Idris Elba

English actor Idris Elba and his wife, Sabrina Dhowre Elba, have joined a $24 million funding round into plant-based meal replacement business Huel, alongside broadcaster Jonathan Ross and Tala activewear boss Grace Beverley.

The UK-based brand, which sells its drinks, powders and meal products directly to customers through online channels, will use the new capital to scale up its retail business and expand its market share in the US.

With the new investment, the company has a valuation of more than €540 million ($569 million).

“I’ve been a Hueligan for several years now, starting my journey while preparing for my role in Thor, so to come on board with Huel was an easy decision,” Elba said.

“I believe in their mission to deliver nutritionally complete food, sustainably. We have some exciting projects coming up and I look forward to spreading the message and raising awareness around healthy, low-carbon food.”

Huel has offices in Hertfordshire, Birmingham and London. The company said the latest funding move comes after it reported a 40 per cent jump in revenue to about $170 million for the year to July 2022, as compared with the previous year.

Elba, 50, has a net worth of $40 million, according to wealth tracking website Celebrity Net Worth.

His principal source of income is acting, but he is also a singer and film producer.

The father-of-two has a real estate investment portfolio that includes a $2.8 million home in Hackney, where he grew up.

Cristiano Ronaldo

Could one of football’s most famous players soon be based in the GCC? The next few weeks will tell.

Portuguese forward Cristiano Ronaldo is reportedly close to agreeing on a deal worth €200 million ($210.5 million) a season with Saudi Arabia’s Al Nassr football club, according to the UK’s Daily Mail newspaper.

The 37-year-old is a free agent after leaving Manchester United recently. Sources close to the football superstar say he remains focused on the FIFA World Cup, but Spanish media claim the agreement has already been concluded.

The deal is expected to run until 2025.

If signed, it would see Ronaldo overtake rival Lionel Messi to become the richest sports star in the world.

The five-time Ballon d'Or winner earned $115 million in on-field and off-field income in 2022, according to Forbes magazine.

Watch: Ronaldo relishes 'beautiful moment' with new World Cup record

The publication ranks him as one of the world’s highest-earning athletes, with a net worth of $1.24 billion.

Off the field, his CR7 fashion brand spans eyewear, underwear and shoes.

With more than 690 million followers across different social media platforms, Ronaldo is able to command high fees from sponsors such as Nike, Herbalife and Clear shampoo.

Business Insider magazine reports that he has a lifetime endorsement deal worth $1 billion with Nike.

A single social media post can fetch him an estimated $1.6 million, the publication reports.

Ronaldo has invested into a wide range of companies, including hotels, garment and fragrance brands, hair care, perfumes, and tech start-ups.

Notable investments include a $40 million outlay into four of Pestana Hotel Group’s boutique hotels, a fitness venture with US health company Crunch, and hair transplant brand Insparya.

On the tech front, he launched the football community app ZujuGP earlier this year in partnership with the son of long-time business partner Peter Lim, and has been involved with the Latin American football fantasy league Draftea.

Gwyneth Paltrow

Goop founder Gwyneth Paltrow is among a group of celebrity investors into ResortPass, which focuses on providing access to luxury relaxation venues such as hotel beach clubs.

The American talent and media agency William Morris Endeavor, actress Jessica Alba and Brian Kelly, also known as The Points Guy, are other investors in the $26 million Series B funding round.

ResortPass offers hotel brands a way to create new revenue streams from amenities such as the pool, spa or fitness centre without requiring guests to book an overnight stay.

Launched in 2016, the company works with more than 900 hospitality brands around the world, including the Four Seasons, Ritz Carlton, Hyatt Hotels, Fairmont, W Hotels and Westin.

The company has delivered more than 1.6 million guests to its partner hotels since inception in 2016.

Oscar-winning actress Paltrow, 50, has a net worth in excess of $200 million, according to Celebrity Net Worth.

The principal source of her income has been her Hollywood career, which includes films such as Shakespeare in Love, The Royal Tenenbaums and Se7en.

Besides her film and music career, Paltrow runs the lifestyle company Goop. The company started out as a lifestyle newsletter in 2008, but has grown into a website, podcast, print magazine and pop-up shops. It now retails candles, beauty products and feminine hygiene items.

In 2019, Goop raised $50 million in Series C funding at a valuation of $250 million. Her stake in the company has been valued at $75 million before taxes, according to Celebrity Net Worth.

Earlier this year, she joined with Cameron Diaz, Drew Barrymore, Carla Harris and others to invest in Evernow, a telehealth company that provides personalised, prescription treatments and clinicians for menopausal and perimenopausal women.

Paltrow also has a significant real estate portfolio that includes homes in New York City, Los Angeles and London. She is also a cookbook author.

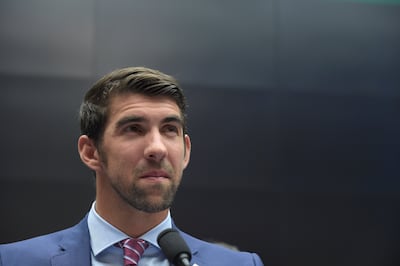

Michael Phelps

Competitive swimmer Michael Phelps has joined an angel funding round into bagel start-up PopupBagels.

Additional investors include actors Paul Rudd and Patrick Schwarzenegger.

Launched over the course of the coronavirus pandemic, the company plans to use small footprint storefronts and existing underutilised restaurant kitchens to get PopupBagels into the hands of bagel lovers everywhere, starting in the Northeast.

Phelps has a net worth of $100 million, according to Celebrity Net Worth.

The 37-year-old athlete amassed his wealth from sponsorship deals with brands such as Visa, AT&T, Speedo, Subway and Under Armour.

Nicknamed the Baltimore Bullet, Phelps is one of the few athletes to retain a significant number of endorsements post-retirement.