Luis Vazquez and his girlfriend were down to their last $50 after she got sick and had to miss work for a month.

He already paid his rent and bills for the month, but without her income the couple couldn't cover groceries and other essentials. His next paycheck was more than a week away.

Faced with a similar cash crunch years ago, Mr Vazquez had resorted to a payday loan, a high-interest, short term loan meant to tide a borrower over until the next pay cheque. But the couple and their toddler son were eventually evicted from their apartment because they couldn't make both their rent and the loan payments.

Mr Vazquez vowed never to take out such a loan again, he tells Reuters. This time, he had another option. An overnight support manager at Walmart, he was able get a $150 advance on his pay using an app that allows the company's employees to access up to half their earned wages during a pay period.

A growing number of companies are rolling out products and services that allow employees to receive a portion of their pay when they need it. This can help workers, especially those making hourly wages or working irregular schedules, to avoid unpleasant and potentially costly options such as borrowing from loved ones, running up credit card debt, selling possessions or taking out payday or other high-interest loans when bills come due or emergencies arise before the next paycheck.

Could this be the future of payday? Developers of flexible-pay services say adhering to a rigid pay cycle doesn't make sense.

Josh Reeves, CEO and co-founder of the payroll company Gusto, sees a model in the way parents pay their kids for doing chores.

"If they mow the lawn, they get paid right away," Mr Reeves says. "We think in the future, everyone will get paid [for their work] when they do it."

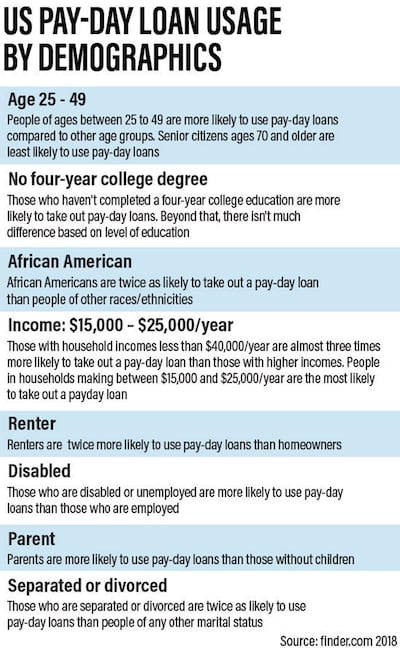

Some experts acknowledge that giving employees early access to their pay can backfire if, for instance, they spend the money unwisely. But the need for flexible pay services is clear. About one-third of US adults were either unable to pay their monthly bills or were one modest financial setback away from financial hardship last year, according to a recent survey by the Federal Reserve. All this plays into the hands of payday loan firms.

Mr Vazquez started working at Walmart in November and says he used the app six times since Walmart made it available in December. The app was developed by the technology company Even.

Mr Vazquez pays $6 a month to use the app - there is no transaction fee. By comparison, a payday loan typically carries an annual percentage rate of 300 per cent to 500 per cent and is due in a lump sum, or balloon payment, on the borrower's next payday. Mr Vazquez didn't provide the terms of the payday loan he took out years ago.

"It gives me peace of mind," he says.

In the UK, getting into debt can be just as painful - although banks are as bad if not worse than payday loan firms, the Financial TImes reported in May.

Which?, the consumer group, looked at the cost of borrowing £100 for 30 days at 16 high street banks, and found that 13 charged more than a payday loan company. The most expensive was Santander, which the analysis found was charging £179 - more than seven times as much as the maximum £24 chargeable by a payday loan company following caps on payday lending fees imposed by the Financial Conduct Authority. Santander said it would remove fees on unarranged overdrafts for its paid current accounts from July. Other banks named in the analysis were TSB, HSBC, First Direct, Royal Bank of Scotland and NatWest, which charged six times higher or more. Lloyds Banking Group came out with the lowest charge of £4.20, having earlier scrapped fees for unarranged overdrafts. Which? said measures brought in by the Competition and Markets Authority in August last year to introduce a monthly maximum charge for unarranged overdrafts had “clearly failed to stop banks from charging sky-high rates”.

Back in the US, newer companies such as Uber and Lyft have used immediate payment as their model for years. Now other organisations are catching on to the advantages of a flexible payday, Reuters says.

Jon Schlossberg, CEO of Even, says more than 200,000 of Walmart's 1.4 million US employees use his company's app, which also has a cash flow projection feature that deducts upcoming bills from expected pay and shows users an "okay to spend" balance.

_______________

Read more:

Heavily indebted Britons face more pain as interest rate hikes loom

Borrowing in the present means payback in future

_______________

Gusto, which provides its payroll services to more than 60,000 businesses nationwide, recently began offering its flexible pay option as an add-on featureat no cost to employers or employees. The company just launched the service in Texas and plans to expand it to additional states later this year.

There's a tremendous need for such services in the US for several reasons, says Rachel Schneider, of the Aspen Institute Financial Security Program and co-author of the book The Financial Diaries: How American Families Cope in a World of Uncertainty.

Income and spending needs are volatile and don't always match up. While some households might be able to make their finances work on paper over the course of a year, they could end up short in any given month, she says.

Some families can build up savings to provide a cushion. But for many workers, the cost of living is outpacing wage growth by such a wide margin that "expecting them to save their way out of volatility is not realistic", Mr Schneider says.

Cutting cheques for every employee used to be time-consuming and costly for companies, which partly explains why many have spread out the pay period. Now the process is largely automated and new technology has enabled more flexibility in timing.

"It takes no extra effort or little effort, so leaving people subject to an outdated rhythm payment or cadence, there's no real logic to it," says Mr Schneider.

There are some potential downsides though.

The immediate access to cash may encourage some people to pick up extra shifts when they are short. While that makes sense in the near term, it can backfire on workers over time. This bigger pool of labour could take the pressure off employers to increase wages, Mr Schneider says.

Employees could also burn through cash faster. Some companies have countered that by limiting the number of times workers can access their money or by only making a portion available. And some are adding a financial counseling component to their services.

FlexWage Solutions is offering a package that combines its flexible pay service with Trusted Advisor, a mobile phone tool developed by the New York City nonprofit Neighborhood Trust Financial Partners, to give employees access to one-on-one financial counseling. Restaurant chain Panda Express is the first to sign on, says FlexWage CEO Frank Dombroski.

The two organisations are also testing an app that would integrate the flexible pay and counselling functions with a cash flow projection feature.

Developers of flexible-pay services also say they can help employers stand out in the current tight job market in the US.

Instant Financial, which began offering flexible pay options in 2017, says its Instant Pay service improves employee satisfaction, increases job applications and reduces turnover.

The company, based in Canada, works with a number of large US employers, including McDonald's, Outback Steakhouse and Wendy's restaurants.

"How we pay people is inefficient and it's broken," says Steve Barha, CEO of Instant Financial.