China's economy lost steam in April, underscoring the fragility of the world's second-largest economy as it sets itself for an intensified face-off with the US over trade.

Industrial output, retail sales and investment all slowed more than economists forecast. The state sector continued to boost investment while private business eased off, and growth in manufacturing investment came in at the slowest pace in data dating back to 2004.

Faltering credit and consumption at home coupled with a weaker global economy means China is running out of steady growth engines right when it needs them. The soggy data spurred expectations the government will need to boost stimulus to cushion the blow from the escalating trade war, sending Asian stocks mostly higher. The yuan was little changed.

US President Donald Trump rolled out 25 pr cent tariffs last week, leaving Chinese producers reeling. There's a chance such levies will be widened to all the Chinese goods America buys.

"The double dip is confirmed," said Lu Ting, chief China economist at Nomura in Hong Kong. "We expect Beijing to significantly ramp up easing/stimulus measures to stabilise financial markets and bolster growth, despite the more limited policy room than in previous easing cycles."

There's ample room to step up policy support, Liu Aihua, a spokeswoman for the National Bureau of Statistics, said on Wednesday. While policymakers have rolled out targeted fiscal and monetary policy measures to stem the slowdown since last year, they can still turn to extra tax cuts, infrastructure spending, as well as trimmed policy rates and reductions in bank reserves if needed.

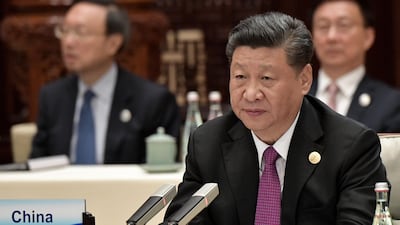

President Xi Jinping faces failure to meet the Communist Party's long-term growth target of doubling 2010 gross domestic product by next year on the back of the hit from Mr Trump's new tariffs, according to a survey of economists. 2019 GDP growth will be lowered by 0.3 percentage point by the rise in US tariffs on $200 billion of imports from China. If more tariffs are introduced to cover all Chinese goods, that will cost 0.6 percentage point in the 12 months after, according to the median estimates of those polled.

At the opening ceremony of the Conference on Dialogue of Asian Civilizations in Beijing on Wednesday, Xi denounced as “foolish” foreign efforts to reshape other nations as he pushed back against US trade demands.

"To think that one's own race and civilization are superior to others, and to insist on transforming or even replacing other civilisations, is foolish in understanding and disastrous in practice," Mr Xi said. State media has beefed up its response to Mr Trump's latest tariff escalation, with the once-banned phrase "trade war" roaring back into widespread use in Chinese media.

Trump tapped into the rising chances for more stimulus in China with a tweet Tuesday saying that the US would win if the Federal Reserve did the same as Beijing. Later in the day he said that more quantitative easing would boost US growth to 5 per cent.

Trump said he'll meet his Chinese counterpart at next month's G20 summit, an encounter that could prove pivotal in reaching a deal that prevents the deepening clash from doing even more damage to the global economy.

The US Trade Representative's office Monday released a list of about $300bn worth of Chinese goods including children's clothing, toys, mobile phones and laptops that Mr Trump has threatened to hit with a 25 per cent tariff - drawing practically all China's exports to the US into the trade war. Bloomberg Economics estimates about 1 per cent of global economic activity is at stake in goods and services traded between the two countries.

One potential bright spot from Wednesday's report is property, with investment rising to 11.9 per cent in the first four months. Unemployment also dipped, a sign that stimulus measures since last year had started to stabilise the economy before the latest challenges. The survey-based unemployment stood at 5 per cent, versus 5.2 per cent the previous month.