Lebanon's economy is set to shrink for the second year in a row as it struggles with higher interest rates, political infighting, arrears in expenditure and disagreements over the fiscal and structural reforms needed to fix the country's deficit, according to the Institute of International Finance.

A new report by the Institute's Middle East and North Africa chief economist, Gardis Iradian, forecasts a decline in real GDP of 0.6 per cent in 2019, following on from a revised estimate of a 0.2 per cent decline last year.

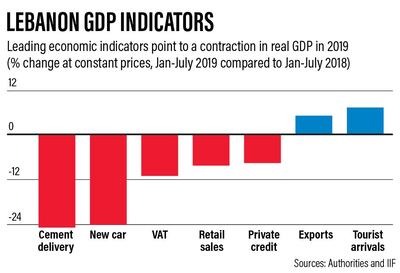

"Our calculations show a contraction of 2.2 per cent in real GDP for the first half of this year," the report said. "The expected modest pick-up in economic activity in the second half of this year will not be enough to offset the sizeable contraction of the first half."

On Monday, Lebanon's prime minister Saad Hariri said the country will declare an "economic emergency" aimed at accelerating public finance reforms with a view to ensuring the stability of the Lebanese pound, which is pegged to the US dollar. According to Reuters, he said this plan had the backing of the cabinet, politicians and lawmakers.

"This difficult economic situation requires us taking speedy measures such as finishing the budget on time and reducing the deficit," Hariri said, according to Reuters.

Lebanon recently passed an austerity budget that aims to shrink the country's deficit to 6 per cent of GDP, both by raising revenue through fighting tax evasion and charging VAT on luxury products, and by embarking on structural reforms aimed at cutting corruption, which the IIF's report states will hinge on "strong and sustained political will".

The country has one of the highest debt burdens in the world, at about 150 per cent of GDP.

The IIF said Lebanon's economy was now at "a turning point", with Fitch Ratings recently downgrading the country's debt rating further into junk status to CCC, while rival ratings agency S&P announced a six-month grace period before changing its current rating, given the proposed reforms.

"The authorities seem to now realise the gravity of the situation and are making a firm and unified call for urgent action, led by President Aoun, to implement the fiscal and structural reforms needed to contain public debt, rebuild confidence, and preserve the peg to the dollar," the IIF said.

Bringing the country's finances under control "would encourage donors to unlock the disbursement of $11 billion of concessional loans" promised at the Cedre conference in Paris in April last year, it added.

Lebanon has always banked on the economy expanding at a faster pace than its public debt and high interest rates on Lebanese pound deposits that attracted inflows from Lebanese citizens abroad. That dynamic changed with the started of a war in neighbouring Syria in 2011 which had direct reverberations on Lebanon's economy, cutting off major land channel for its exports and saddling it with the burden of hosting more than 1 million refugees.

Despite Lebanon's current woes, the Washington-based Institute said it did not believe the country would default on its obligations, given that it has sizable international reserves, a robust banking system and a track record of paying down foreign currency-denominated debt. The country's central bank is among the top 20 holders of gold globally, which valued at $14bn rank it second behind Saudi Arabia in the Middle East and North Africa.

Speaking on Monday, Mr Hariri said accelerating reforms would help the country prevent the type of debt crisis that crippled Greece's economy in the wake of the global financial crisis.

"We don't want this to happen to us. So we are taking measures to save the country," he said.

The IIF is forecasting a pickup in Lebanon's fortunes next year, reforms permitting, with a higher tax take and a lower burden on spending as reforms are made to the electricity sector and several thousand public sector employees are retired.

In a separate note last week, London-based Capital Economics expressed scepticism over the reform plan, pointing to the rising cost of insuring against a sovereign debt default via credit default swaps.

"For our part, we think that the government will struggle to implement fiscal austerity on the scale needed to stabilise the public debt ratio and some form of debt restructuring looks likely," it said.