The first Mina Cup youth football tournament in Dubai included sides bearing the names of Barcelona, Manchester City and La Liga.

It attracted champion teams from Mexico, the UK and Austria. Some of the players involved had been hand-picked and coached by the former Real Madrid Champions League winner Michel Salgado.

And yet the most dominant side anywhere in it were a set of kids from India, all of whom were making their first trip outside of their home country, having secured passports especially for it.

On the opening day of the Under 12 event, Minerva Academy, from India’s Punjab region, trounced Barcelona Academy.

In Monday night’s final in Jebel Ali, they thrashed Dubai-based La Liga Academy 4-0. In between, they did not concede a goal.

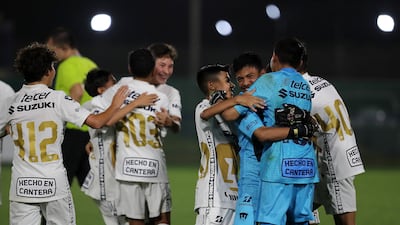

“I cannot believe we have won a tournament involving Barca, La Liga, Man City – it doesn’t feel like real life,” said Yoihenba Khwairakpam, Minerva’s goalkeeper.

“This is my first time outside India. When we were leaving, I was feeling nervous and excited that I was going outside our country and playing for our nation.

“We have the India flag on our shirt and we feel like we are representing our country as well as our academy.”

Khwairakpam, who was first introduced to the game and the wonders of Cristiano Ronaldo by his father who was also an ex-footballer, is from Manipur, one of India’s football hotbeds.

The players are scouted from five regions in the country, with 90 per cent of the academy’s current intake originating from India’s north east.

“Football is a unique sport and I love it very much, especially when we play a tournament with the support we get,” said Ishan Saikia, a 10-year-old who has been with the Minerva Academy for three years after moving from his home in Assam.

“We feel like we are playing for our country. In cricket, you can hit the ball with the bat, but it is not like scoring a goal in football, or when the fans scream, ‘goal!’ We are very proud to win.”

In all, the tour to Dubai – including the administration of passport applications for all the players - cost the academy around $30,000.

A crowd funding campaign brought in around $1,000 of that, with the academy’s owner, Ranjit Bajaj, covering the remaining costs.

“The only difference between us and the other teams is these guys are on 100 per cent scholarships,” Bajaj said.

“They don’t pay even one single rupee. We take care of their food, stay and education. That is my personal dream.

“It is about getting India to the World Cup in 2034. It is a 15-year plan, and it is two years old.

“All the money I earn from my business, I put in here. There is no profit coming in. But hopefully one of these guys will be the next Mohamed Salah.”

Bajaj said his academicians are taught the methods of top European football sides from the age of seven.

“If you give Messi the ball for the first time at the age of 40, he will never be Messi,” Bajaj said.

“You have to start young. The reason you saw the difference in standard in this tournament is because these boys play all day with senior players, and they have been doing so since they were eight, nine, 10.

“This is unlike any football ever seen in India before. In terms of the way they play, what you see here is exactly what you see in top European clubs.

“If we keep doing this, you don’t need 1.3 billion people, you just need the right 30. Work on them, give them exposure every year, and we will get there. We have won a lot of national titles back at home, but I don’t think that is legacy.

“Legacy is getting your team to the World Cup. We are really far behind, and this is the only way we can catch up.”

Minerva Academy’s home base is a 25-acre campus in Punjab, with three full-size football fields, seven for seven-a-side, a gym and rehab and physiotherapy department.

He says, though, that his players have had their eyes opened by what they have seen at the Mina Cup.

“We play on natural grass at home, but these facilities here are world class,” he said of the Jebel Ali Centre of Excellence.

“That gives such an uplift to our players. Why? Because they know if they make it in life, this is what is waiting for them.

“The hunger for someone who is in Dubai or someone in Europe is not so great because they are used to this lifestyle.

“For these players, it is heaven. They have never been to these sort of facilities, or anywhere close to this.”