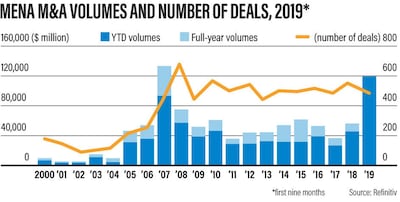

The value of mergers and acquisitions in the Middle East and North African reached $120.6 billion (Dh443bn) in the first nine months of the year, up 160 per cent on the same period last year, according to data by Refinitiv.

The energy and power sector accounted for 78 per cent of the M&A deals in Mena region, followed by the financial sector with a 14 per cent share of the market. The biggest deals so far this year have been the $69bn acquisition of Sabic by Saudi Aramco, Kuwait Finance House's $7.6bn purchase of Ahli United Bank and Abu Dhabi National Oil Company's $4bn sale of pipeline assets to US investment companies KKR and BlackRock.

Other deals include the acquisition of Union National Bank by Abu Dhabi Commercial Bank for $3.98bn, and the buyout of Careem by Uber for $3.1bn.

BlackRock, the world's largest asset manager as well as and KKR paid $4bn upfront through a special purpose vehicle to invest in 18 of Adnoc's pipelines, totalling 750 kilometres in length with 13 million barrels per day of capacity.

Refinitiv data also showed equity markets remained quiet, but debt markets were busy with a number of issuances in the first nine months of this year. Mena equity and equity-related issuance totalled $1.7bn so far in 2019, a 57 per cent decrease year-on-year and the lowest level for the nine-month period since 2004, according to the data.

Initial public offerings represented 61 per cent of the region's equity capital markets issuance, up 25.1 per cent compared to last year with a total value of $1bn, the data shows.

Arabian Centres Company, which raised $660m through a listing on Saudi Tadawul, stands out as the biggest deal on equity capital markets so far this year. Debt issuance stands at $77.5bn, up 5 per cent compared to the first nine months of 2018. Saudi Arabia was the top source country for bond and sukuk issuance, with $26.6bn raised on debt capital markets – a 40 per cent year-on-year increase. The UAE was the next-biggest, with government and corporate entities raising a total of $23.3 billion, a 29 per cent year-on-year increase.

The amount of investment banking fees earned in the region totalled an estimated $651.4m in the first nine months, up 15.2 per cent on the same period last year

HSBC has been the highest regional fee earner this year, followed by JP Morgan and Standard Chartered. Bank of America Merrill Lynch and Citi made up the top five. In an interview with The National last month, Citi's head of Europe, Middle East and Africa emerging markets cluster, Atiq Rehman said he expected " a record year for revenues" for the Middle East business on the back of a robust deals market.

“This year investment banking has done exceptionally well … M&A activity in the region … has been unprecedentedly high and Citi has been part of most of the transactions,” Mr Rehman said.

Refinitiv is the former financial and risk business of Thomson Reuters, in which private equity firm Blackstone took a majority stake in a $20bn deal last year. It is currently the subject of a $27bn bid from the London Stock Exchange.