Under bright-blue morning skies, China launched its first crewed space mission in five years on Thursday, sending three science-minded military pilots rocketing to a new orbiting station they are expected to reach about mid-afternoon.

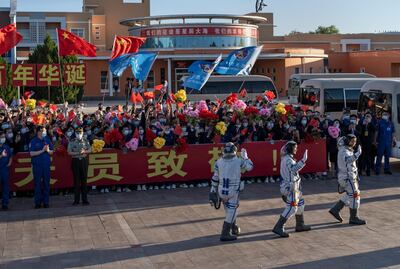

The astronauts were seen off by space officials, other uniformed military personnel and a crowd of children waving flowers and flags and singing patriotic songs. The three gave final waves to a crowd of people, then entered the elevator to take them to the spaceship at the Jiuquan launch centre in north-west China.

The astronauts are aboard the Shenzhou-12 spaceship launched by a Long March-2F Y12 rocket that blasted off shortly after the target time of 9.22am (0122 GMT) with near-perfect visibility at the launch centre on the edge of the Gobi Desert.

The two veteran astronauts and a newcomer making his first space flight are scheduled to stay three months in the Tianhe, or Heavenly Harmony, conducting experiments, testing equipment and preparing the station for expansion before two laboratory modules are launched next year.

The rocket dropped its boosters about two minutes into the flight, followed by the coiling surrounding Shenzhou-12 at the top of the rocket. After about 10 minutes it separated from the rocket’s upper section, extended its solar panels and shortly afterwards entered orbit.

The spaceship is scheduled to dock with the Tianhe at about 4pm (0800 GMT) after a series of adjustments to line up with the station over four to six hours, the mission’s deputy chief designer, Gao Xu, told state broadcaster CCTV.

The travel time is down from the two days it took to reach China’s earlier experimental space stations, a result of a “great many breakthroughs and innovations”, Mr Gao said.

“So the astronauts can a have a good rest in the space which should make them less tired,” he said.

Other improvements include an increase in the number of automated and remote-controlled systems that should “significantly lessen the pressure on the astronauts”.

The mission brings to 14 the number of astronauts China has sent into space since its first crewed mission in 2003, becoming only the third country after the former Soviet Union and the US to do so on its own. Two astronauts on those past missions were women, and while this first station crew is all male, women are expected to be part of future station crews.

The mission is the third of 11 planned into the coming year to add additional sections to the station and send up crews and supplies. A new three-member crew and a cargo ship with supplies will be sent in three months.

China is not a participant in the International Space Station, largely as a result of US objections to the Chinese space programme's secrecy and close ties to the military. However, China is stepping up co-operation with Russia and several other countries, and its station may continue operating beyond the International Space Station, which is reaching the end of its functional life.

China landed a probe on Mars last month that carried a rover, the Zhurong, and earlier landed a probe and rover on the Moon’s less explored far side and brought back the first lunar samples by any country’s space programme since the 1970s.

After the Tianhe was launched in April, the rocket that carried it into space made an uncontrolled re-entry to Earth, although China dismissed criticism of the potential safety hazard. Usually, discarded rocket stages re-enter the atmosphere soon after lift-off, normally over water, and do not go into orbit.

The rocket used on Thursday is of a different type and the components that will re-enter are expected to burn up long before they could be a danger, said Ji Qiming, assistant director of the China Manned Space Agency.