Mubadala Investment Company recorded a significant rise in both comprehensive income and assets under management in 2018 as Abu Dhabi’s strategic investment arm continued to invest globally, despite tough market conditions and macroeconomic headwinds.

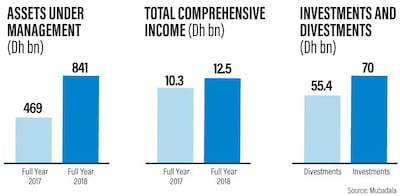

Comprehensive income increased 21 per cent in fiscal 2018 to Dh12.5 billion from a year earlier, Mubadala said in its annual review released on Monday. In line with its strategy to diversify its investment base, Mubadala monetised a number of its mature assets, realising a total of Dh55.4bn in funds, it said.

Mubadala’s capital investment surged to Dh70.1bn for the reporting period. The company, which invests globally on behalf of the Abu Dhabi Government, took stakes in ventures across new geographies and sectors including specialty pharma, MedTech and agribusiness, taking assets under management up to Dh841bn, an 80 per cent year-on-year jump.

Capital investments and managed assets both include contributions from the Abu Dhabi Investment Council, which merged with Mubadala last year amid a consolidation of wealth funds in the emirate, the company said.

“Mubadala is operating as a global investor to drive financial returns and strategic value for Abu Dhabi, towards a vision of an internationally-connected and future-focused economic base,” said Khaldoon Al Mubarak, Mubadala’s group chief executive and managing director.

“The addition of the Abu Dhabi Investment Council was a transformational step, strengthening our position as an international investor across different sectors,” he said.

Mubadala, which merged with International Petroleum Investment Company in 2017, is at the heart of the government's plans to diversify Abu Dhabi's revenue base and generate income from sources other than oil. Bringing Adic into its fold has significantly increased Mubadala's scale as an investor and expanded its global outreach. At home, the company has stakes in Emirates Global Aluminium; green-energy company Masdar; property developer Aldar; and a host of other companies including Abu Dhabi's diversified investment company Aabar, which has stakes in commodity trader Glencore and Italian bank UniCredit.

Mubadala's international investments include a shareholding in General Electric; private equity company Carlyle Group; Spanish refiner Cepsa; Austria's OMV; and petrochemicals companies Borealis from Austria and Nova Chemicals of Canada.

Mubadala is a cornerstone investor in SoftBank Group's $100bn (Dh367.25bn) Vision Fund, with commitments of $15bn. The company last year also joined hands with SoftBank and launched a $400 million fund to invest in European technology companies.

“Technological disruption is creating the potential for value across all sectors, which is an opportunity for us to deepen our position as a major global investor,” Mr Al Mubarak said. “We are also activating our investments and relationships to establish Abu Dhabi as the technology hub for the Mena region.”

As well as venturing into new investment sectors last year, Mubadala invested "additional and recycled capital" across the group's existing sectors including technology, aerospace, commodities and financial services.

The company has opened new offices in Moscow and San Francisco as it seeks returns in a broad range of geographies and asset classes. These offices add to its presence in Rio De Janeiro, and in Hong Kong through a joint venture. Earlier this year, Mubadala also opened an office in New York City.

Mubadala reduced its corporate debt through a combination of repayments, new issuances and favourable foreign exchange movements, it said, without elaborating.