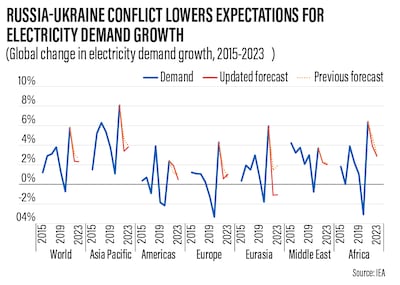

Electricity demand growth worldwide is slowing sharply this year as the global economy slows and energy prices remain high, according to the International Energy Agency.

Demand is forecast to grow by 2.4 per cent in 2022, lower than the IEA's roughly 3 per cent growth forecast at the start of the year and down from the 6 per cent increase recorded in 2021, the IEA said in its latest Electricity Market Report on Wednesday.

The latest expectation brings electricity demand growth for this year in line with its average growth rate over the five years prior to the Covid-19 pandemic.

While the rapid economic recovery that boosted demand in 2021 was expected to slow, demand this year has been affected by a combination of factors such as high commodity prices, rising inflation — which led to interest rates hikes, and China's strict Covid-19 lockdown measures, which affected industrial production and increased tension across already tight global supply chains, the report said.

“The world is in the midst of the first truly global energy crisis, triggered by Russia’s invasion of Ukraine, and the electricity sector is one of the most heavily affected,” said Keisuke Sadamori, director of energy markets and security at IEA.

“This is especially evident in Europe, which is experiencing severe energy market turmoil, and in emerging and developing economies, where supply disruptions and soaring fuel prices are putting huge strains on fragile power systems and resulting in blackouts."

The EU, which is weaning itself off Russian energy imports and is also concerned about Moscow cutting off gas supplies, has been scrambling to stock its supplies ahead of winter.

This has left natural gas prices soaring, with countries in other parts of the world also feeling the brunt. Pakistan, for instance, has been suffering from blackouts because of insufficient gas supplies as the country struggles to cope with high gas prices.

In the first half of 2022, average natural gas prices in Europe were four times as high as in the same period in 2021, while coal prices were more than three times as high, resulting in wholesale electricity prices more than tripling in many markets, the IEA said.

The agency's price index for major global electricity wholesale markets reached levels that were twice the first-half average of the 2016-2021 period.

The Ukraine war, high energy prices, along with supply chain disruptions and soaring inflation, have also led to downward revisions of economic growth forecasts.

The International Monetary Fund lowered its estimates for the global economy's growth to 3.6 per cent for 2022 in April, down from an earlier 4.4 per cent and has said it will cut its outlook further later this month. The World Bank has also reduced its growth estimate for this year to 2.9 per cent in June, from a previous 3.2 per cent projection.

"Considering that industry is responsible for more than 40 per cent of final electricity demand and 20 per cent is consumed by commercial and services, the resulting slowdown of economic activity has triggered declining consumption," the IEA said.

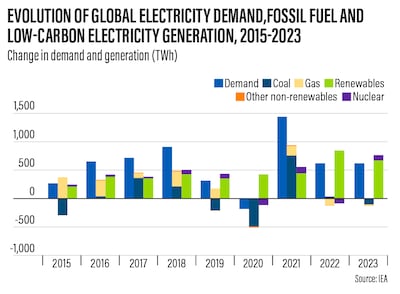

In terms of electricity generation, coal is now replacing natural gas for power generation in markets with spare coal plant capacity, particularly in European countries, the agency said.

To secure energy supplies, some European countries — including Germany, Austria, Italy and the Netherlands — have all indicated they may have to rely more on coal, which has the highest carbon footprint among fossil fuels.

Globally, coal use for power is expected to increase slightly in 2022 as growth in Europe is balanced by contractions in China, due to strong renewables’ growth and only a modest rise in electricity demand, and the US, due to constraints on supply and coal power plant capacity, the IEA said.

Gas power is expected to fall 2.6 per cent as declines in Europe and South America outweigh growth in North America and the Middle East.

Meanwhile, strong capacity additions are set to push up global renewable power generation by more than 10 per cent in 2022, displacing some fossil fuel generation.

Despite a 3 per cent decline in nuclear, low-carbon generation is set to rise 7 per cent overall, leading to a 1 per cent drop in total fossil fuel-based generation, the IEA said.

As a result, carbon dioxide emissions from the global electricity sector are set to decline in 2022 from the all-time high they reached in 2021, although by less than 1 per cent, it added.

Looking ahead, while electricity demand is currently expected to continue on a "similar growth path" into next year, the outlook is "clouded by economic turbulence and uncertainty over how fuel prices could impact the generation mix", the IEA said.

"Governments are having to resort to emergency measures to tackle the immediate challenges, but they also need to focus on accelerating investment in clean energy transitions as the most effective lasting response to the current crisis," Mr Sadamori said.