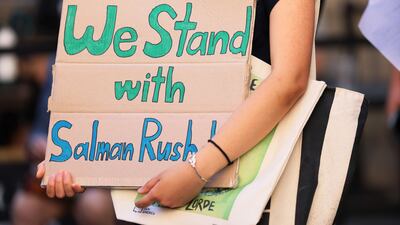

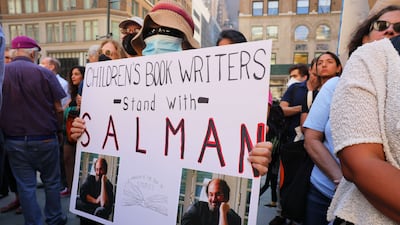

Writers and free speech advocates gathered on the steps of the New York Public Library in Manhattan on Friday to stand in solidarity with author Salman Rushdie, who was attacked on stage during an event last week.

Rushdie was scheduled to speak at the Chautauqua Institution on freedom of expression and writers in exile when 24-year-old Hadi Matar jumped on stage and allegedly stabbed him several times.

The author has a damaged liver, severed nerves in his arm, and could lose an eye, his literary agent said.

“When a would-be murderer plunged a knife into Salman Rushdie's neck, he pierced more than just the flesh of a renowned writer,” Pen America chief executive Suzanne Nossel said during her opening remarks at the event.

“He sliced through time, jolting all of us to recognise that horrors of the past were hauntingly present.

“He infiltrated across borders, enabling the long arm of a vengeful government to reach into a peaceful haven.”

Rushdie lived in hiding under the protection of the UK government for about 10 years after Iran's former supreme leader Ayatollah Ruhollah Khomeini declared a fatwa calling for the author's death in response to the publication of his 1988 novel The Satanic Verses.

Mr Matar, speaking to The New York Post, said he admires Khomeini, but did not say if the attack was inspired by the fatwa.

Hari Kunzu, a columnist for Harper's Publishers, read the opening passage from the controversial book.

“Salman once wrote that the role of the writer is to name the unnameable, to point at frauds, to take sides, start arguments, shape the world, and stop it from going to sleep,” Kunzu said after reading the passages. “And that's why we're here, because we owe it to him to stay awake.”

Andrew Solomon, author and former chief executive of Pen America, said writers are living in a time when the freedom of speech is under assault, pointing to recent book bans in American schools and libraries.

“The idea that the fatwa managed to stay at bay for so long, and that this appalling attack took place now is not happenstance. It's a reflection of something we all have to fight,” he said.

Nossel added: “We need to fight with vigour as if all our freedoms depended on it, because they do.”

Solomon and other writers read selected passages from works by the Indian-born author, whose style blending surrealism with reality and politics has garnered him worldwide fame.

Iranian writer Roya Hakakian read from Haroun and the Sea of Stories, a novel on the dangers of censorship and the first Rushdie wrote under the fatwa.

AM Homes, whose novel May We Be Forgiven was selected by Rushdie for The Best American Short Stories 2008, quotes Rushdie's remarks on censorship made at the 2012 Pen World Voices Festival.

“Writers talk about creation. And censorship is anti-creation, negative energy, un-creation … Censorship is the thing that stops you doing what you want to do,” she said, quoting Rushdie.

Mr Matar told the Post he had only “read, like, two pages” of The Satanic Verses, a book that drew condemnation from Muslims around the world.

“I read a couple pages. I didn’t read the whole thing cover to cover,” he said.

He has pleaded not guilty to second-degree attempted murder and assault charges. A judge in Chautauqua County, New York, has ordered him to be held without bail and to not give any further interviews to media.