Abu Dhabi National Oil Company has awarded one of the world's largest seismic surveys for hydrocarbons assets to a unit of China National Petroleum Corporation as the UAE looks to engage its biggest consumers in exploration.

BGP, a subsidiary of state-owned CNPC, was awarded contracts associated with the surveys onshore and offshore the emirate in a deal estimated to be worth Dh5.88 billion, Adnoc said on Thursday.

“The scale of the project shows our commitment to upstream investment and to bolstering our oil and gas reserves and production for the long-term,” said Adnoc group chief executive Dr Sultan Al Jaber.

“The award, following a highly competitive bid process, also represents another key milestone in Adnoc’s thriving partnership with CNPC as well as the UAE’s strategic energy partnership with China."

Adnoc produces much of the UAE’s crude, which accounts for 4.5 per cent of the world’s total, and has launched its first ever licensing round this year. The company has awarded around $8bn worth of upstream concession stakes to companies from its rising consumer base of China and India as well European majors including Total and Eni. The award of seismic data surveying for an acreage of around 53,000 square kilometres comes amid efforts by the UAE and countries in the region to develop hydrocarbon assets at a time of reviving crude prices.

BGP, which is represented in the UAE through local firm Al Masood Oil Industry Supplies & Services Co, will acquire 2D and 3D seismic data on Abu Dhabi, covering up to 30,000 square kilometres offshore and 23,000 square kilometres onshore.

BGP will complete the subsurface survey by 2024 using high-resolution 3D imaging to probe reservoirs up to 25,000 feet below the surface. The firm, a leading international survey contractor, will deploy seismic streaming vessels and ocean bottom nodes to gather data in Abu Dhabi waters and will employ specialist vibrator trucks to survey onshore desert areas.

_______________

Read more:

China’s diplomacy efforts go a long way towards quenching thirst of its economy

Adnoc's Yasat awards offshore contract to Abu Dhabi's NPCC

Adnoc awards CNPC twin offshore concessions worth Dh4.3bn

_______________

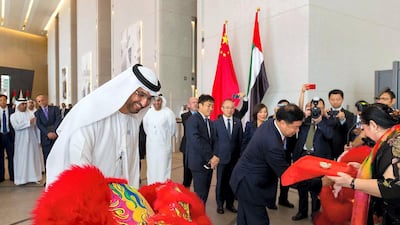

The award to the Chinese firm comes during the three-day visit of President Xi Jinping to Abu Dhabi, which is expected to see the two countries extend their co-operation further on issues relating to energy security. China is the world's biggest importer of crude, with around 42 per cent of it sourced from the Middle East. The UAE sells approximately 7 per cent of its crude to China, whose biggest suppliers are Saudi Arabia, Iran and Iraq.

Chinese firms have, however, increasingly scouted for stakes in Abu Dhabi to offset increasing political vulnerabilities associated with exploring for oil and gas assets in Iran and Iraq.

Abu Dhabi and the UAE are some of the more stable places where India or China can look for an upstream oil asset, said Amit Bhandari, senior fellow, energy and environment with Mumbai-based think tank Gateway House.

“One part of it is simply that China continues to import a large amount of oil and that will continue and also that as the price of oil has started recovering, there’s a realisation that the assets are not such bad deals after all,” he added.

In March, CNPC was awarded a 40-year rights agreements worth Dh4.3bn by Adnoc for concessions offshore Abu Dhabi. The Chinese state oil company company also has a 40 per cent stake in Adnoc subsidiary Al Yasat Company for Petroleum Operations, from whose concession the first batch of crude, a 50,000 barrel-per-day shipment, was loaded and shipped to China in June.

Chinese state-backed firms have become one of the largest foreign investors in Abu Dhabi's energy sector, as Adnoc renewed its efforts to engage the biggest consumers of its crude to become co-investors across its value chain.

In May, Tayba Al Hashemi, Al Yasat's acting chief executive, told an audience in Beijing that the company had received significant interest in the ongoing Adnoc licensing round from Chinese firms.