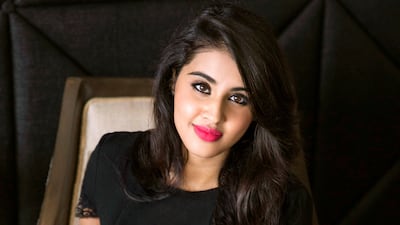

Nidhi Sharma believes money has the power to build a legacy and a brand. She channelled the money she had saved over the years to launch a business powered by her passion for beauty.

The Indian entrepreneur, who has been living in the UAE for two years, created e-tail app NOUR to disrupt the way customers shop for beauty products online.

“Our mission is to become the go-to beauty destination for users in the UAE and across the GCC,” she says.

“The current e-commerce ecosystem is based on ‘what’ to buy. The future is all about the ‘why’. NOUR is the answer to that.”

Ms Sharma kicked off her career as a beauty writer at Vogue India, a role that paid very little but offered “immense satisfaction and growth”.

She later became beauty director, and conceptualised and executed the Vogue Beauty Awards for a decade.

“This experience allowed me to work closely with industry stalwarts like Victoria Beckham, Bobbi Brown and Karl Lagerfeld,” Ms Sharma recalls.

She lives in Downtown Dubai with her husband, Gulrayz, who is the co-founder of NOUR.

Did wealth feature in your childhood?

I come from money, but it was fairly understated during my childhood. My father works in real estate, experiencing the emotional and financial highs and lows that come with it.

My mother is a homemaker who instilled the value of money. I received a moderate allowance, which taught me the importance of managing money wisely, even during times of abundance or scarcity.

How did you first earn?

My first earnings came from internships at beauty counters in Selfridges. My first salaried job was as a beauty writer at Vogue India, where the pay was quite modest.

However, I wasn’t there for the money. I was driven by my love for the beauty industry and the iconic brand that is Vogue.

The experience and knowledge I gained were priceless and set the foundation for my future career.

Any early financial jolts?

Absolutely. Running a start-up like NOUR involves constant financial stress. There have been countless moments when financial uncertainties have kept me up at night.

However, each jolt has taught me resilience and the importance of meticulous financial planning and management.

How do you grow your wealth?

I work incredibly hard. I’ve been fully committed to my career since I was 18 and have rarely taken time off. I’ve invested every penny I’ve saved over the years into my start-up, including my fixed deposits.

My focus is on making my business a success and a formidable beauty brand. That, for me, would be my biggest wealth.

Building a legacy and a brand is what drives me.

Are you a spender or a saver?

I’d like to think of myself as a saver, but in reality, I’m more of a spender. However, running a business operation has taught me the importance of budgeting and financial planning.

Have you been wise with money?

I’ve been extremely wise with money. I plan a lot and evaluate the value of money spent. I’m wise with investing in my health and experiences that help me grow as a person.

What has been your best investment?

My best investment has undoubtedly been in myself.

I've devoted considerable time and effort to both my mental and physical health. Strength training is something that grounds and empowers me. It gives me the discipline and the resilience to tackle any challenge that comes my way.

founder, NOUR

I've invested heavily in my passion for beauty. I’ve spent four years learning how to read, write and speak Korean – as the beauty capital of the world, I wanted to understand the nuances that make it so influential.

From watching cosmetic chemists break down formulations to reading [the] ingredients list just for fun, over the years I’ve dedicated a little bit of my every day to enhance my understanding of every aspect of the beauty industry.

Any cherished purchases?

I’ve always wanted to give my mother a timeless piece of jewellery. My most cherished purchase would have to be the tennis bracelet I bought her a few years ago.

How do you feel about money?

Growing up, I saw money as a means to an end, a way to access opportunities and experiences.

But beyond the numbers, money also represents freedom. It's the freedom to innovate, to take risks and to create something that genuinely resonates with people.

Money should work for you, not the other way around. And when you reach a point where you can give back – whether that's through philanthropy, mentorship or creating opportunities for others – that's when it truly becomes powerful.

Money is an instrument of change, it’s important to understand its potential and leverage it to create a lasting impact.

Any financial advice for your younger self?

I’d tell myself to start thinking about money as a tool for freedom, not just security. Invest wisely, don’t just keep money in the bank.

Any key financial milestones?

Not having to think about money is truly liberating. It may sound simple, but achieving a state where financial concerns no longer dominate your thoughts is a profound milestone – it allows you to focus solely on innovation and growth.

What luxuries are important to you?

One luxury that's incredibly important to me is time. Time to reflect, time to connect with the people I love and time to invest in my personal growth.

In the fast-paced world of entrepreneurship, where every second counts, carving out moments just for yourself becomes a true luxury.

I find immense value in the luxury of self-care. This might seem like a cliché, but for me, it’s about those small rituals that make a big difference – like a long, leisurely self-care Sunday dedicated to all things beauty and self-love.

What are your financial goals?

My financial goals are centred around security and freedom. I want to build NOUR into a brand that resonates with the consumers.

Financially, this translates to sustainable growth, reinvesting profits back into the business to fuel innovation and expanding our reach to new markets.

Ultimately, my financial goals are not just about numbers. They are about creating an impact.