Related – UAE Salary Guide 2021: How much should you be earning?

About 72 per cent of UAE companies plan to hire new employees within the next year as the labour market improves following pandemic-induced job redundancies and salary cuts, according to a new survey.

The top industries looking to hire new employees in the next three months are healthcare and medical services at 66 per cent, human resources (65 per cent) and consumer goods/FMCG (64 per cent), the employment index survey from jobs site Bayt.com and market research agency YouGov showed.

The survey polled 1,027 recruiters and businesses in the Mena region, including the UAE, Saudi Arabia, Lebanon, Jordan and Egypt, from July 4 to August 24.

The global jobs market, which was badly affected during the Covid-19 pandemic, is showing signs of recovery as economies reopen. Job listings in the UAE have also increased amid an economic rebound and as Dubai gears up to host Expo 2020.

About 45 per cent of UAE companies that plan to hire in the next three months will recruit people for a maximum of five roles, while 25 per cent are looking to fill six to 10 positions, the survey found.

“The Mena region offers a host of job opportunities for various industries and career levels,” Ola Haddad, director of human resources at Bayt.com, said.

“The Mena region continues to evolve and transform, affecting the volume and quality of employment opportunities, as well as the factors that are crucial in attracting and retaining top talent.”

More than half of all jobseekers in the UAE are considering switching industries in the next few months as new career opportunities open up in sectors such as healthcare, engineering and banking, a separate survey by Bayt.com and YouGov showed last month.

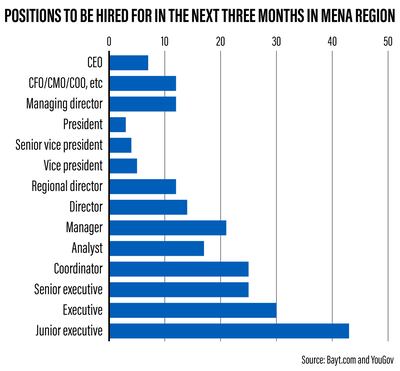

About 25 per cent of UAE employers said they are seeking to fill customer service representative positions within the next three months, while 19 per cent of companies are also looking to hire sales executives in the same time frame, followed by HR managers and receptionists on 17 per cent, the new survey found.

Meanwhile, 52 per cent of UAE employers are looking for employees with good communication skills in English and Arabic, 48 per cent are seeking team players, 43 per cent want to hire people with good leadership skills and 37 per cent said the ability to work under pressure was important.

The most sought-after academic qualifications among employers in the UAE include business management at 34 per cent, followed by engineering on 28 per cent and information technology at 17 per cent, the survey added.

About 38 per cent of employers said they are looking to hire candidates with managerial experience, while 31 per cent want candidates with mid-level experience and 24 per cent are searching for sales and marketing specialists.

At 88 per cent, the healthcare and medical services sector ranked as the top industry looking to hire in the next year. This was followed by commerce, trade and retail at 83 per cent and human resources at 74 per cent.

The industries that attract or retain top talent in the UAE include the IT, internet and e-commerce sector at 30 per cent, followed by advertising, marketing and public relations on 28 per cent, and healthcare and medical services with 28 per cent, the poll found.

At 30 per cent, banking and finance ranked as the industry that attracted the most Emirati talent, while 32 per cent said the IT, internet and e-commerce sector attracted the most graduate talent. Meanwhile, banking and finance emerged as the industry that attracts the most female talent in the UAE, survey results showed.

“The Middle East Job Index Survey … helps candidates gain an understanding of the current state of the employment sphere in the region,” Zafar Shah, research director at YouGov, said.

“This helps them determine their position in the current job market and also reflects the sentiment and outlook of businesses operating in the region’s key industries.”