Economic growth and a continued digitisation push mean the UAE will probably need to add 1 million workers by 2030, according to a new skills forecast report.

The analysis, conducted by enterprise software company ServiceNow and education company Pearson, said the UAE's affinity for technology, artificial intelligence and its well-known push for the digital transformation of services will help to create jobs in manufacturing, education and retail.

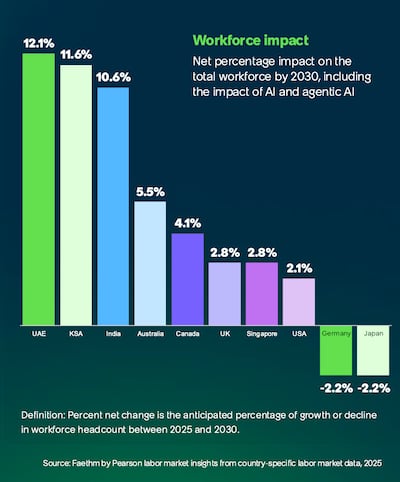

“This 12.1 per cent increase in the human workforce represents one of the highest percentage increases among the markets studied, compared to projected growth in major economies such as the US (2.1 per cent), the UK (2.8 per cent), and India (10.6 per cent),” a news release from ServiceNow highlighting the report read.

Finance, health care, energy and utilities sectors will also see a boost, the analysis added.

The findings of the report, which looked at the UAE, Saudi Arabia, India, Australia, Canada, the UK, the US, Germany and Japan, run contrary to many of the prevailing sentiments about AI potentially disrupting the labour market to the detriment of overall economic growth.

William O’Neill, GCC vice president at ServiceNow, reflected on the economic and employment projections.

“The future of work depends on collaboration between people and AI, and it’s a future that’s hiring now,” Mr O’Neill said, pointing out the need for upskilling, which in turn, could boost growth amid continued AI investment.

“What we are seeing in the UAE, as well as in nearly every other country surveyed, is that AI augmentation will be central to capturing the next wave of economic growth,” he added.

In terms of technology roles in the UAE, ServiceNow and Pearson's report said that by 2030 “organisations will require more than 91,000 additional technology specialists” and that other in-demand roles will revolve around search marketing strategy, programming and computer systems analysis.

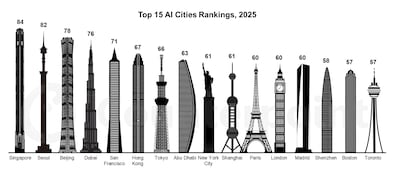

In recent years, the UAE has pushed to be an AI leader as it diversifies its economy away from hydrocarbons.

The country’s affinity for research into the technology has resulted in the establishment of start-ups, partnerships and investments from industry leaders including Microsoft, Nvidia and OpenAI.

The UAE has also teamed up with the US to develop an AI campus, which will include 5GW of capacity for AI data centres, in Abu Dhabi.

At first glance, the workforce report may appear not to bode well for Germany and Japan, which project a workforce loss, but ServiceNow says other factors beyond technology and AI are at play.

“Overall, eight out of the 10 countries we studied will need additional workers to support their projected economic growth,” the report read.

“The exceptions are Germany and Japan, where we forecast workforce shrinkage due to demographic shifts as well as slower job creation related to their modest growth and relatively high tech adoption rates.”

Debate continues to rage in various economic, technology and organised labour circles about the impacts AI might have on employment.

Those debates have caused a shift in public sentiment on AI and the technology sector overall.

In the US, a recent poll from the Pew Research Centre showed an increasing chasm between experts and the general public in enthusiasm for AI.

Technology experts surveyed by Pew, however, were significantly more likely – 56 per cent compared with 17 per cent – than the average American to say that AI would have a “very or somewhat positive” impact on society over the next 20 years.

ServiceNow and Pearson's report briefly touches on the negative impacts of AI development, showing that cumulatively among the countries focused on in their report, roles in the finance sector could see the most disruption from “agentic AI”.

Broadly speaking, agentic AI is defined as a way to use technology to automate complex decision-making tasks usually performed by humans.