Major disease outbreaks are as old as civilisation itself.

And when it comes to the UAE’s own history, infectious disease plagued the land more than a century before the country’s founding.

These were some of the fascinating insights from the Plague and Pandemic session at the Abu Dhabi International Book Fair on Monday.

British historians Bettany Hughes and Peter Hellyer rolled back the years and explored how major outbreaks of disease reshaped history and regions, ranging from ancient Egypt and to the years preceding the UAE's formation.

When it comes to the latter, one of the country’s first recorded brushes with an outbreak goes as far back as the 18th century.

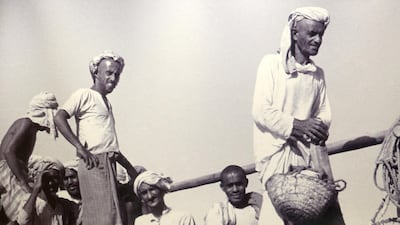

According to Hellyer, author and advisor to the UAE Ministry of Culture and Youth, Delma Island, west of Abu Dhabi and a major pearl diving hub, experienced an outbreak of smallpox.

"It probably came through the pearl traders from India because the pearls fished in Delma were sought after. The traders would then head back to Bombay where it was sold on from there," he said.

"The story that came from the island is that everybody living there, which ranged from several hundred to the low thousands, died except for 15 people. And for a while the island was abandoned and then repopulated to become an important pearling centre again."

Hellyer added: "This is nothing new. We have traditions and we have legends of the impact of diseases usually arriving from overseas.”

Quarantine is an old concept

Another major health scare the UAE faced was during the Trucial States era in the 1930s, when a cholera outbreak emerged from the northern emirates.

“It didn't hit Abu Dhabi, as far as the records go,” Hellyer said.

“But there were thousands of cases and it has all been very well documented in the British records of the time.”

Within those documents and other evidence, Hellyer said the authorities reacted with policies relatively similar to today's fight against Covid-19.

They ranged from quarantine measures to social and border restrictions.

“If you caught cholera or were suspected of having it in Dubai or Sharjah you were sent out of the town until you got better and then you came back.

"In Fujairah you were sent out into the hillsides, food was provided and they were left there until they got better,” he said.

“This idea of quarantine and shutting people away is several hundreds of years old. People didn't necessarily know how diseases worked, but they knew somehow that it was arriving with people.

“So they took precautions, closed off the traffic, shut down the trade and stopped the movements of boats back and forth. Now we do that with planes.”

Boom and bust

Hughes also found familiar historical patterns in how pandemics took shape in societies.

"When charting the impact of plagues on a great civilisation, what is interesting is that you will find some incredible similarities to Covid-19," she said.

"It seems to have spread in times when there was an increased amount of international trade."

She points to ancient Egypt during the reign of Amenhotep III, whose 38-year reign from 1836 BC included a devastating plague, which killed millions.

“Before that was a boom time in ancient Egypt. There were a lot more boats going out from ports and more transfer across borders with lots more merchants meeting,” she said.

“The plague, which is thought to be the bubonic plague, spread in cities, in military barracks, temples and religious groups and, again, in ways similar to today by people travelling from what they think are infected areas to what they think of as pure areas and therefore taking the plague with them.”

What also links these thousands of years – which also saw the Plague of Justinian, regarded as the world's first major outbreak from 541 to 449 AD – are the human reactions and the rise of conspiracy theories.

Hellyer views them almost as a natural occurrence.

“When you don't understand something, you look for explanations and justifications and when you don't find that, then you look for someone or a community to blame," he said.

"You look for some kind of explanation because there is no way of explaining in a sense that means something to you."

It will get better

As bleak as all these pandemics were, Hughes notes there are positive after-effects.

She explained how England bounced back after it was ravaged by the Black Death for a five-year stretch from 1348.

"The population was devastated and it was great leveller, because, as we discovered with our pandemic, social status and money doesn't protect you from infections," she said.

"So in the UK, after the Black Death, there were so few people left and those who normally had no agency in society were able to do things they previously couldn't.

“This was particularly the case with women and the so-called lower class. From that moment on we saw a complete rewriting of the social structure of the UK which helped form the birth of the middle class.”

With the constant mutating nature of viruses and medical advancement, Hellyer is positive the impact of Covid-19 will recede over generations.

"Is been suggested that the flu epidemic that hit Europe at the end of the 19th century later evolved to become the common cold,” he said.

“So if we look forward from the mess we're in now with Covid-19, perhaps our children will put it down to a little summer's cold 50 years from now.”

The pair were speaking at a session during the Abu Dhabi International Book Fair, which runs until Saturday, May 29 at the Abu Dhabi National Exhibition Centre, with safety precautions and a hybrid programme of in-person and digital events.

More international and regional authors will appear, either physically or online, including Jordanian author and 2021 International Prize for Arabic Fiction winner Jalal Barjas, French-Egyptian novelist Gilbert Sinoue and Emirati and Lebanese poets Afra Atiq and Zeina Hashem Beck.

More information on the Abu Dhabi International Book Fair is available at adbookfair.com