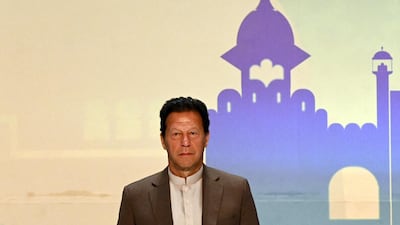

Pakistanis living abroad will be able to buy cars for relatives back home and make charitable donations under new digital schemes designed to tap the spending power of expatriates, Imran Khan's government said.

The prime minister said the country's diaspora, which includes about 1.6 million Pakistanis living in the UAE, was a key asset for the country and ministers were looking at innovative ways to harness their wealth.

Under two new schemes, overseas Pakistanis will be able to use newly introduced digital accounts to get financing to buy cars in Pakistan and will be able to donate to charities and the government's flagship social safety net scheme.

"Overseas Pakistanis have, over the years, kept our economy afloat," Mr Khan said after inaugurating the new scheme in the capital Islamabad on Thursday.

“We will innovate and brainstorm to tap overseas Pakistani's remittances,” the former cricketer said.

Mr Khan's ruling Pakistan Tehreeik-e-Insaf (PTI) party last year launched digital bank accounts in an attempt to plug overseas Pakistanis into the nation's banking sector.

Bank officials at the time said they hoped the launch of the Roshan digital account would cut bureaucracy for expats and boost remittance flows into a country perennially short of foreign capital.

Account holders will be able to invest in the stock market, buy government debt and conduct basic banking services, officials said.

Since the launch, about 120,000 accounts were opened from 170 countries and received more than $1 billion in deposits, the government announced.

Faisal Javed Khan, a PTI senator, called the initiative a milestone.

The scheme, he said, was "a testament to faith that non-resident Pakistanis have in Pakistan and the Prime Minister Imran Khan-led government”.

Under the car-financing scheme, account holders will be able to get vehicles “at very attractive terms" for loved ones in Pakistan.

"Banks are offering conventional and Islamic modes of financing at attractive mark-up rates starting from 7 per cent, with priority delivery," the senator said.

Another scheme will streamline donations to charities and allow account holders to pay into Pakistan's Ehsaas welfare programme, which provides cash handouts to the poorest.

Mr Khan, who for years during his cricketing career was himself Pakistan's most high-profile expatriate worker, has often tried to woo the diaspora.

Pakistan's central bank this month announced that monthly remittances exceeded $2 billion for the past 10 months and hit a record $2.7bn in March.

Remittances helped to keep many families afloat while the country is being battered by the economic fallout of the Covid-19 pandemic.

Workers in Saudi Arabia send home the most, followed by those in the UAE, UK and US, bank figures show.

Yet expat workers often complain they are neglected or badly treated by the country's overseas missions.

“Overseas Pakistanis are our asset,” the prime minister said. “Our embassies, sadly, do not appreciate them that way.

“They are very special people for us. They live far from families and work hard day and night. My message to our embassies is to take care of them, of this overseas labour class."

He said he would launch an inquiry into complaints that officials at the embassy in Saudi Arabia had been demanding bribes from workers.

“I am launching a high-power inquiry into the complaints about the Saudi mission and we will give exemplary punishments and we will take strict action,” he said.