KOLKATA // Ayan Mitra stepped into the cavernous warehouse of one of Kolkata's last remaining auction houses with his eye on a pair of hand-painted Chinese vases. He picked up the 30-centimetre tall vessels, examined their gold-painted handles and put them down to circle the venue.

He came back to the dark blue vases. They reminded him of his childhood.

Mr Mitra, 34, the general manager of a hotel and a first-time bidder brought along his wife, Alila Ao, 29, and daughter, Leah, two, to the Russell Exchange on a recent Sunday afternoon.

The Mitras are a part of India's young, upper-class looking for one-of-a-kind pieces to show in their homes. Their growing incomes have spurred a revival in the city's rich history of auction houses. From vases and paintings to furniture, the afternoon auction comes alive with smartly dressed men and women rifling through dust-covered artefacts, hoping to outbid each other for a piece of forgotten glory.

Mr Mitra was willing to bid as much as it took to bring home the vases that reminded him of a set in his grandfather's home.

"I always coveted them," said Mr Mitra. "But with time, they were lost."

The tag on the vases indicted the bidding would start at 5,000 rupees (Dh330) each. He did not flinch.

"I could go higher. I am here to bid. I want to find the vases a better home," Mr Mitra said, adding that he was looking for something unique for his flat in Kolkata.

"I am tired of these mass-produced pieces," he said. "I want my guests to be impressed when they walk into my home, when they see these vases. They will give added value to my house when I display them in my curio cabinet."

Auction houses of Kolkata have been a long-standing tradition, with Sundays dedicated to those who like to scrounge through the vintage to find something valuable.

With the arrival of the East India company in 1690, Kolkata became the centre of trade and imports and exports. For 200 years, till 1911, Kolkata (then called Calcutta) served as the capital of British India. During this time, the British made auctioneering, a hobby, fashionable. Even after the British moved their capital to Delhi, the culture of auction houses remained.

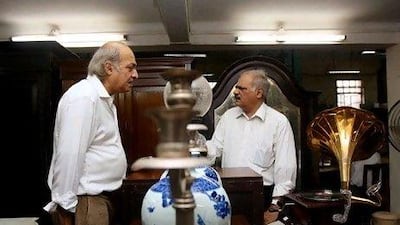

"Every Sunday, they were regulars at the auction. The British would come and sit in rows and rows of chairs. Actors and wealthy businessmen would weave in and out too," said Anwer Saleem, whose father established the Russell Exchange in 1940.

After India's independence from the British rule in 1947, the culture continued with the royalty of erstwhile kingdoms and wealthy business patrons of the city who continued to follow British norms.

However in the 1980s poor business forced eight of the city's 11 auction houses to close.

The remaining three, all next to each other on Russell Street, however, have recently noticed an upswing in business. There has been a noticeable difference in the past three years, said Mr Saleem, who runs the Russell Exchange house with his brother, Arshad Salim, who spell his surname differently than his brother, and sister, Sarfaraz Javed.

"They want to re-create the atmosphere of the old," Mr Saleem said. "They are shunning mass-produced, ready-made pieces because now people like to show off a nice piece of furniture. They realise it is an investment. There is hereditary value."

The highest bidders are "young people", said Mr Saleem, including the wives of executives because "they hold the purse strings", the rich and their children.

There is also the "nouveau riche", said Mr Saleem, who "have money but they are eager to show they have old money".

"In an auction, most of the time, ego comes in. When they enjoy the thrill of the auction, they get carried away and buy things they didn't even think they wanted to buy. That's how we make our commission."

Jai Krishna, 32, runs a business consultancy firm. Dressed in a blue-and-white striped Lacoste shirt and shorts, he had has his eye on three lots that day and a budget of 50,000 rupees for a dining room table.

"I have moved to a new house and I need new furniture," Mr Krishna said. "I mean, I need furniture that is made of good quality wood, that will make a statement."

Mr Krishna placed the winning 15,000-rupee bid on four-poster wooden bed made of Burmese teak wood. He also got the table.

"These are not pieces to use and throw away," he said.

Most of the paintings, furniture, chandeliers, silverware and statues that end up at the Russell Exchange are come from estates of people who have died.

"Families can't maintain bigger homes anymore," said Ms Javed, who is also an auctioneer at the auction house. "And flats these days cannot accommodate such big pieces of furniture. The families want to sell the old stuff. They send them here."

For this, Indranil Das, 42, is grateful. A tea broker by trade, he is a self described "regular collector". Mr Das sits by the entrance of the auction house, watching and waiting for the final lot of ceramics to go under the hammer. Two months ago, he paid 4,000 rupees for a set of Dutch porcelain wall plates. He collects wall plates, porcelain figures and small art deco pieces to display in his home.

"I collect what suits me," Mr Das said. "And I have been doing this since before being a collector became trendy."

sbhattacharya@thenational.ae