Thousands of troops were on the streets of South Africa and scores of people were arrested on Monday as a demonstrators tried to bring the country to a standstill.

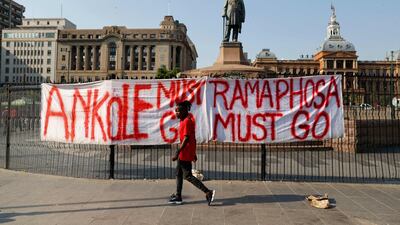

The left-wing Economic Freedom Fighters (EFF) mobilised supporters demanding the resignation of President Cyril Ramaphosa for his handling of the sluggish economy, electricity shortages and high unemployment.

The ruling African National Congress (ANC) promised business would continue as normal, but the protests raised fears of violence similar to 2021, when at least 350 people were killed in days of rioting and looting.

About 3,500 troops joined police, with authorities saying they had arrested 87 people for violence in the hours before the protests were scheduled to start.

Shopkeepers said they were intimidated into shutting their businesses, the government claimed, while thousands of tyres were confiscated after they were stockpiled as roadblocks to be burnt.

“The president has instructed law enforcement agencies to ensure that we do not have to see the repeat of those scenes that we saw back in 2021,” Mr Ramaphosa's spokesman Vincent Magwenya said.

“The state has a responsibility to ensure that citizens can go on about their day … in a normal way and when doing so, that they are safe and that they are not subjected to any anarchy or any form of violence.”

Pretoria and Johannesburg streets were reported to be quiet on Monday morning. Many shops were closed and their shutters were down.

The EFF, which describes itself as “a radical and militant economic emancipation movement” is South Africa's third largest political party, with support among poor and working class Black South Africans who feel they have not benefited from the end of white minority rule in 1994.

Critics say the party has used anti-white rhetoric, but the EFF denies it is racist.

The shutdown may serve as a barometer for the EFF's support ahead of national elections in 2024.

The ANC, the party of Nelson Mandela, has ruled since 1994, but has gradually lost support as voters have become disillusioned with an anaemic economy, rampant corruption and high levels of crime.

'Just the beginning'

The party is expected to struggle to win an outright majority next year, ushering in an era of coalition politics and potentially putting the EFF, or the main opposition Democratic Alliance, in a position to share power.

As the day got under way, Julius Malema, the EFF's commander in chief, told supporters: “It's just the beginning. Now, let's go out and join the picket lines. They said it was a normal day, but you could see who the deceivers were. You proved to the doomsayers once more that we remain the only disciplined force on the left.”