Money in the UAE is about far more than material wealth.

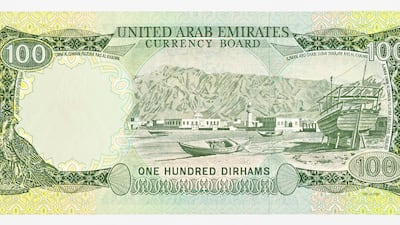

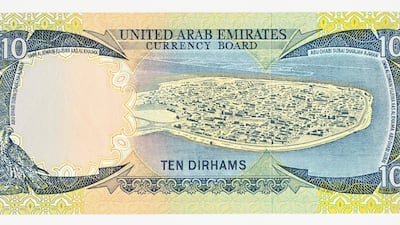

A clock tower and police fort in Sharjah. A bird's eye view of Umm Al Quwain. The Ruler's palace in Ajman. A harbour in Ras Al Khaimah.

These were some of the images displayed on the UAE's first-issue banknotes, which came into being on May 19, 1973, nearly two years after the nation was unified.

Arabic lettering adorned the front of the Dh1, Dh5, Dh10, Dh50 and Dh100 notes, while there was English on the back.

While the currency undoubtedly hoisted the UAE into a new era of global recognition, allowing it to join the World Bank, these banknotes not only symbolise the country's prosperity, but also its heritage, traditions and moral values.

A brief history of UAE currency

Three years later, in 1976, a dark blue Dh1,000 note was issued, featuring forts from Dubai and Abu Dhabi.

It was 10 years before the Dh500 note, featuring Dubai's Jumeirah mosque, made its debut, while the colour-shifting, brown-hued Dh200, on which the Central Bank of the UAE is pictured, did not appear until 1989.

Before the UAE dirham, which since 1997 has been pegged to the US dollar at a rate of Dh3.6725, the Qatar and Dubai riyal changed hands among Emiratis, and previously, in 1959, there was a special Gulf issue of the Indian rupee, which was in circulation in what were then known as the Trucial States.

The Qatar and Dubai riyal had been in circulation since 1966 in all emirates but one: Abu Dhabi, where residents used the Bahraini dinar instead.

The Saudi riyal and even the Maria Theresa silver thaler were other currencies that had been used at various points the history of the area.

Paper money was not the only form of currency issued nearly 50 years ago, there were also six types of coin, only three of which are still in circulation: the 25 fils, 50 fils and one dirham. The 1, 5 and 10 fils are no longer used.

A sand gazelle, oil derricks and traditional dallah coffee pot all featured on the metal coins.

'A renewed pledge'

The currency continues to progress with the times and, over the years, several new banknotes marking important occasions have been circulated, such as in December, when a new Dh50 banknote was launched to celebrate the country's 50th National Day.

It depicts a portrait of the UAE Founding Father, the late Sheikh Zayed bin Sultan Al Nahyan, with a commemorative picture of the founding rulers after signing the Union document, and an image of Wahat Al Karama, a memorial for Emirati soldiers killed in the line of duty.

“We see, in this issuance, the new phase that the UAE will enter and a renewed pledge to continue its growth path,” said Sheikh Mansour bin Zayed, Deputy Prime Minister and Minister of Presidential Affairs, and chairman of the board of directors of the UAE Central Bank, at the launch of the note, state news agency Wam reported.

Only last month the Dh50, with new Dh5 and Dh10 banknotes, entered circulation, made of durable polymer material and with security features to prevent counterfeiting.

Ajman Fort and Dhayah Fort in Ras Al Khaimah feature on the Dh5, while Sheikh Zayed Grand Mosque in Abu Dhabi and Sharjah's Khor Fakkan amphitheatre appear on the Dh10.

Each has a transparent window featuring a portrait of Sheikh Zayed, along with the UAE brand logo, fluorescent drawings and inscriptions created using special printing techniques.

The technology and techniques might be new, but the symbols and images are as old as the country, and will no doubt continue to be used for many years to come.