The UAE's currency was introduced on May 20, 1973, a little more than two years after the country was formed.

Prior to the dirham, the rupee, dinar and even the Maria Theresa silver thaler were used.

In this weekly series, The National breaks down the historical and cultural significance of the designs for each of the dirham denominations.

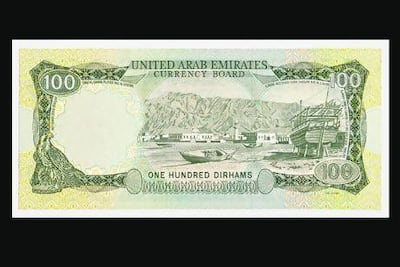

Dh100

Always a welcome presence in your wallet, the Dh100 note was the highest denomination in general circulation when it was introduced in 1973.

The original note was green, and superficially resembled today's Dh10. Mixing the two up would be an unfortunate mistake to make.

The design on the English language face was a charming scene of Khor Fakkan on the Gulf of Oman, with a dhow and buildings that include a mosque and the fish market.

Although almost completely surrounded by Fujairah, Khor Fakkan is part of Sharjah, which also features on the Dh1 note and was the only emirate to be included twice on the original issue.

Design changes in 1982 meant the Dh100 note became the familiar pink or pale red (depending on your point of view) that we see today.

On the Arabic face is Al Fahidi Fort in Dubai, once the home of the emirate's Ruler and now the Dubai Museum. The reverse is the World Trade Centre, once the tallest building in the Middle East and still a symbol of Dubai's extraordinary progress in barely half a century.

If you have recently made a large withdrawal from a bank, take a closer look at your Dh100 notes and you may find the second version.

This was released in 2018 to mark the Year of Zayed and the 100th anniversary of the Founding Father's birth. The World Trade Centre on the English side is replaced with an image of Sheikh Zayed Bridge in Abu Dhabi, and on the reverse is the official symbol of the Year Of Zayed with his portrait.