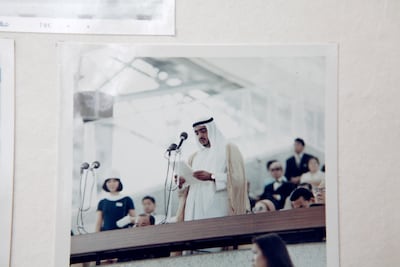

The UAE’s journey with Expo began in Osaka 52 years ago. With its humble pavilion, Abu Dhabi participated in Expo Osaka in 1970, culminating with the visit of the President, Sheikh Khalifa, in his capacity as the Crown Prince of Abu Dhabi.

This high-level engagement began a tradition of visits between the UAE and Japan, extending from the UAE’s first appearance in an international exhibition. Fifty two years later, the UAE hosted the largest Expo to date, with 192 countries and more than 24 million visits under the theme “Connecting Minds, Creating the Future”.

Moreover, 2022 marks the 50th anniversary of diplomatic relations between the UAE and Japan. The year also and represents an opportunity to reflect on the ways in which the two countries intend to strengthen co-operation over the next 50 years and diversify an important relationship. The UAE looks forward to signing the Comprehensive Strategic Partnership Initiative with Japan, thereby enabling an expansion and co-ordination in emerging fields and laying the groundwork to build upon existing areas of economic, political and cultural co-operation.

The UAE's co-operation with Japan has its roots in a long history of trade exchange. Today, the countries enjoy a robust trade relationship, with the UAE maintaining its ranking as Japan’s eighth largest trading partner globally in 2021, and fifth largest in terms of Japan’s total imports. Moreover, Japanese exports to the UAE amounted to $6.2 billion in 2021, with imports from the UAE at $23.8 billion in 2021. The strength of bilateral trade can primarily be explained by the economic recovery post-Covid-19 that has been championed by both countries.

We now see diversified economic co-operation, with the UAE hosting approximately 340 Japanese companies. According to a survey by the Japan External Trade Organisation, 75 per cent of Japanese companies in the UAE regard the “merits of free zones and special economic zones” as one of the biggest advantages of doing business in the country.

And despite the challenges of the pandemic, new horizons of economic co-operation have emerged between the UAE and Japan, such as Japan’s first fuel ammonia and carbon recycling co-operation agreement with the Abu Dhabi National Oil Company. Numerous other agreements in the energy field have further illustrated the growth of UAE-Japan economic ties. In 2021, the UAE and Japan signed a hydrogen co-operation agreement, aiming to enhance investment in the hydrogen sector while realising joint ambitions to accelerate the energy transition towards a low-carbon future.

Such partnerships also support the direction of the two countries to fulfill commitments to combat climate change made under the Paris Agreement. Both the UAE and Japan have announced plans to achieve Net Zero Carbon Emissions by the year 2050, and the UAE will host the climate summit Cop-28 next year to bring together world leaders in driving this change.

Last month, Sheikh Mohamed bin Zayed, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the Armed Forces, spoke with Japanese Prime Minister Fumio Kishida. They discussed key international developments and ways to strengthen co-operation in the energy and trade sectors while reaffirming their shared desire to bolster bilateral ties.

The co-operation, however, extends beyond the economic and energy domains. Tourism exchange remains a significant pillar of the UAE-Japan relationship, which is expected to grow as the world continues to open up from the pandemic. More than 4,000 Japanese nationals live and work in the UAE, the largest number in the Mena region. Furthermore, the two countries’ partnership in the arts, culture, and education sectors has enabled the UAE and Japan to exchange best practices while encouraging people-to-people ties among citizens, especially the youth.

Our partnership has even grown through the technological and aeronautic fields, and the UAE has already ventured into outer space with Japan through the KhalifaSat remote sensing satellite and the Mars Mission Probe. The UAE is looking to work closer with Japan in priority sectors such as future industries, space and advanced technology. In the coming years, the UAE will continue to look to Japan as an important partner in this regard.

Three years from now, the UAE will once again return to participate in EXPO Osaka. With the memory of Expo 2020 Dubai fresh, we reflect fondly on the role that Japan played as one of the top attractions at Expo. The theme of Japan’s pavilion was “Where ideas meet,” and the pavilion was in the Opportunity district, fittingly, and the design of its facade symbolised a long history of cultural exchange between Japan and the Middle East.

As Sheikh Abdullah bin Zayed Al Nahyan, the UAE's Minister of Foreign Affairs and International Co-operation, visited the Japan pavilion at Expo and Yoshimasa Hayashi, Foreign Minister of Japan, visited the UAE pavilion in March 2022, so concluded the greatest showcase of human brilliance and innovation the region has ever seen. We hope to similarly impress the people of Japan when it is our time to participate in Osaka, under the theme of “Designing Future Society for Our Lives”.

In bringing the world together to inspire future generations, Japan will host an Expo where participants will develop solutions to contemporary challenges and send a message of solidarity to the international community. Fifty five years after the UAE’s first appearance at Expo, the UAE will proudly stand with Japan in celebrating how far both countries have come as partners and as global beacons of prosperity, development and growth.