Lebanese and Israeli officials say there has been positive progress during maritime border talks between the two countries and US mediators have recently been back in the region in a bid to get progress.

But as a potential deal takes shape behind closed doors, Lebanese political rhetoric surrounding it has been loaded.

Officials in the country have promoted the benefits of an agreement, presenting it as the key to unlocking oil and gas resources and as a solution to Lebanon’s economic problems.

But energy experts in Lebanon say the rhetoric is largely populist appeasement.

Areas in Cyprus and Israel’s Exclusive Economic Zones, which border Lebanon’s waters, have proven to be rich in hydrocarbons. This, along with some seismic assessments conducted by surveyors in Lebanese waters, has raised hopes that the country's seas will also yield significant quantities of oil and gas.

But that is not necessarily the case, warn experts who also say that politicians should not pin solutions to today's crisis on a potential windfall from hydrocarbons down the road.

Exploration, they point out, is a long and prospective process. It is impossible to know when gas will be found and whether it will be abundant enough to warrant extraction.

"We cannot know how much a prospective field contains until we drill," said Marc Ayoub, an energy researcher at the Issam Fares Institute for Public Policy and International Affairs.

There is also a lengthy process of building the infrastructure to support the sector if and when oil and gas are found.

The momentum in negotiations comes against a backdrop of heightened tensions ― Iran-backed Hezbollah has threatened to attack Israel if it continues with its plan to extract gas from a field near disputed waters in September.

What is Israel and Lebanon's maritime dispute about?

Lebanon and Israel, formally at war since 1948, have no diplomatic ties and have done little to formally agree on the border between their two countries. Both claim an approximately 860 square kilometre section of the Mediterranean Sea.

The impetus to agree on where the boundary between the countries stood became more important when Israel discovered and began to extract oil and gas in its waters.

Since a maritime dispute between the two countries began in 2007, various rounds of US-mediated negotiations have taken place.

But talks have proceeded at a distinctly faster pace since June.

What is Lebanon's 'unified stance'?

Amos Hochstein, the Israeli-born US diplomat mediating between the two countries, has attributed the “positive” direction of the talks to the unified position adopted by Lebanon’s three leaders – President Michel Aoun, caretaker Prime Minister Najib Mikati and Parliament Speaker Nabih Berri ― whom he met with last week.

The three men are from different political factions and previously had different red lines on any agreement.

The US made it a precondition to resuming the stalled talks that Lebanon agree on a unified position regarding the negotiations. This essentially means that if negotiators finalise a deal with Israel it will not then be blocked by a different part of the Lebanese state with its own demands.

But Mr Ayoub said the momentum created by this unified stance is also due to political pressure to make Lebanon concede a claim on the additional maritime territory.

Some energy experts, including Mr Ayoub, believe Lebanon is technically entitled to more of the maritime area than they are now negotiating over.

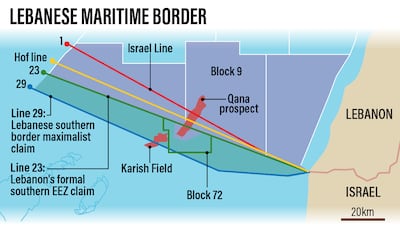

Line 23 is the maritime line officially claimed by Lebanese negotiators. The Qana prospective gas field sits mostly to the Lebanese north of the line and some lies to the south.

However, complicating the matter is that in 2011 a group of Lebanese army specialists - backed by the UK Hydrographic Office – demarked an area to the south which they said should be Lebanon's boundary named Line 29. This would give Lebanon about 1,400 square kilometres more territory than Line 23.

Claiming line 29 would put part of the Karish gas field that Israel is planning to start exploiting inside Lebanese territory.

However, Lebanon's negotiators have been working on the basis of the more northerly Line 23 ― in effect conceding the 1,400 square kilometres to Israel. This line cuts the Qana prospective gasfield near its furthest edge.

Israel is claiming that the border should follow Line 1, which would give it a further 860 square kilometres of sea.

Although the Lebanese survey placed the prospective border at Line 29, a decree amending the new co-ordinates of the frontier to match this was never ratified by Mr Aoun or sent to the UN.

Doing so would have officially registered the maritime area north of Line 29 as disputed under international law.

“The Lebanese position today is mainly focused on Line 23 and a little beyond so Lebanon can get all of Qana," Mr Ayoub said. "The compromise is all of Qana for Lebanon and all of Karish for Israel”.

It remains to be seen whether Lebanon’s demand will be met, with Mr Hochstein promising to deliver Israel’s response in the coming weeks.

Dysfunctional politics

Mr Ayoub worries that conceding Line 29 will cost the struggling country dearly in the long term.

He believes that Lebanon “conceded Line 29 because of US political pressure”.

But former US diplomat Frederic Hof, who previously mediated the border dispute from 2011 to 2012, said Lebanon's dysfunctional politicians were at fault for not making a deal years ago and squandering the potential benefit.

He said the years of previous failed negotiations were “a case study in political dysfunction, for which the Lebanese people are paying a high and totally unjustifiable price”.

Mr Hof proposed what became known as the Hof Line, which falls north of Line 23 just above the Qana potential gasfield but south of Israel's Line 1 demand.

It would put both the Qana and Karish gasfields in Israeli territory but give Lebanon about 480 square kilometres more territory than Israel's demands of Line 1.

However, he said that agreeing to that offer in 2012 would have ended the maritime dispute and allowed Lebanon to begin exploring for and producing hydrocarbons in potentially lucrative waters.

The slow pace of the talks under Mr Mikati’s 2012 government — rocked by political assassinations and upheaval — and its failure to accept the Hof Line ended up costing Lebanon “ten years and billions of dollars of revenues,” Mr Hof said.

The Hof Line proposal was taken off the table at the end of the US diplomat's tenure. Although Lebanon tried to negotiate a slightly improved offer in the years after, Mr Hof said that talks effectively returned to the start.

The struggling Mediterranean nation is in its fourth year of a prolonged financial crisis that has wrecked public institutions and brought the state to the point of collapse. The local currency has plummeted in value, causing severe inflation and leaving nearly 80 per cent of the population impoverished.

Shortages in power, diesel, medicine and water have come to define the economic crisis for residents.

In short, Lebanon is badly in need of a solution to the maritime dispute so it can exploit offshore prospects.

Best-case scenario

Ten years after the Hof Line was presented, Mr Mikati is again prime minister, albeit in a caretaker capacity, and struggling to form a new government during a period of economic upheaval.

But all the experts in the energy sector reiterate that a deal is just the first step.

“Even if a new compromise is agreed to ― and I hope it is ― several more years will pass before Lebanon is able to derive revenue from natural gas,” Mr Hof said.

Historically, Lebanon’s leadership have not been known for expedience or efficiency.

Mr Ayoub echoed Mr Hof's warning about the timetable involved and said that Lebanon would need at least five years if there are no delays, calling it the country's best-case scenario.