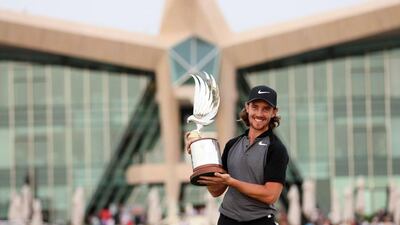

Tommy Fleetwood has surged to the top of the Race to Dubai standings following his victory at the Abu Dhabi HSBC Championship.

Fleetwood, who turned 26 on Thursday, ended a 1,247-day wait for a second European Tour title on Sunday when he triumphed in the UAE capital. The Englishman clinched the Falcon Trophy by one shot ahead of Spain’s Pablo Larrazabal and American world No 3 Dustin Johnson. Fleetwood also impressed in his other European Tour outing this season, finishing tied-third at the Hong Kong Open in December.

As a result of his triumph and the €421,139 (Dh1.67 million) winner’s prize, Fleetwood assumes top spot in the European Tour’s order of merit, which concludes with the tour’s top 60 players competing at the season-ending DP World Tour Championship in Dubai.

Larrazabal’s runner-up finish in Abu Dhabi moved him up to third, while Australia’s Sam Brazel, winner of the Hong Kong Open, separates the two in second place.

Meanwhile, reigning Race to Dubai winner and British Open champion Henrik Stenson occupies 27th, with four-time major winner Rory McIlroy in 11th. However, both have only played in one tournament so far this season, with Stenson tied eighth in Abu Dhabi, while McIlroy, who withdrew from Abu Dhabi due to a rib injury, claimed second at the South African Open.

The European Tour heads to the Qatar Open this week before returning to the UAE for the Omega Dubai Desert Classic on February 2 to conclude the three-part Desert Swing.

* The National staff

__________________________________

Read more

■ Tommy Fleetwood: Sixth-time lucky for 'very proud' Abu Dhabi champion

■ Photo gallery: Pictures from the Abu Dhabi HSBC Championship final round

■ Dustin Johnson: Plans 2018 return and aims to go one better next time

__________________________________

RACE TO DUBAI STANDINGS

1. Tommy Fleetwood (Britain) 526481

2. Sam Brazel (Australia) 318540

3. Pablo Larrazabal (Spain) 276594

4. Rafael Cabrera-Bello (Spain) 237776

5. Andrew Dodt (Australia) 227984

6. Graeme Storm (Britain) 204709

7. Brandon Stone (South Africa) 198498

8. Harold Varner III (US) 175631

9. Dean Burmester (South Africa) 141976

10. Richard Sterne (South Africa) 138000

11. Rory McIlroy (Britain) 119287

12. Thomas Aiken (South Africa) 116550

13. Bernd Wiesberger (Austria) 107306

13. Martin Kaymer (Germany) 107306

13. Kiradech Aphibarnrat (Thailand) 107306

16. Jordan Smith (Britain) 98972

17. David Lipsky (US) 93990

18. Thomas Detry (Belgium) 89160

19. Alexander Bjoerk (Sweden) 83523

20. Benjamin Hebert (France) 73845

21. Paul Waring (Britain) 67855

22. Danny Willett (Britain) 65488

23. Carlos Pigem (Spain) 64029

24. Brett Rumford (Australia) 63298

25. Joel Stalter (France) 58966

26. Scott Jamieson (Britain) 58241

27. Lee Westwood (Britain) 56770

27. Peter Hanson (Sweden) 56770

27. Henrik Stenson (Sweden) 56770

30. Peter Uihlein (US) 56546

Follow us on Twitter @NatSportUAE

Like us on Facebook at facebook.com/TheNationalSport