Former Iraq prime minister Nouri Al Maliki appeared before a judge in Baghdad on Tuesday over leaked audio recordings in which he seems to insult his powerful rival, Shiite cleric Moqtada Al Sadr, and plots to arm a militia group.

The audio tapes — the authenticity of which is contested — were leaked in early July by US-based blogger and activist Ali Al Fadhil amid rising tension among political rivals over forming a new government.

Mr Al Maliki says the audio is fake.

In September, politicians linked to Mr Al Sadr filed the legal action against Mr Al Maliki, who was Iraq's prime minister between 2006 and 2014.

Senior Sadrist member Jaafar Al Mousawi said the investigative judge registered Mr Al Maliki’s statements and ordered his release on bail.

If charges are brought, the judge would then set a date for the trial, Mr Al Mousawi said.

Husham Al Rikabi, who runs Mr Al Maliki’s media office, confirmed that he was at a Baghdad court on Tuesday, giving no other details.

There was no immediate comment from the Iraqi Judiciary Council.

The tapes feature a meeting between someone said to be Mr Al Maliki and representatives of a Shiite militia. The date and whereabouts of the meeting is unknown.

In the audio, the person said to be Mr Al Maliki appears to accuse Mr Al Sadr of kidnappings and murder campaigns after the 2003 US-led invasion that toppled Saddam Hussein, mainly during sectarian warfare in 2006 and 2007.

In the recording, the voice attributed to Mr Al Maliki also seems to claim Mr Al Sadr is backed by foreign powers who want to drive a wedge among Shiites who ascended to power after 2003 and expresses readiness to fight Mr Al Sadr.

He describes the government-sanctioned Popular Mobilisation Forces — a largely Iran-backed militia force — as “cowards”, accusing their senior leaders of corruption.

At one point, he urges representatives of the militia group to align with Iran’s Revolutionary Guards, a branch of Iran's armed forces, and promised to arm them.

In September, the head of the Sadrist bloc, Nassar Al Rubaie, asked authorities to issue an arrest warrant and travel ban against Mr Al Maliki, accusing him of threatening peace and security in the country.

He also accused Mr Al Maliki of seeking to cause sedition and sectarian fighting in the country.

After serving two terms as prime minister up to 2014, Mr Al Maliki sought a third term. But he was forced out from office as ISIS swept through northern and western Iraq, amid a collapse in security.

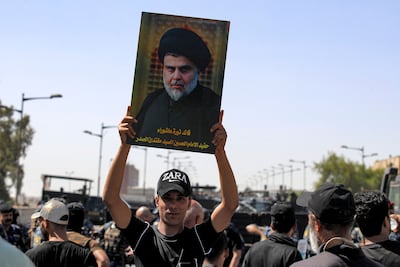

Bitter feuding between Mr Al Sadr and Mr Al Maliki is one of the main reasons behind the deadlock in forming a new Iraqi government.

Mr Al Sadr, who emerged a clear winner in October 2021 elections with 73 seats out of 329 seats, but required coalition partners to form a government.

He sought to sideline Mr Al Maliki’s State of Law coalition that won more than 30 seats.

The enmity between the two men dates to 2008, when Mr Al Maliki launched a military operation against Al Sadr’s Mahdi Army militia.