Follow the latest news on the US midterm elections 2022

Inside a small boutique, tucked into an office complex in a suburban district in Phoenix, Arizona, Samira Jabbar stares nervously at the television as a Republican advertisement declares US President Joe Biden to be weak on immigration.

The Venezuelan-born Palestinian American businesswoman does not usually vote in midterm elections. But this year, a number of Donald Trump-backed Republican candidates are on the ballot, many of whom who have refused to accept the 2020 presidential election results and are espousing anti-immigrant sentiments.

Ms Jabbar feels compelled to execute her democratic right.

“Things have to change,” she said. “I’m getting tired of not having a place.”

Arizona is one of a handful of states that could help to determine the outcome of the key US midterm elections. The Senate race between the Democratic incumbent, Mark Kelly, and Republican Blake Masters is neck and neck.

In Washington, Vice President Kamala Harris currently holds the deciding vote in an evenly split Senate. However, if Mr Kelly loses, that could all change.

If the Democrats lose control of the House of Representatives and the Senate, their legislative agenda is dead in the water.

The race for governor is equally close and consequential. Kari Lake, a former news anchor, has run a blistering campaign drawing on her endorsement by Mr Trump.

Ms Lake, who has continuously claimed the 2020 election was “stolen”, has a narrow lead over Democratic candidate Katie Hobbs. As secretary of state for Arizona, Ms Hobbs oversaw the state’s 2020 election count and has repeatedly defended the results.

If Ms Lake wins on Tuesday, Arizona, which has been at the centre of conspiracy theories surrounding the 2020 election, would be run by a governor who has propagated some of those baseless claims.

Ms Lake has made immigration and security along the southern border a cornerstone of her campaign.

She has said that as governor she would declare an “invasion” due to the number of “illegal” immigrants in the state.

Her rhetoric has left many in immigrant communities worried about their future and place in the state they call home.

“I am very worried,” said Karina Ruiz, the executive director of the Arizona Dream Act Coalition.

For Ms Ruiz, who arrived in the US as a child, this election feels all too familiar.

“It takes me back to when Trump was elected and a lot of fear and anxiety happened in our community because of these views of fear of the outsiders or xenophobia and fascism that some of the candidates are holding on to,” she told The National.

“To me, Arizona is going to go backwards if certain candidates are elected.”

Two years removed from office, Mr Trump’s shadow remains firmly over the Republican Party and the midterms.

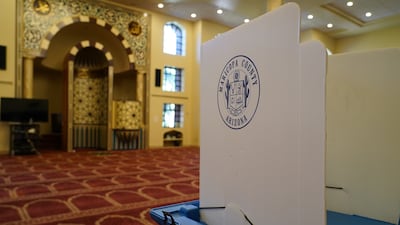

“What Trump exposed is a vein of racism in the society against Muslims, against blacks, Hispanics, immigrants, really whoever you want to name,” said Usama Shami, the executive director of the Islamic Community Centre of Phoenix.

“So, this election, it connects or ties to what happened in 2016.”

Mr Shami worries that the US has become so divided and the seesaw of power so constant that the very fabric of the country may be coming undone.

“If you take a piece of metal and you keep on bending it back and forth, eventually it is going to snap at some point,” he said. “I think the same thing is happening in this country, right now.”

Not all are concerned. Rajab, an Afghan refugee, who will be voting for the first time on Tuesday, said he has yet to make up his mind on who he will support.

“I would like to be independent, because there are good people involved in both parties,” he said.

Rajab, who became a US citizen in August, is excited to uphold what he sees as his duty to vote and hopes that whatever happens, the results are respected.

For Ms Jabbar, this election cycle has been taxing. The prospect of having people in power whom she feels actively question her worth, is enough to get her to the polls on Tuesday.

“I’m invisible if I don’t vote,” she said.