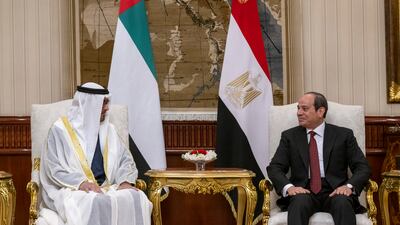

President Sheikh Mohamed arrived on Wednesday in Cairo where he held talks with Egypt's president, Abdel Fattah El Sisi, state news agency Wam reported.

The two leaders reviewed bilateral relations in all fields and close cooperation between the two nations on regional issues, the Egyptian presidency said.

"The meeting included an exchange of views on the most pressing regional and international issues. Their discussion reflected mutual understanding on how to handle these issues," it said.

"I had the pleasure of meeting with my brother President Abdel Fattah El Sisi in Cairo today. We explored opportunities to further strengthen the deep-rooted ties between the UAE and Egypt, and discussed our shared interest in promoting regional stability and progress," Sheikh Mohamed said in a tweet.

Earlier on Wednesday, the UAE leader was greeted on his arrival at Cairo International Airport by Mr El Sisi.

The two leaders then drove to the nearby Ittihadiyah presidential palace, where Sheikh Mohamed inspected a guard of honour, footage released by Mr El Sisi's office showed.

Sheikh Mohamed was accompanied on his visit to Cairo by Sheikh Mansour bin Zayed, Vice President, Deputy Prime Minister and Minister of the Presidential Court; Sheikh Hamdan bin Mohamed; and Sheikh Sultan bin Hamdan, adviser to the UAE President.

Also travelling with the UAE leader was Sheikh Mohamed bin Hamad, adviser for Special Affairs at the Ministry of Presidential Affairs, and Ali Al Shamsi, Secretary General of the Supreme Council for National Security.

The UAE's ambassador in Cairo, Mariam Al Kaaby, joined the delegation.

In addition to Mr El Sisi, the UAE President was received at the airport by Prime Minister Mostafa Madbouly, Foreign Minister Sameh Shoukry, Electricity Minister Mohammed Shaker, Planning Minister Hala El Said and Abbas Kamel, the chief of intelligence.

Strong allies

The UAE is among Egypt's main Arab allies and financial backers. The two countries are bound by vast economic and military ties.

The leaders of the two countries frequently consult on regional and international issues and their armed forces regularly hold joint exercises.

In February, Mr El Sisi visited Abu Dhabi during a working trip to the UAE to attend the World Government Summit in Dubai.

During a short break at Al Shati Palace, he and Sheikh Mohamed discussed bilateral ties, aspects of co-operation and ways of strengthening them.

In August, Sheikh Mohamed held talks with Mr El Sisi at El Alamein International Airport north of the Egyptian capital, Cairo.

The two sides discussed co-operation and opportunities to grow the strategic partnership between the UAE and Egypt, especially in the economic and development fields.

The UAE, Saudi Arabia and Kuwait are thought to have provided Egypt with about $100 billion over the past decade in grants, loans, investments and discounted shipments of oil products.

Mr El Sisi has frequently thanked the three nations publicly for their aid, saying Egypt could not have managed economically without their help during the economic slump and political turmoil in the years that followed a 2011 uprising that forced long-time ruler Hosni Mubarak to step down.

Egypt has again been gripped by an economic crisis chiefly caused by the fallout from the Ukraine war.

Since March last year, the value of Egypt's currency has almost halved. Its double-digit inflation is at its highest level in nearly six years and the country suffers from a persistent foreign currency shortage.

The Egyptian government is hoping that national sovereign funds from Gulf Arab states would buy stakes in 32 companies and banks which Cairo announced this year would be available for privatisation.