The Middle East region is one of the fastest-growing gaming markets in the world and the industry offers bright prospects for software designers and equipment makers, according to a new whitepaper.

The regional industry has evolved from casual gaming to virtual reality games, e-sports and competitive knockouts that involve contestants from throughout the world, the paper titled Gaming and Esports: The Next Generation by online market research company YouGov found.

"This highly engaged gaming audience in the region presents a huge opportunity for game developers and console manufacturers … e-sports industry in Mena [Middle East and North Africa] is likely to witness a boom in the future," the paper, which was published on Monday, said.

The growth is being propelled by the region's young and fast-growing population of active gamers, as well as a deep penetration of smartphones and the internet, it added, without disclosing a dollar value for the industry.

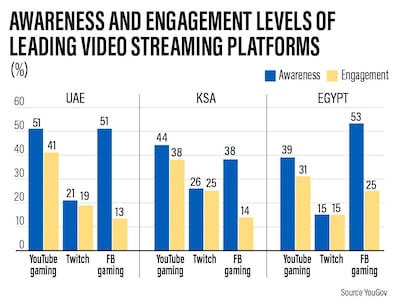

For an important sub-section of players, watching video games online has become as much of a pastime as gaming itself, with high engagement rates on platforms such as Twitch, YouTube Gaming and Facebook Gaming. The UAE and Saudi Arabia, the Arab world’s largest economies, rank among the top 10 global markets for YouTube Gaming, in terms of awareness and engagement, according to YouGov’s survey.

The survey was conducted in September and involved nearly 24,000 respondents in 24 markets including the UAE, Saudi Arabia, Iraq, Egypt, China, the US, India, Germany, the UK, Australia, Singapore, Sweden, Thailand, Spain, France and Italy.

The gaming industry – split into mobile games, e-sports streaming, console purchases and more – is currently the most profitable form of entertainment in the world.

Worldwide, the industry is worth $148.8 billion, while the market in the Middle East and Africa is valued at about $4.8bn, accounting for just 3 per cent of the global total, according to a study published late last year by market research firm Newzoo.

Egypt, the region’s most populous country, has the highest proportion of gamers at 68 per cent, followed by the UAE (65 per cent) and Saudi Arabia (61 per cent).

In the Mena region, mobile gamers – playing on a smartphone or tablet – outnumber PC or console gamers.

In Egypt, just 14 per cent play on consoles, compared to 58 per cent who use a smartphone or a tablet. In the UAE, 21 per cent play on consoles, 28 per cent on PCs and 57 per cent on mobiles. In Saudi Arabia, 20 per cent play on consoles, 22 per cent on PCs and 52 per cent on mobiles.

A majority of smartphone gamers in the UAE (79 per cent), Saudi Arabia (76 per cent) and Egypt (73 per cent) are light-to-regular players, playing for up to 10 hours a week, YouGov said.

Consumer appetite for gaming rose rapidly in 2020 with the creation of new platforms such as Apple's Arcade and Google's Stadia. Movement restrictions due to the Covid-19 pandemic also propelled users’ interest, industry experts said.

“This year the global video gaming industry has captured the attention of brands, marketers and investors on a large scale,” said Nicole Pike, global sector head of e-sports and gaming at YouGov.

Games by international developers have the lion’s share of the Gulf market. The top mobile games played in the region include PUBG, Intikam Al Salatin, Fortnite and Rise of Kingdoms.

Regional players such as Beirut-based gaming studio Falafel Games and Amman-based Arabic mobile games publisher Tamatem have started to gain traction by developing culturally-relevant content.