Live updates: Follow the latest on Israel-Gaza

The UAE has provided almost 40,000 tonnes of urgent supplies to Gaza since November, when the country launched its aid mission to help those affected by the war in the enclave.

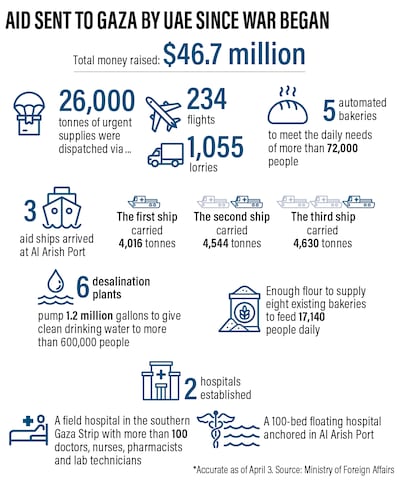

The figures, from the Ministry of Foreign Affairs, show that 26,000 tonnes of aid was delivered by 234 flights and 1,055 lorries up until April 3.

Three aid ships also set off with 13,190 tonnes of much-needed aid to Al Arish Port in Egypt, to be distributed to Gaza as part of an operation called Gallant Knight 3.

The overwhelming majority of Gaza’s 2.3 million residents have been displaced since the war began on October 7. About 1.5 million have taken refuge in the city of Rafah in southern Gaza close to Egypt’s border.

Almost 620 people from Gaza have also been brought to the UAE for medical treatment, accompanied by 635 family members.

Two hospitals have also been established as part of the UAE's programme to help those in need in Gaza, including one with a centre for amputees to provide prosthetic limbs to Palestinians wounded during the war.

These include a field hospital in the southern Gaza Strip with more than 100 doctors, nurses, pharmacists and lab technicians.

“The UAE has spared no efforts both diplomatically and in its humanitarian efforts throughout this conflict to show that it does not simply pledge but makes efforts through action to help our Palestinian brothers and sisters,” UAE Minister of State for Youth Affairs Dr Sultan Al Neyadi, told The National this year.

By mid-February, more than 3,500 patients had been treated at one of the field hospitals since it was established in December. The facility is used for general surgery and orthopaedics, while also offering anaesthetic services and intensive care for children and adults. It also offers internal medicine, dentistry, family medicine and psychiatric treatment.

The UAE has also provided a 100-bed floating hospital in Al Arish Port to support the hospital. The repurposed vessel – which has 100 medical and administrative staff on board – will remain docked off the coast of Al Arish to support relief efforts for Gaza.

The floating hospital has operating rooms, intensive care facilities, a laboratory, a pharmacy and medical warehouses.

The vast ship, which sailed from Khalifa Port, also has an evacuation plane and boat, as well as fully equipped ambulances.

The UAE also supplied five automated bakeries in Gaza which produces bread for up to 72,000 people, and enough flour for eight existing bakeries, which is helping to feed 17,140 people each day.

Six desalination plants were provided by the UAE, capable of generating up to 1.2 million gallons of clean drinking water a day to 600,000 people.

“Drinking water contains 100 to 800 parts per million [of salt], but the sea gives us about 25,000 parts per million. So, the clean water can now be used for drinking and other uses,” the desalination plants' project manager, Mohammad Al Rashidi, told The National in January.

Other initiatives include the Tarahum for Gaza campaign to collect humanitarian relief packages.

The campaign has resulted in more than 71,000 relief packages being prepared, with the involvement of 24,000 volunteers and 20 charity organisations.

More than 1,150 tonnes of food and relief aid have been dropped by plane into Gaza.