US President Donald Trump is preparing to impose tariffs on two of the world’s most strategically important industries, semiconductors and pharmaceuticals, measures that Washington says are necessary to protect national security.

Due in the coming days, the tariffs aim to reduce US reliance on foreign manufacturing, boost domestic production and, at least for medicines, lower costs for American consumers.

For semiconductors, the reasoning is straightforward. These chips power everything from smartphones to fighter jets, and, like most of the world, the US is heavily reliant on Taiwan Semiconductor Manufacturing Company (TSMC), the dominant producer of the most advanced semiconductors.

Taiwan’s contested political status – Beijing claims the island as part of China – and Washington’s concerns that a crisis could disrupt production have heightened fears that access to critical semiconductor technology might be cut off. The tariffs are intended to encourage companies to build more capacity on US soil.

The challenge is that state-of-the-art chip fabrication plants, or fabs, are among the most expensive industrial projects in the world, with leading-edge centres costing $10 –$20 billion or more.

TSMC has agreed to expand in the US with six planned fabs at an estimated cost of $100 billion, but progress has been slow. The first Arizona plant has already faced delays, with TSMC partly blaming a shortage of skilled US workers.

Battling for pharma share

Pharmaceuticals are a different challenge. The US relies heavily on Europe for brand-name drugs, with Ireland, Switzerland and Germany among the largest suppliers. India leads in generics, while China is a major source of active ingredients for both markets.

Europe is home to some of the industry’s most profitable companies, for whom the US is critical: Novartis earns about 42 per cent of its revenue there, and Roche nearly 48 per cent. Losing that market, or seeing prices fall, would hurt Europe’s big pharma players far more than lower-cost producers in China or India.

That reliance makes them especially vulnerable to US policy shifts and helps explain why Washington’s concerns over supply security carry such high stakes.

Mr Trump has also presented the proposals as a way to lower prices domestically, arguing that Americans pay far more than patients in other countries. In May, he said his goal was to align US prices with the lowest paid abroad – a move that, for some medicines, could mean cuts of up to 80 per cent.

Against this backdrop, Novo Nordisk this week halved the US price of its Ozempic weight-loss drug for uninsured patients, while Eli Lilly raised the UK price of its rival Mounjaro shot by 170 per cent. Both moves reflect growing pressure on drugmakers to narrow the gap between American and international prices.

This issue is separate from supply security and one that tariffs alone will not solve. Experts say US drug prices are driven less by where medicines are made and more by the structure of the American market, particularly the influence of intermediaries such as pharmacy benefit managers.

Mr Trump aims to tackle that through regulation, but past experience suggests any price-cutting rules will face lengthy legal challenges. His earlier “most-favoured-nation” plan to tie US drug prices to those abroad was blocked in 2020 following lawsuits from the industry.

Seeking suppliers elsewhere

If tariffs take effect, US buyers may seek suppliers in countries not covered by the measures, creating opportunities in both sectors – provided those suppliers can match quality and capacity.

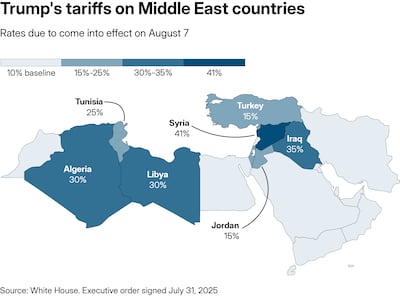

Which regions stand to gain? The Middle East is already focused on expanding high-value manufacturing as part of a broader push to diversify economies away from oil.

However, chip production is extremely capital-intensive and technologically complex. Without tens of billions of dollars and a deep pool of skilled talent, companies in the region will struggle to compete in cutting-edge semiconductor manufacturing.

A more realistic option may be to expand in chip design, which requires far less capital than building fabs. Another option is producing simpler semiconductors for uses where top performance is not essential, such as in cars and home appliances.

UAE, Saudi Arabia invest heavily in AI

Both Saudi Arabia and the UAE are investing heavily in building data centres and AI infrastructure, which rely on high-performance chips.

Pharmaceuticals offer a clearer path for Middle East participation. Saudi Arabia aims to produce 40 per cent of medicines locally by 2030, spurring investment in both finished medicines and active ingredients. In the UAE, drug manufacturer Julphar now produces insulin from scratch.

Tariffs on strategic goods highlight deeper fractures in trust between major economies. This is a canary in the coal mine for globalisation, with chips and medicines probably among the first products to be sourced closer to home or from trusted partners.

For multinational companies, the first step is to gauge how much supply chain risk they can manage directly. Stockpiling semiconductors can buy time, but it cannot replace building more secure and diverse supply sources.

The probable long-term outcome is a focus on producing the next generation of “good enough” chips – cheaper alternatives sufficient for most applications. China is already producing more of these chips as US export controls limit access to the most advanced technology.

Even so, Mr Trump said last week he might allow US chipmaker Nvidia to sell a higher-spec AI chip to China, on the condition that Washington receives a share of the revenue from those sales.

Still, some executives I engage with at IMD are now considering whether they really need the very best technology, or if a cheaper, lower-tier chip would do the job just as well.

That kind of reassessment is exactly what Mr Trump’s tariffs will probably provoke on a larger scale, at least in industries where lower-tier chips can meet the need.

The question is whether this shift will make supply chains stronger, or just leave the global market more divided and harder to do business in.