Follow the latest updates on the Covid-19 pandemic here

As the Covid-19 pandemic keeps several airline fleets grounded, carriers are accelerating the retirement of aircraft, leading to a surge in the dismantling and trading of plane parts.

The aviation industry is pushing to become more sustainable amid growing pressure from climate change activists.

The number of jets in storage worldwide was 6,329 in August 2021, up from 2,167 before the Covid-19 pandemic, as the global crisis and ensuing collapse in air travel demand continues to keep about a quarter of the world's commercial passenger aircraft idle, according to aviation analytics company Cirium.

Around 676 aircraft were retired in 2020, slightly below 2019 levels of 680 jets, but above the 20-year average of about 625 retirements a year, according to Richard Brown, managing director of London aerospace consultancy Naveo.

Aircraft retirements, as a percentage of the active fleet, typically average 2.5 per cent. The retirement rate in 2020 was 2.6 per cent, Mr Brown said. As of this mid-August, about 276 aircraft had been officially retired.

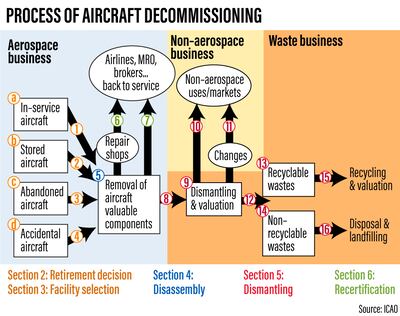

Jets that are no longer in service are either maintained in an airworthy condition, put into long-term storage complexes or disassembled for parts that are taken out to be used in other planes or recycled.

“For aircraft parked or stored that are unable to fly again, the most economic option would be to part-out the aircraft as quickly as possible to realise the maximum commercial value for hard time-restricted components, such as landing gear,” Steven Taylor, senior vice president of sales and marketing at aircraft recycling company eCube Solutions, said.

Airlines around the world are drastically restructuring their fleets and retiring aircraft due to the Covid-19 pandemic and the subsequent slump in air travel demand.

This is driving up the inventory of plane components and parts, with the market for used surplus material, or USM, expected to grow to $7.9 billion by 2022, according to the International Air Transport Association, the airline trade association.

“We expect jet recycling market to increase as the number of aircraft and parts available for tear-down significantly increased during the pandemic,” said Michael Wette, head of transport and services at Oliver Wyman in India, the Middle East and Africa.

“Historically, the use of USM was not constrained by adoption or demand – it was only constrained by the amount of available supply.”

Depending on the type and its age, an aircraft can yield anything from 700 parts to 1,600 parts, according to Mark Gregory, managing director of Air Salvage International. The company, based at Cotswold Airport in Gloucestershire, the UK, specialises in aircraft disassembly.

“The parts go back into the supply chain while the rest is recycled with minimal landfill,” Mr Gregory said. “About 80 per cent to 95 per cent [of an aircraft] can be recycled in one way or another.”

The company's customers typically harvest 500 to 2,000 components from an aircraft, depending on its maintenance status, Mr Taylor said.

“Customers remove high value parts such as landing gear, thrust reversers and auxiliary power units and components such as avionics, slides, seats and galleys,” he said.

“ECube also upcycles sections of the hull ... to serve both B2B [business-to-business] requirements, such as cockpits for training purposes, and also unique items, such as window cuts and landing gear doors, to B2C [business-to-customer] aviation enthusiasts.”

Disassembly, the final stage of an aircraft's life, is coming into sharper focus as the global aviation industry seeks to meet its overarching environmental sustainability goals and contribute to a circular economy.

“Every part that is reused on an aircraft is one less part manufactured from new materials, reducing the manufacturing footprint,” Mr Taylor said.

However, the aircraft recycling industry is expected to face additional challenges as newer jets contain composite materials that are more difficult to process, according to experts.

Carbon fibre, which is difficult to recycle in a cost-effective way, is one such future problem, Mr Gregory said.

ECube said it is working with” innovative start-ups” to develop new technology that increases the recyclability of carbon fibre and reduce waste sent to landfills.

However, the global fleet of stored aircraft has steadily decreased since February 2021, according to Cirium, as some planes return to service due to a gradual recovery in air travel.

There is still a glut, which should mean there will be more aircraft retirements. However, retirements in 2020 were down, compared with 2019, and retirements in 2021 are still lagging behind the figure for 2020, Cirium said.

While overall numbers are low, it is clear that some owners still see value in part-outs, Cirium said in an August report. And as recovery continues, the analytics company expects an increase in the volume of part-outs to support rising maintenance, repair and overhaul, or MRO, activity within the growing operational fleet.

Industry experts expect the aircraft recycling business to keep growing steadily over the next few years.

“About 18 months ago, you could get more for the aircraft as parts; that is not the case at the moment, but needless to say this will come back in 2022-2023,” Mr Gregory said.

With an estimated 12,000 aircraft retiring in the next two decades, aircraft recycling offers a “broad range of opportunities” for the aerospace industry, the Aircraft Fleet Recycling Association said.

“We expect the demand for aircraft recycling to continue and incrementally increase over the next several years,” Mr Taylor said.

“Market demand for used serviceable material is a key driver to determining the optimum timing for disassembly. Currently, there is oversupply of USM due to diminished MRO activity and USM demand. This will change when aircraft fly more and maintenance requirements increase.”