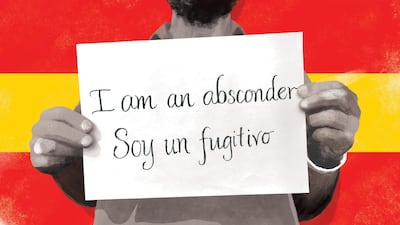

I absconded from Dubai in June last year with debts of around Dh140,000 on two loans and two credit cards. I am willing to repay but my bank seems uncooperative. I can make a lump sum payment of 12,000 euros (Dh54,719) thanks to a friend offering to lend me the money, however, I am unable to repay the full amount as I have been unemployed since I left the UAE. My debts are all with the same bank and when I left the amount owed was:

Bank loan: Dh90,000

Car Loan: Dh43,000

Fast card for car loan downpayment: Dh11,000

Credit card 1: Dh5,000

Credit card 2: Dh5,000

Total Dh154,000

The debts have escalated since then and when I last checked (I am no longer able to access my online account anymore) I owed Dh170,000.

When I was in Dubai, I worked as a quality manager for a hotel, earning Dh12,500 a month with allowances. I had to return home to Spain due to a number of family complications; my father passed away and I needed to handle matters back home. What do you advise? RP, Spain

Debt Panellist 1: Ambareen Musa, founder and chief executive of Souqalmal.com

Since you left the country without settling your debts and have failed to make regular repayments, the bank has the right to file a police case and initiate legal proceedings against you. It is also likely that these debts may follow you back home, since the bank could authorise a local debt collection agency to recover the amount owed by you. Therefore, you must act fast if you hope to become debt-free for good.

Your best bet is to appoint a legal representative that can negotiate with the bank on your behalf. This legally appointed individual could negotiate to settle your outstanding debts by either reducing the total amount due or waiving the interest and late payment penalties. It is highly unlikely that the bank will agree to any other repayment plan since you have failed to keep up with your instalments over the last year.

As you have access to a lump sum, you should first use it to pay off your credit card debt and close the credit card accounts subsequently. This would plug the interest drain caused by high interest accruing on your credit card debt. You could use what's remaining and supplement it with your personal savings to close the smaller bank loan. This would leave you with only one debt to deal with in terms of negotiation.

While you continue to look for a job, explore other ways to collect the cash you need to repay your debts. Do you own any assets or investments that can be sold? You must also consider part-time work or freelance jobs to help you stay afloat in the meanwhile.

It may take a while to reach a settlement with the bank even if you enlist the services of a legal professional. But remember to keep a record of all communication with the bank and get any form of agreement in writing from an authorised representative.

_____

Read more:

The Debt Panel: 'I've repaid my credit card for two years but the balance barely reduces'

Bounced cheques in UAE: new rules 'a progressive step for the justice system'

It is possible to restructure debt directly with UAE banks, a Sharjah resident reveals how

______

Debt panellist 2: Steve Cronin, founder of DeadSimpleSaving.com, which helps people invest their money sensibly

Absconding puts both you and the bank in a difficult situation, but at least you are willing to make repayments. It is not clear whether you intend to repay the full amount over time or just pay the €12,000.

You may be arrested if you take a flight that passes through the UAE, potentially including transit or emergency landing. The bank may also chase you through debt collectors in Spain, though you would not be arrested there.

The bank is not in a particularly strong position, given you have left the country. It should logically be encouraging any form of payment, while trying to ensure the best outcome for itself. Talk to the most senior manager you can find, as they may be more empowered and reasonable than your current contact person.

You should aim to pay off the credit card debt first and any loans with a high interest rate. This will help stop the debt ballooning rapidly over time. For the remaining amount of approximately Dh115,000, try to establish a time period, payment frequency and interest rate with the bank so you can make regular payments. You need to find a job to support this and avoid the temptation to ignore the debt.

Also, where is the car that you took out a loan for? If you have not sold it, the bank should accept it as partial payment, assuming it is still in reasonable condition.

______

Read more:

The Debt Panel: Dubai absconder's Maldives job pays too little to cover his Dh86,000 debts

A nine-step guide to help you renegotiate bank debts in the UAE

The Debt Panel: 'I bailed out my mum when my dad died and now owe over Dh240,000'

______

Debt panellist 3: Shaker Zainal, head of retail banking of CBI bank in the UAE

Firstly, I am very sorry for the loss of your father and the predicament you have found yourself in.

At the moment, you cannot afford to service your monthly repayments due to your circumstances. The increase in the amount you owe is most likely the result of penalties for missed payments and accrued interest on your credit cards and loans. As far as I see, you have two options to becoming debt free.

Option one is speaking to your bank about consolidating your outstanding debt into a single loan. I know you have said the bank is uncooperative, but as all your debt is with the same financial institution, it is worth discussing your options with them again. In general, banks always want to recover outstanding payments amicably and will assist customers with financial problems and help them make repayments.

Try to get the bank to agree to a programme of repayments, which is both achievable and sustainable on your current budget. Also, if you are able to pay a lump sum upfront, you can also explore the option of a grace period, where the bank will give you an opportunity to take a break from paying instalments for a period without incurring any late payment penalties.

Option two is using a debt consolidation agency to act as a broker between you and the bank to help you negotiate a better deal on your repayments. If you do end up using an agency, please note that there are associated contractual obligations and fees, which you need be aware of.

Also, as you are currently unemployed, you should also look to source another job as soon as possible, as well as explore other avenues of generating cash flows, which you can use to settle your debts in the UAE.

The Debt Panel is a weekly column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae