The International Monetary Fund has marginally raised its forecast for the global economy for this year and the next but said it is “not out of the woods” due to headwinds that persist, even though the recovery is on track.

Covid-19 has been declared officially over, supply chain disruptions are returning to pre-pandemic levels, global inflation is still elevated but receding while the March banking turmoil in the US and Switzerland is contained and strong economic activity in the first quarter was resilient, the IMF said.

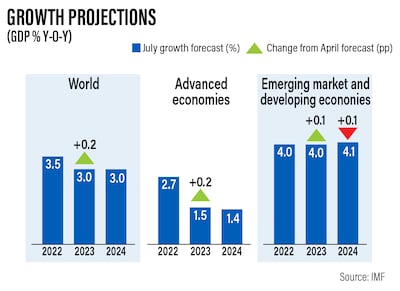

As a result, the fund revised its earlier forecast for this year upwards, raising it by 0.2 percentage points to 3 per cent, although lower than the 3.5 per cent expansion recorded in 2022. It is projecting a similar pace of growth in 2024.

Despite the positive developments, “many challenges still cloud the horizon, and it is too early to celebrate”, said IMF chief economist Pierre-Olivier Gourinchas.

The projected growth rates are weak by historical standards, as advanced economies decelerate to 1.5 per cent this year, from 2.7 per cent in 2022, and are expected to remain subdued, expanding at 1.4 per cent in 2024.

The US, the biggest in the group, is forecast to grow 1.8 per cent in 2023, instead of 1.6 per cent as previously projected, with the estimate lower than the 2.1 per cent expansion recorded last year. Its economy is projected to expand 1 per cent in 2024.

The euro area, which was greatly affected by the Ukraine war, soaring energy prices and record inflation last year, is set to decelerate sharply as the European Central Bank continues to raise interest rates to restore price stability.

Annual inflation across the EU hit a record 9.2 per cent in 2022, compared with 2.9 per cent in 2021.

The bloc, which includes 20 countries that use the euro as their primary currency, is forecast to grow by 0.9 per cent in 2023, following a 3.5 per cent expansion in 2022.

Germany, Europe's largest economy, is now set for a 0.3 per cent contraction this year, instead of shrinking 0.1 per cent as previously forecast.

The UK, which slipped a notch to become the world's sixth-largest economy due to an economic crisis last year that drove the pound to its lowest level against the US dollar, is now expected to expand 0.4 per cent, instead of contracting 0.3 per cent as previously estimated.

Meanwhile, growth in emerging markets and developing economies is expected to maintain its 4 per cent growth rate this year and edge up to 4.1 per cent in 2024.

The growth estimate for China remains unchanged at 5.2 per cent in 2023, following a 3 per cent expansion in 2022, before slowing down to 4.5 per cent in 2024.

India, which overtook the UK to become the world's fifth-largest economy in 2022, is expected to outpace the rest of the world as it expands by 6.1 per cent in 2023, compared with an earlier 5.9 per cent estimate, before picking up to 6.3 per cent in 2024.

The Middle East and Central Asia are forecast to slow to 2.5 per cent, instead of a 2.9 per cent expansion as previously projected, after growing 5.4 per cent in 2022. Growth is set to pick up to 3.2 per cent in 2024.

Saudi Arabia, the Arab world’s largest economy, is forecast to grow by 1.9 per cent this year, instead of 3.1 per cent as previously projected, following an 8.7 per cent expansion in 2022, largely a reflection of production cuts and lower oil prices.

Growth in the kingdom is expected to pick up to 2.8 per cent in 2024.

Saudi Arabia, the world's largest exporter of oil, benefitted from the rally in crude prices last year.

Oil prices are projected to fall by about 21 per cent in 2023, with the assumed average price per barrel, based on futures markets, at $76.43 in 2023 and $71.68 in 2024, compared with $96.36 in 2022, the IMF said.

World trade growth is also expected to decline to 2 per cent in 2023, from 5.2 per cent in 2022, before rising to 3.7 per cent in 2024, according to the fund.

This is well below the 2000-2019 average of 4.9 per cent and reflects slowing global demand, as well as a pivot towards domestic services, the lagged effects of US dollar appreciation – which slows trade owing to the widespread invoicing of products in US dollars – and rising trade barriers, the IMF said.

Weighing on growth are tighter monetary policies by central banks, which have raised borrowing rates to fight inflation while reducing the supply of credit.

The US Federal Reserve, which has raised rates by a combined 500 basis points since it started its monetary tightening cycle in March 2022, is expected to increase its key interest rate to a 22-year high on Wednesday as it looks to tame inflation and restore price stability.

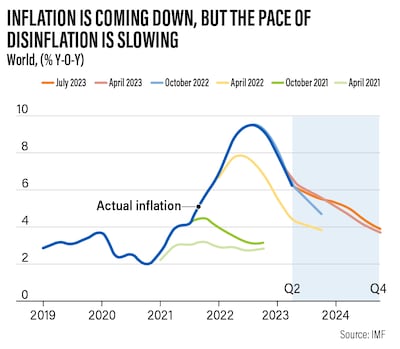

The IMF expects global inflation to decline to 6.8 per cent this year, from 8.7 per cent in 2022, a 0.2 percentage point downwards revision for 2023. It expects inflation to fall further to 5.2 per cent in 2024.

“Stronger growth and lower inflation than expected are welcome news, suggesting the global economy is headed in the right direction. Yet, while some adverse risks have moderated, the balance remains tilted to the downside,” said Mr Gourinchas.

“Global tightening of monetary policy has brought policy rates into contractionary territory. This has started to weigh on activity, slowing the growth of credit to the non-financial sector, increasing households’ and firms’ interest payments, and putting pressure on real estate markets.”

As the priority for most economies remains achieving sustained disinflation while ensuring financial stability, central banks should remain focused on restoring price stability and strengthening financial supervision and risk monitoring, the fund said.

The Washington-based lender said countries should provide liquidity promptly if market strains emerge, while also building fiscal buffers.

“Hopefully, with inflation starting to recede, we have entered the final stage of the inflationary cycle that started in 2021. But hope is not a policy, and the touchdown may prove quite tricky to execute,” Mr Gourinchas said.

“Risks to inflation are now more balanced ... yet, it is critical to avoid easing rates prematurely, that is, until underlying inflation shows clear and sustained signs of cooling. We are not there yet.

“All the while, central banks should continue to monitor the financial system and stand ready to use their other tools to maintain financial stability.”