Employees in the UAE face a contraction in salaries this year as a flood of new residents comes to the country, a senior executive at recruitment company Cooper Fitch said.

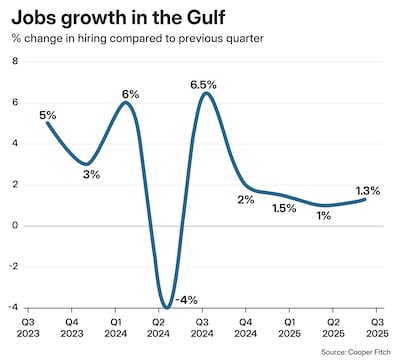

Hiring activity in the Emirates increased 3 per cent for the three months to the end of September as business activity and new orders picked up, Cooper Fitch’s third quarter Gulf employment index found. Meanwhile, about 200,000 people are moving to the country each year.

The Emirates' population is booming, and job seekers in many professions far outnumber the available roles. People are coming in and taking jobs for very low salaries to get their foot in the door, according to Trefor Murphy, founder and chief executive of Cooper Fitch.

“Despite the 5 per cent to 6 per cent population growth in the UAE annually, the skills and experience of new arrivals do not match the requirements of employers, he told The National.

“New people are looking at doing anything to get gainful employment. For instance, we've had dentists come to the UAE to work as real estate agents.”

When employers have access to people who are willing to take a job that's three levels below their skills, it makes it harder for existing talent in companies to get a “justifiable wage increase”, Mr Murphy said.

The UAE is also facing a surplus of skilled professionals in many roles, particularly at middle and senior management levels, according to recruitment experts. The country’s attractive lifestyle and tax-free salaries continue to draw skilled professionals from around the world.

Hiring in the UAE in the third quarter was robust for roles in senior finance, real estate, investments and public sector to a slightly lesser extent, Mr Murphy said.

The growth in ultra-high-net-worth individuals coming to the UAE is also contributing to the employment market because they're creating jobs.

“A lot of founders are coming to the UAE and setting up business, that's reflecting in the cost of commercial space. Organisations are trying to get office space in Dubai, but setting up in Sharjah instead because they can't find space here,” he added.

Saudi Arabia jobs

Saudi Arabia recorded steady hiring across manufacturing, supply chain and senior finance, with hiring activity growing 1.5 per cent in the third quarter, according to Cooper Fitch.

Hiring is on for big-ticket events like Asian Games, Asian Cup, Expo and World Cup, Mr Murphy said.

“Are they looking for the same volume or skills that was required a year or two years ago? Absolutely not. The ones that are coming out of the ground and have closer end dates will take priority,” he added.

The priority shifted to completing projects and tightening operations, with many companies adding staff only as specific project milestones required it, according to the research.

Once the dust settles, Saudi Arabia should operate at a higher level of job creation in the Gulf because it’s a developing market. Currently, jobs in the kingdom on average pay 5 per cent to 7 per cent more than those in the UAE, according to Mr Murphy.

“It's very important understand how to navigate the local market and gain permissions, particularly in Saudi Arabia. It’s a bit freer in the UAE,” he said.

How other Gulf countries fare

Overall hiring in the Gulf rose by 1.3 per cent in the third quarter following the 1 per cent increase recorded in the second quarter, Cooper Fitch said.

Employers continued to advance strategic initiatives, but most kept tight control over headcount as financial and geopolitical uncertainties persisted. Markets with active project pipelines saw measurable hiring gains, while smaller economies expanded at a steadier pace, the report showed.

High borrowing costs and restricted credit availability continued to weigh on private sector expansion. Further easing in rates, once it materialises, is expected to support stronger hiring activity across the region.

“Overall sentiment among employers in the Gulf remains one of cautious optimism. We're seeing stable market conditions, strong focus on operational efficiencies, and a bit slower project activity across the Gulf,” Mr Murphy said.

Hiring in Qatar remained flat at 0.5 per cent, with upcoming LNG projects yet to translate into meaningful workforce demand, according to the report.

founder and chief executive, Cooper Fitch

Job growth in Oman remained unchanged. There was consistent activity in renewables, industrial and logistics sectors, Cooper Fitch said.

Kuwait recorded a 2 per cent drop in hiring as business growth slowed and employers tightened cost controls. Most hiring was limited to replacement and compliance-driven roles.

In Bahrain, hiring decreased 1 per cent, reflecting softer private sector activity. Financial services and tourism continued to provide employment stability, but limited new capital inflows held back job creation, the Cooper Fitch report said.

Mr Murphy said there was continued growth in hiring activity for roles in real estate, technology, digital, data and AI, cloud, software, public sector and investments in the third quarter across the region.

“There was an 8 per cent growth in jobs in senior finance over the quarter as demand for FP&A [financial planning and analysis] and treasury talent intensified across the Gulf,” he said.

“Strategy and management consulting saw the sharpest decline of 4 per cent in job growth as firms tightened advisory budgets.”

Real estate − up 7 per cent − saw strong hiring in Saudi Arabia and the UAE, led by private sector developers and joint ventures moving major masterplans into design and enabling stages. Roles in development management, project delivery, commercial and technical functions were in high demand, the report said.