Saudi Arabia’s Crown Prince Mohammed bin Salman began a tour of Gulf states on Monday evening with a visit to Oman, where his talks with Sultan Haitham are expected to focus on salvaging a nuclear pact between Iran and the West, resolving regional conflicts and increasing co-operation between their countries.

Sultan Haitham received Prince Mohammed at the Royal Airport, along with senior government officials and members of the royal family.

An Omani Foreign Ministry spokesman told The National that the talks between the two leaders would be “a follow-up of His Majesty Sultan Haitham bin Tarek’s visit to the Kingdom of Saudi Arabia and also the relations between the Gulf countries with Iran, particularly on Iran’s nuclear agreement with the West”.

Sultan Haitham met King Salman during his visit to Saudi Arabia in July, when the two countries agreed to establish a joint council on economic ventures including maritime, agriculture, industrial and logistics projects.

The Saudi Press Agency said Prince Mohammed would sign an agreement to establish the Omani-Saudi Co-ordination Council during his visit.

The council will “see to the sustainability and expansion of co-operation between the two countries, with great scope for more agreements and memorandums of understanding", Spa said.

Western diplomats in Oman said they expected the Saudi crown prince’s visit to be dominated by talks on resolving regional conflicts.

“The Saudis see Oman as a crucial link with Iran. Bin Salman needs Oman to convince the Iranians to get back to the negotiation table to salvage the nuclear pact. Also, the Saudis need Oman to tame the Houthis in Yemen to accept a peace treaty,” a western diplomat based in Muscat told The National.

“Oman stands to benefit from being a mediator for these two conflicts by winning important contracts from the Saudis to boost its ailing economy."

A government trade official said Saudi Arabia’s plans to establish an industrial zone in Oman would also feature in the discussions.

“Part of the talks will be on the Saudis developing an industrial zone at Duqm to transport goods between Oman and Saudi Arabia from this special economic zone,” the official told The National.

He did not give further details.

The Oman News Agency reported that leading Saudi Arabian and Omani companies on Monday signed several agreements before Prince Mohammed’s arrival, covering vital sectors such as petrochemicals, renewable energy, mining, tourism and maritime transport.

Omani energy company Okio Group agreed with Saudi Aramco and the privately-owned ACWA Power, which specialises in desalinated water production, to increase co-operation in renewable energy and hydrogen technology in power generation. Saudi Basic Industries Corporation signed an agreement to develop a petrochemicals project in Duqm, while the Muscat Stock Exchange and the Saudi Tadawul Group agreed to increase co-operation, the Omani state news agency said.

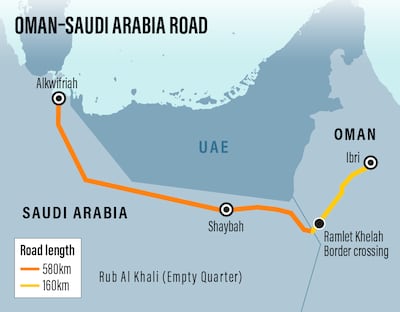

Oman and Saudi Arabia this year announced the construction of a motorway linking the two neighbours through the Empty Quarter desert region.

The motorway, more than 700 kilometres long, will start from Ibri, a town in south-west Oman, and end in Alkwifriah in Al Ahsa, eastern Saudi Arabia.

Abdullah Saud Al Anzi, the kingdom's ambassador to Muscat, said the motorway would be opened soon.

He said Prince Mohammed's visit reaffirmed the "deep historical ties" between the two nations and their expansion into "wider horizons of co-operation".

Oman has embarked on an ambitious economic development plan – Vision 2040 – to wean its economy off dependence on oil revenue and introduce medium-term measures to rein in its debt, which has grown in recent years.

Prince Mohammed’s tour will take in all five fellow members of the Gulf Co-operation Council – Oman, the UAE, Bahrain, Qatar and Kuwait.

It will be his first visit to Qatar since the AlUla summit in January ended a rift in the GCC and re-established ties between Doha and Saudi Arabia, the UAE and Bahrain.

Saudi Arabian state media reported that the tour would be focused on ways to enhance co-ordination between GCC states and measures to strengthen the work of the regional body, before the leaders’ summit in mid-December.