By now accustomed, gladly of course, to being referred to as “Champion Golfer of the Year”, Collin Morikawa was enjoying another moniker upon arrival in Abu Dhabi to begin his 2022 DP World Tour season.

Last July’s stellar Open victory - a second major championship for the American still only 24 – helped in large part seal a first Race to Dubai crown.

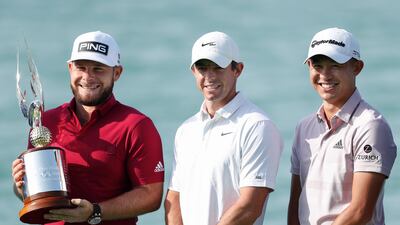

True to form shown since turning professional what feels a barely believable two-and-a-half years ago, Morikawa departed Jumeirah Golf Estates in November with two titles. The win in the season-concluding DP World Tour Championship secured the European No 1 spot, too.

So, just down the road as he prepares to make his bow at the Abu Dhabi HSBC Championship this week, Morikawa was understandably delighted to be back for a two-week stint in the UAE that includes the Slync.io Dubai Desert Classic.

With both Rolex Series events, these next two tournaments offer the opportunity for a statement start to his Race to Dubai defence.

On Tuesday, though, Morikawa was happy to bask in the still-fresh glow of his 2021 Order of Merit crown. Even if it carries a certain pressure.

“Feels great,” the world No 2 said regarding his return to the Emirates. “I've been announced for a handful of months now as ‘Champion Golfer of the Year’, but this is the first time someone brought up being the reigning Race to Dubai champion, and there's a lot of weight that's on your shoulders right now.

“It's a great weight to have and I want to come back as strong as ever. I want to start these first two weeks off on a real high note and hopefully come out with a couple trophies.”

It just so happens that Morikawa’s Abu Dhabi debut coincides with the tournament’s first run at Yas Links. After 16 years on the National Course at Abu Dhabi Golf Club, the event will play out across Sheikh Zayed Road on Yas Island.

Having seen the front nine for the first time on Monday, Morikawa was off to check out the second half after Tuesday's media duties. Although the game appears right where expected – last time out, at the Sentry Tournament of Champions, he finished tied-5th – Yas Links will require some adjustment.

“It's a very good golf course,” said Morikawa, the highest-ranked player in the field. “Coming from Kapalua where the fairways are about 100 yards wide, this looks pretty narrow.

“The conditions are going to prove tough. We're going to have a lot of wind this week, a lot different from Monday and Tuesday compared to what the tournament is going to be. A lot of slopes in these greens, a lot of undulations and run-offs. You've got to be sharp and you've got to know this course.

“I'm going to have to do my homework. I'm going to have to spend a little more time out there preparing and learning what to do, because if I don't know where a slope is and I somehow hit it there and I'm a little surprised, that's going to be a problem for the entire week.”

Negotiate any issues that arise, and Morikawa will be hoping to lay a sturdy platform for another standout year. It should be memorable anyway, with the defence of the Claret Jug taking place at St Andrews, the oldest major’s 150th edition staged appropriately at the "Home of Golf". Morikawa has never been.

“It's really special,” he said. “Whenever you're defending a tournament, it means you've done a great thing in the previous year, but when it's the 150th anniversary of the Open Championship, obviously there's a lot of weight on your shoulders.

"There's going to be a lot of obligations on my back for that entire week, so I'm still going to have to remember that like every other week, I've got to be ready by Thursday… really space it out to where I feel relaxed and ready to play golf. Because it is a tournament that I absolutely do want to defend.”