Bahrain has struck a pot of gold offshore.

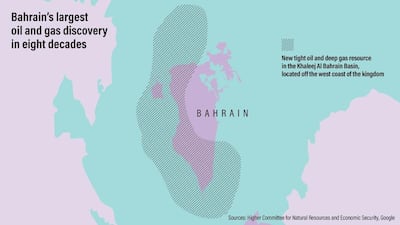

The island kingdom announced Wednesday that it had found at least 80 billion barrels of shale oil off its west coast, as well as associated gas of around 10 to 20 trillion cubic feet.

Onshore, beneath the country’s historic Bahrain field, around 13.7 trillion cubic feet of gas will be explored, with two wells to be drilled over the coming two months.

The discovery outsized Bahrain’s current reserves several times. Bahrain’s announcement of the discovery of the Khaleej Al Bahrain basin took analysts by surprise, given Bahrain’s limited output over the last decades.

After Iran struck oil at the turn of the 20th century, the precursors to Big Oil frantically explored along the Arabian Peninsula for reserves, finally finding oil in Bahrain, an island, which had until then been known for its pearl diving and trading.

Read more: Bahrain says it has discovered 80 billion barrels of shale oil

The discovery of oil in 1932 changed the fortunes of the kingdom, and prompted a search for bigger reserves in Saudi Arabia and the surrounding region. Despite its beginner's luck, Bahrain, which realised the need for diversification way of ahead of its regional peers, developing a robust financial sector and building one of the largest aluminium smelters in the world, its oil reserves began maturing rapidly.

At the turn of the current century, the island’s historic Bahrain Field saw production dwindle to 50,000 barrels per day, with exits from partners such as Abu Dhabi's Mubadala Investment Company and Occidental Petroleum in 2016.

The latest findings come at an opportune moment for the country’s economy, the smallest among its GCC peers. Bahrain’s economy started to slow down following the unrest in 2011 as well as the three-year slump in oil prices, which led all three credit ratings agencies to slash its investment grade credit rating to junk.

Bahrain, which relies on its Gulf neighbours for cash injections into large-scale infrastructure projects, is in need of a boost to its finances. It has also continued to saddle itself with debs, which Moody’s Investors Service has forecast will reach nearly 100 per cent by 2019.

Current levels are dangerously close to 90 per cent.

While exploration work will take time - nearly five years according to the oil ministry - the discovery will help revive interest in its investment landscape, and help Bahrain seek more structured financial commitments in the near future.