversifying its economy away from oil, it is expected to continue to double down on AI investment and research.