Interest in sustainable investing has been growing rapidly over the past few years. However, the demand for socially responsible investments has exploded in the wake of the Covid-19 pandemic, helping investors to realise just how important environmental, social and governance (ESG) considerations are to their portfolios.

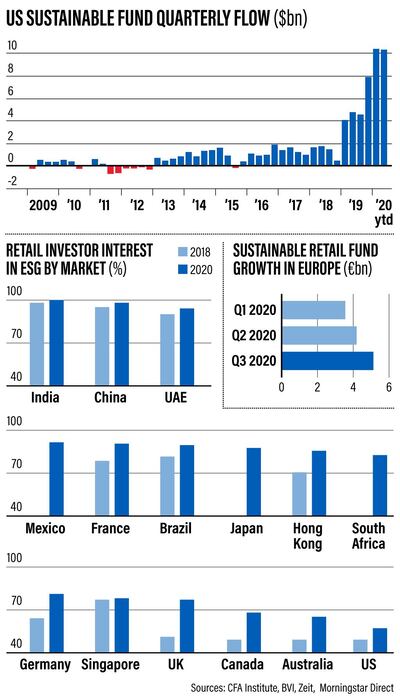

In what is shaping up to be yet another blockbuster year, ESG funds in 2020 attracted record capital inflows. In the US alone, ESG funds reeled in a whopping $21 billion in the first half of the year, as much as the entire 2019 inflows, according to Morningstar data.

In a similar trend across the pond, demand for green stocks is currently at its highest level. Investors ploughed €5.1bn ($6.2bn) in sustainable mutual funds in the third quarter of 2020, up from €3.5bn in the first quarter, a jump of 45.7 per cent.

Closer to home, a CFA study revealed there is a significant appetite for ESG investing in the UAE, the second-largest economy of the Middle East. The survey revealed that 94 per cent of retail investors in the UAE were interested in or using ESG in 2020, up from 90 per cent in 2018. Globally, ESG assets now account for about one-third of all investments.

“Partly, this is a result of the way that the pandemic rocked working patterns and changed beliefs about the relationships between people, corporations and governments,” Zainab Kufaishi, head of Middle East and Africa at Invesco, says.

At the beginning of the pandemic, many wondered whether ESG issues would tumble down the list of investor priorities as the crisis sparked a sharp sell-off and market volatility in March. However, Sustainalytics' latest research underscores that the majority of ESG investments have outperformed their non-sustainable counterparts this year and have had overall lower volatility.

The outsized returns for ESG funds have bolstered investors’ belief that performance and sustainability are by no means mutually exclusive, which further deepened the ESG trend.

ESG investing is here to stay

The ongoing boom in sustainable investing is proof that ESG issues are now key economic determinants that have a significant bearing on businesses and investors. The numbers bear out the fact that ESG investing is not going anywhere.

Institutions that have committed to the Principles of Responsible Investment (PRI) now manage more than $100 trillion in assets, up 20 per cent from last year. “Clearly, the financial market ecosystem has come to the conclusion that ESG is important and is a vital responsibility of the industry, as owners of the world’s largest corporations,” Ms Kufaishi says.

European and US flows into ESG products grew by more than four times between 2018 and 2019, a trend that has continued into 2020 and is proof that ESG investing is here to stay.

The bullish observation finds further support from Nigel Green, chief executive and founder of deVere Group, who foresees an unprecedented boom for ESG investments in 2021 under US President-elect Joe Biden.

“The next US president – the CEO of the world’s largest economy – and his Vice President Kamala Harris actively championed on the election trail values that have an inherent synergy with ESG-orientated investments,” he says.

Both Mr Biden and Ms Harris campaigned on ESG issues including climate change, social justice, equality, diversity, human rights and corporate transparency and accountability.

On issues relating to the environment, the Biden administration is widely expected to reverse policies enacted by outgoing President Donald Trump. For instance, Mr Biden has promised to bring the US back into the Paris Agreement. It is hoped that under the Biden administration, US regulations around ESG investing and corporate disclosures will become closely aligned with those of Europe – something Mr Trump fiercely opposed.

“If the rules on ESG investing are matched and agreed upon, and an international standard and framework brought in, we can expect further institutional investment piling into the ESG sector and the boom to intensify further,” Mr Green says.

The urgency of ESG in the GCC

While the appetite for ESG-related funds has skyrocketed in 2020, adoption in the Gulf is still in its infancy. That said, sovereign investors, an industry parlance for a state-owned pool of money, have started to give ESG issues greater attention through organisational-level commitments and membership of international bodies and government-sponsored initiatives.

“In doing so, they are driving attention to core investment themes that have an impact on sustainability and long-termism in the region, in particular climate change,” Ms Kufaishi says.

These investors are now opting for a more impactful ESG implementation in their investment process rather than just avoiding controversial investments, she adds.

Today, the UAE government is taking ESG seriously, evidenced by the development of new regulatory frameworks that will mandate sustainability reporting. The Abu Dhabi Financial Services Regulatory Authority, for instance, is set to introduce ESG criteria for entities within the Abu Dhabi Global Market.

“This is a much-needed development because it is the absence of regulation on how the ESG label is applied that raises fears of ‘greenwashing’ funds,” Ms Kufaishi says.

Sustainable investing needs better PR

Environmentally conscious consumers are making ethically driven decisions every day. However, when it comes to investing, ESG isn’t always at the forefront of investors’ minds. The messaging around ESG investing has room for improvement.

In addition to helping investors recognise the returns potential of their socially conscious investment decisions, there is “need to increasingly communicate the evidence of impact to instil confidence and belief that investors are making the right choice”, Alex Hoctor-Duncan, global head of Aberdeen Standard Investments, says.

Investors care less about the internal processes surrounding sustainability factors and are more focused on the overall impact and how they can make a difference as an individual, he adds.

“They want to see real results when it comes to investing sustainably,” Mr Hoctor-Duncan says, noting that if investors cannot see the tangible impact of their choices, “many will default to the returns of the fund as the only measurement of its performance”.

The integration of sustainability issues requires application of system-level thinking, even if the demand for ESG investing continues unabated. Rhodri Preece, senior head of industry research at the CFA Institute, points to a relative scarcity of sustainability talent in the investment industry.

He argues that investment firms that incorporate sustainability into their business models need access to specialist knowledge to enrich their investment capabilities. “Education and training in the ESG space, along with the rise of alternative data sources and enhanced disclosure frameworks, will equip firms to deliver on the potential of sustainable investing,” he says.

The assumption is that the rise of alternative data will make sustainability analysis more robust and enhance its integration in investing decisions.

A pivotal juncture

Some of the key drivers behind the mainstreaming of ESG investing include regulatory pressure, demographic shifts – which notably includes the growing influence of millennials – as well as the greater availability of corporate data on ESG issues. Now more than ever, “investors generally want investments to align with their own values”, says Ms Kufaishi.

More importantly, investors around the world have concluded that ESG performance and financial performance are interconnected. In other words, ESG-related factors can be used as qualitative measures alongside more traditional metrics to value a company and its ability to create long-term value.

“ESG analysts can better assess the risks within a company and gauge how to manage deals with risks, as well as identify opportunities for future revenues,” Ms Kufaishi says.

“Companies with strong ESG profiles found that they have characteristics that lead to greater profits, and more manageable risks.”

Investment vehicles to ride ESG growth

ESG assets have grown from an estimated $30tn in 2018 to more than $40tn in 2020. Not surprisingly, the number of ESG-focused funds quadrupled from 20 to 81 during 2018, then exploded to 564 in 2019, according to Morningstar data.

There are now tailor-made, cause-specific funds that investors can choose from. They range from renewable energy funds to gender diversity funds and fossil-free funds, among other sustainability issues. It is worth noting, however, that investors are becoming more sophisticated in ESG investing. They can now differentiate between a company that has sustainability embedded in its corporate DNA and one that is simply classified in what is deemed to be a "green" sector.

“Investors should be looking beyond labels or exclusion screening and make capital allocation decisions based on favourable ESG metrics at the asset level, and ensure alignment with their investment mandates,” Ms Kufaishi says.

While climate change remains a top issue of concern, the Covid-19 pandemic outbreak has served to shine a particularly bright light on employee welfare, access to healthcare, corporate culture, and supply-chain sustainability, all of which are now considered core social issues.

Covid-19 also put every assumption about sustainable investing to the test. The resilience of ethical funds and strategies established a clear positive link between ESG and corporate financial performance – and cemented sustainability as a megatrend poised to influence investing decisions for a long time to come.