Ajay Mankani understood from a young age that true wealth isn’t all about money and that financial circumstances do not define one’s potential. Instead, he learnt that true wealth involved building something meaningful and lasting.

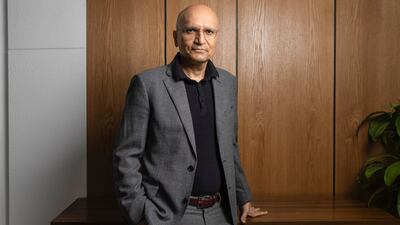

As vice chairman and executive director of Fortes Education, these values have shaped Mr Mankani’s approach to life.

He has been instrumental in driving the growth and expansion of Fortes Education, including setting up Regent International School and Sunmarke School.

Mr Mankani, 55, also leads Fortes’ education technology business and integrates EdTech solutions into the curriculum.

“My background in engineering from the University of Pennsylvania, coupled with over 25 years of experience across various sectors like property development and technology, empowers me to lead and innovate in my field,” says the Indian resident, who was born and raised in the UAE.

Mr Mankani lives in Jumeirah Islands, Dubai, with his mother, wife and two children. He is passionate about collecting art, fitness and philanthropy.

Did wealth feature in your childhood?

Growing up, I was cognizant of wealth, largely because we didn’t have much of it. My family lived a modest life, and while we may not have had financial abundance, we were incredibly rich in values, love and support. My parents instilled in us the importance of a broad-based education and the notion that hard work could lead to personal achievement and success.

They encouraged their children to be ambitious, to dream big, and to believe that our circumstances did not define our potential. These values shaped my approach to life. I understood from a young age that true wealth wasn’t about money but about building something meaningful and lasting.

What did you learn from it?

The financial limitations of my early life taught me to work harder and to be tenacious in my pursuits, whether in academics or sports. I grew up to be highly competitive by nature and constantly raising the bar of my own potential.

Challenges were never “problems” – they were “opportunities” to be taken advantage of. I developed a mindset where obstacles were stepping stones, allowing me to innovate and seek solutions rather than be deterred by difficulty. This resilience and drive laid the foundation for my career.

I have always thought of myself as a humanities person. I love reading and writing. But I also like maths and numbers, which come to me quite easily. I found that I could make a real difference by standing at the intersection of the humanities and sciences and applying both – by building a career in education, property development and technology start-ups.

How did you first earn?

I earned my first pocket money at the age of 12 working at my father's construction sites during school holidays. This early experience taught me the dignity of labour and the importance of teamwork.

My first salaried job was as a project engineer in the same company, where I earned Dh3,000 ($816.88) per month.

Any early financial jolts?

My initial venture in entrepreneurship involved cross-border trade with the USSR which was seceding into sovereign independent republics in 1991. I set up base in the USSR, which was challenging and exhilarating at the same time.

Despite the early success, I faced significant challenges from a lack of rule of law, which eventually led me to close the business. The experience was financially and emotionally tough for a young 20-something, but through it, I learned invaluable life lessons about persistence and the need for long-term, strategic planning.

How do you grow your wealth?

I concentrate on industries where skilled human talent and innovation can thrive. My approach is to create businesses with substantial differentiation and brand equity, focusing on generating steady, compounded returns over time. I eschew short-term thinking ventures that promise rapid gains but come with significant risk.

Growing wealth, for me, is about taking calculated risks and aligning with my values of meaningful, long-lasting impact. Along with my partner and brother, I strive to lead a company that, while not the largest, stands out in its positive social impact on our stakeholders and society, its ability to grow sustainably, its deep human capital, and its technological advancement.

Are you a spender or a saver?

I would describe myself as an investor. I prioritise reinvesting in my organisation over personal spending. My primary responsibility is ensuring the company’s growth and stability, which means putting our resources into building capabilities and expanding strategically.

Additionally, I manage a family office that invests in public equities, private equity, venture capital and alternative investments, with the goal of generating sustainable, long-term, compounded returns.

Have you been wise with money?

Prudence and strategic foresight have guided my financial decisions, enabling me to achieve healthy, risk-adjusted returns.

I believe in the power of disciplined investment, the power of compounding over the long-term and thoughtful business development.

What has been your best investment?

My best investments have been in the education and development of my team and myself. These are investments that pay dividends beyond financial gain – they enrich lives and drive positive impact.

On a personal level, continual learning and upskilling have been invaluable, keeping me competitive, informed, able to adapt and inspired in my career and life.

Any cherished purchases?

My most cherished investments are time spent with my family and in developing the well-being and growth of my colleagues who I work with and employ.

Apart from these, I maintain a simple lifestyle and have few personal material desires.

How do you feel about money?

I view money as a tool to further my goals and as a by-product of impactful work. It enables my purpose, supporting efforts to improve lives through education and services.

Any financial advice for your younger self?

Trust your instincts. Just because others say something can’t be done doesn’t mean it’s true. The path less travelled is often where you find the most rewarding opportunities.

I would tell my younger self to embrace failure as part of the journey and to be unafraid of standing alone in a unique direction.

What are your financial goals?

My financial goals extend beyond mere numbers; they are about creating a lasting impact through our services and positively influencing the lives of those we serve and employ.