This has been a year like no other in the world of investing. The year 2021 was when the investment world recovered from the knock-out punch of the pandemic and hustled hard to regain what it lost in 2020 and then some. In a reversal of fortunes, this year saw investors turn just about every handicap and hardship to their advantage as they boldly charted new investing paths to a world of opportunities.

As the global economy rebounded and earnings boomed, stock markets soared to new highs. We now have an exclusive trillion-dollar club comprising five US companies with market value exceeding $1 trillion.

The year saw the emergence of many new trends. Lockdown boredom and stimulus cheques hatched bizarre investment themes, some including cult-like armies of speculative investors using internet forums to pump worthless stocks of drain-circling businesses (here’s looking at you, GameStop and AMC Entertainment Holdings) to ridiculous heights.

The year also saw the emergence of memecoins, low-cost trading apps, teenagers trading cryptocurrencies, NFT buying frenzy and a taste of the metaverse, just to name a few.

How will this transformation affect the way we trade in 2022? Let’s look at a few megatrends that are likely to shape the trading and investing space in the year to come.

ESG investing

Sustainable investing saw an unprecedented boom in 2020. The Covid-19 pandemic proved to be a catalyst for environmental, social and governance (ESG) investing. The asset class has attracted record inflows of a whopping $21.5 billion in the US, according to a Morningstar report. In fact, each of the first three quarters of 2021 saw inflows higher than the corresponding quarter in the year before.

Globally, sustainable funds had already hoovered up a record $508bn in investments in the first three quarters of 2021, while their assets under management rose to a $3.9tn at the end of September, according to Morningstar data.

Unshackled by a myriad of myths and investor scepticism, the trend is well anchored. ESG has become a key theme in the investing space, both as a consequence of the pandemic and the global response to it.

For a growing number of investors and businesses, ESG issues are now key economic determinants with significant bearing on profitability. From gender and racial equality to global warming and clean energy, everything is now on the table under the ESG umbrella. There’s every indication that the trend is poised to surge unabated in 2022.

NFTs

This was the year non-fungible tokens (NFTs) exploded into the mainstream consciousness. From social media platforms to financial media, there’s no escaping the NFT chatter.

NFTs are non-fungible cryptocurrency tokens – means the tokens are not interchangeable, unlike fungible assets like fiat currency or Bitcoins – that run on a blockchain network, a digital ledger that records all cryptocurrency transactions.

Earlier this year, NFTs generated global sensation when artist Beeple sold his artwork, Everydays: The First 5000 Days, for an eye-popping $69 million. The sale triggered an NFT mania that pulled in $10.7bn in investments in the third quarter of 2021, according to data from market tracker DappRadar.

As NFTs grow into a multibillion-dollar industry, they are attracting art enthusiasts and memorabilia seekers who are investing millions of dollars in unique digital creations. NFTs’ allure as an investment asset has become so irresistible that even music celebrities, sports stars and corporations are getting in the game, both as buyers and sellers of digital tokens.

At it current rate of growth, the global NFT market is projected to rocket to US$80bn by 2025. Evidently, NFTs are here to stay and their popularity is expected to continue unabated in the coming year.

If you’re curious to know more about NFTs, here’s a primer that has you covered.

Metaverse

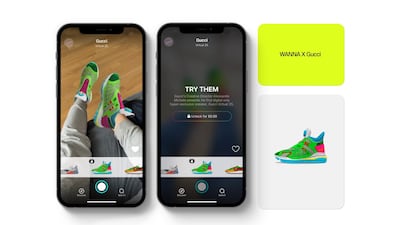

Touted as the biggest idea in tech, the metaverse represents a seismic shift in the digital realms we inhabit. As a buzzword, the metaverse refers to a variety of virtual experiences, environments and assets that garnered traction during the pandemic-led shift to the digital world.

In the simplest terms, the metaverse is a giant communal cyberspace built on the intersection of virtual reality and augmented reality. It promises an immersive world where millions of users, or their digital avatars, can participate in a range of activities as they socialise, work and play.

If the Big Tech are to be believed, metaverse is the future of the internet. Evidently, these companies are jumping into the metaverse feet first. In October, Facebook decided to rebrand itself as Meta to reflect its growing focus on the metaverse. Microsoft, Walt Disney, Apple and Nike have also poured billions of dollars into the metaverse technology, a market that is projected to zoom to $800bn by 2024 from $500bn in 2021.

Still in its infancy, the more evolved metaverse could be a technological leap forward that can be likened to the web’s transformation from barebones text and images in the 90s to a place where you can binge watch TV series, buy groceries and gadgets, and create a workstation accessible from anywhere in the world.

For investors, 2022 could represent the opportunity to get in on the ground floor of the metaverse movement.

Memecoins

Riding on the coattails of the wider cryptocurrency boom, there is a subcategory of altcoins that are raking in big investing bucks. These virtual tokens are memecoins, a category of lightweight cryptocurrency coins inspired by internet memes, jokes and trends.

While there are as many as 124 memecoins currently in circulation, according to CoinMarkatCap.com, the two dog-inspired memecoins dogecoin (Doge) and Shiba Inu (Shib) remain the king of hill in this category.

Both Doge and Shib are inspired by the same breed of dog, Shiba Inu, and have now amassed a following large enough to place the tokens among the top 15 cryptocurrencies by market cap, according to CoinMarketCap.

As millennials and Gen Z investors piled into joke coins, bewitched by a low-stakes, high-gains game, the market cap of memecoins like Dogecoin and Shiba Inu swelled dramatically to $23bn and $20bn, respectively, as of December 22.

Memecoins’ popularity is also attributed to frequent celebrity shoutouts in social media. Tesla chief executive Elon Musk, rapper Snoop Dogg, rock star Gene Simmons and entrepreneur Mark Cuban are some of the loudest cheerleaders who have amplified both visibility and desirability of memecoins.

While joke coins are seen by many as a source of comic relief during the onslaught of Covid-19, their steadily growing popularity and price point to a growing seriousness among the investing community about memecoins.

Moreover, Mr Musk isn’t quite done pushing Doge to the moon. With Tesla now accepting dogecoin as a legitimate payment for its merchandise, we certainly haven’t heard the last of Doge and other memecoins. These tokens are likely to continue to be popular among younger investors as an attractive choice for play-money investments.

Low-cost trading apps

The year saw a boom in low-cost trading apps that brought a whole new dimension to investing. Although as a concept, online trading platforms have been around for a while, the popular online trading app Robinhood and Covid-19 have really ripped open the floodgates for millions of mostly young stock traders.

The popularity of these low-fee or no-fee apps among DIY investors led to a barrage of new trading platforms creating an ecosystem that underpins a range of investment trends: stock trading, meme stocks, cryptocurrencies, NFTs, decentralised finance (DeFi), you name it.

Users download the trading apps for their easy interface, zero-commission, no minimums and access to no-frills trading in a matter of seconds. These apps took the power to trade from legacy institutions and put it into the hands of young investors. This had a dramatic impact on the rise of cryptocurrencies as an investment asset.

Cryptocurrency exchanges and trading platforms – such as Binance, Kraken and CoinBase among others – offered fractional ownership of prohibitively expensive cryptocurrency coins such as Bitcoin and Ethereum, fuelling demand for these and other virtual tokens. The game-ified and habit-forming features of these apps drew in hordes of first-time traders wanting to dip their toes into the cryptoverse.

Since cryptocurrencies are the building blocks of NFTs, the metaverse and DeFi, the popularity of trading apps played a big role in the rapid ascent of these investment themes and several peripheral digital trends.

Thanks to these apps, even worthless memecoins had their day in the sun as smartphone-wielding investors joined the Fomo-fuelled frenzy chasing Bitcoin-like windfall returns.

Looking at their growth trajectory, these apps aren’t going anywhere. If a crushing global pandemic couldn’t derail their explosive growth, it’s hard to see how 2022 isn’t going to be another blockbuster year for low-cost trading apps.