Life from Earth could live on Mars, according to scientific findings that could have a major effect on future space missions.

Microbes, such as fungi and bacteria, can survive in conditions similar to those found on the Martian surface, said Nasa and German Aerospace Centre researchers.

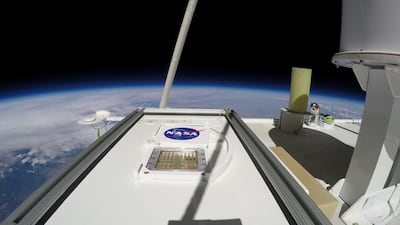

They sent micro-organisms by balloon into the Earth’s stratosphere, which comes close to replicating conditions on the Red Planet. When the balloon returned, the scientists discovered that some of the microbes had survived the trip.

The findings, published in Frontiers in Microbiology, mean scientists now better understand the threat of microbes to future space missions.

“We successfully tested a new way of exposing bacteria and fungi to Mars-like conditions by using a scientific balloon to fly our experimental equipment up to Earth’s stratosphere,” said Marta Filipa Cortesao, an author of the study based at the German Aerospace Centre in Cologne.

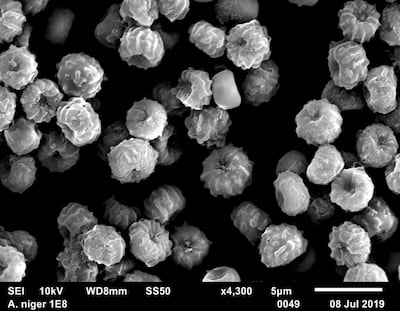

“Some microbes, in particular spores from the black mould fungus, were able to survive the trip, even when exposed to very high UV radiation.”

Nasa's Perseverance space probe landed on Mars on Friday in a quest to determine whether life existed on the planet billions of years ago.

Over several years, Perseverance will attempt to collect 30 rock and soil samples in sealed tubes to send back to Earth for analysis in the 2030s.

Scientists searching for extraterrestrial life must ensure that anything discovered has not merely travelled there from Earth.

“With crewed long-term missions to Mars, we need to know how human-associated micro-organisms would survive on the Red Planet, as some may pose a health risk to astronauts,” said joint author Katharina Siems, who is also based at the German Aerospace Centre.

Martian conditions are not easily replicated on the surface of our planet, but the area above the ozone layer in Earth’s middle stratosphere is remarkably similar.

“We launched the microbes into the stratosphere inside the Marsbox payload, which was kept at Martian pressure and filled with artificial Martian atmosphere throughout the mission,” Ms Cortesao said, referring to the Microbes in Atmosphere for Radiation, Survival and Biological Outcomes experiment.

“The top-layer samples were exposed to more than 1,000 times more UV radiation than levels that can cause sunburn on our skin.”

"While not all the microbes survived the trip, one previously detected on the International Space Station, the black mould Aspergillus niger could be revived after it returned home," Ms Siems said.

This month, the UAE released a close-up image of Mars captured by the Hope probe as it aims to uncover more secrets about the Red Planet.

The picture was posted on Twitter by Sheikh Mohammed bin Rashid, Vice President and Ruler of Dubai.