Demonstrations against the Syrian regime persisted in Suweida on Tuesday, the eve of the 20th anniversary of a transition that led to more bloodshed and economic malaise than during the iron rule of Hafez Al Assad.

The citizen journalists’ network Suwayda24 said demonstrators in the mostly Druze governorate of Suweida took to the streets for the third day.

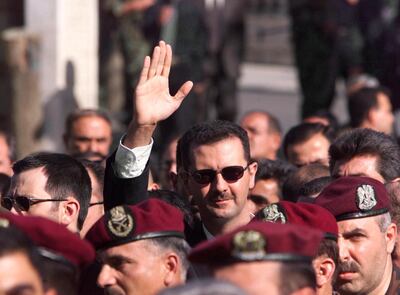

They demanded the removal of Bashar Al Assad, 54, the ophthalmologist who inherited power almost 20 years ago, when his father Hafez died on June 10, 2000.

The Syrian pound was about 50 pounds to the dollar at the time, compared with 2,700 pounds to the dollar on Tuesday, a week before toughened US penalties against doing business with the regime are due to come into effect.

A resident of Suweida told The National that the demonstrations lasted an hour.

He said security forces stayed away, although one demonstrator was later arrested at his workplace, a stationery shop, in the first known arrest since the protests began on Sunday.

The demonstrations have been sporadic and small, with 100 to 300 mostly young men and women in the streets.

Video footage showed the marchers chanting “Bashar, leave”, with men gesturing obscenities at huge posters of Hafez Al Assad and his son, which hang from public buildings.

The images, broadcast by activists on social media, are potentially explosive in an area that the Alawite-dominated regime regards as loyalist and inhabited by a fellow minority.

But the conservative society in Suweida is heavily armed and not all those with weapons are on Mr Al Assad’s side.

Some groups may not be keen on shedding blood on behalf of the regime, particularly with economic conditions so dire that even militia wages in Syrian pounds have become paltry.

With historic links to Jordan and the Syrian desert, the rugged agricultural province constitutes the soft belly of Damascus.

Suweida stretches to the outskirts of the Damascus suburb of Saida Zeinab, a main base of Hezbollah and other militia supported by Iran.

Despite the Shiite militia influx in the last decade, it took the Russian military intervention in late 2015 to prop up the regime, as Syria fragmented into Russian, Iranian, American and Turkish spheres of influence.

When Bashar inherited power 20 years ago, the Assad family had only lost the Golan Heights.

That happened when Hafez was defence minister, in the 1967 Arab-Israeli war.

Hafez took power from another Alawite officer in a 1970 coup. The Syrian pound was at four to the dollar then.

By massacring thousands of Sunni civilians in the city of Hama in 1982, Hafez signalled to the majority sect what could befall them if they rose again.

The late dictator also undertook social engineering that altered the societal pyramid of Syria. Merchant and clerical classes, professional unions and academia, as well as clans and tribes, were morphed into a more loyalist composure to ensure the perpetuation of the Assads as a ruling dynasty.

Bashar touted the Chinese model and portrayed himself as an economic reformer in his 2000 debut.

But he promoted his cousin, the tycoon Rami Makhlouf, whose father Mohammad was a behind-the-scenes oligarch in the Hafez era.

A rift between the president and Mr Makhlouf broke out into the open last month, reminding Syrians of the huge wealth of the Assads and Makhloufs, as livelihoods took a huge hit from the currency collapse.

When signs of dissent against the regime surfaced in the southern governorate of Deraa in February 2011, Bashar took a trip to the region with his Sunni wife, Asma.

The couple stayed away from Deraa but visited towns and villages in Suweida, to reinforce an image Bashar has cultivated as protector of Syria’s minorities.

Most of the young protesters in Suweida were toddlers when Assad came to power, and children in 2011.

Having cast himself as the undisputed winner in the war, the economy has come back to haunt the dictator’s son, two decades after he promised to fix the malaise.