Follow the latest updates on Expo 2020 Dubai here

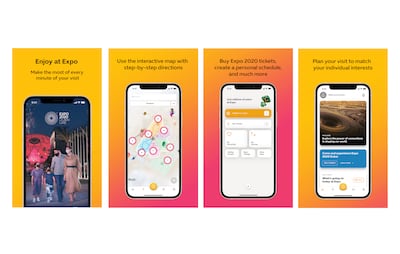

Visitors to Expo 2020 Dubai can now download three different apps to streamline their visit.

The official app will help match users' interests with events and attractions, and offer a virtual queuing facility.

The Business App aims to facilitate business connections through an innovative AI-powered algorithm.

Both apps are now available for download through App Store or Google Play.

The Expo 2020 Dubai site is twice the size of Monaco, so organisers recommend people plan their visits ahead of arriving.

What can I use the official Expo 2020 Dubai app for?

Visitors can use the app to buy tickets, or choose from more than 200 dining options and themed culinary events.

Guests can also use the app to manage reservations for Expo 2020’s intelligent Smart Queue system, which has been designed to dramatically reduce queues at popular pavilions.

Using the app, visitors can reserve a convenient time slot to visit the pavilions of their choice.

A chatbot on the app provides information on opening times, parking options and how to reach Expo using Dubai’s public transport options, and the RTA's free bus service.

There is also a GPS-enabled interactive map of the Expo site on the app, and step-by-step directions to places of interest across Expo, so visitors can make the most of their time.

The app also allows users to tailor their visit to Expo 2020, matching individual interests to create a personal schedule of events and attractions.

Where do I get the official Expo 2020 Dubai app?

The free app can be downloaded from App Store or Google Play.

Users then need to create an Expo 2020 account or link to it using their social media account.

How do I book tickets for Expo 2020 Dubai attractions?

Mohammed Al Hashmi, the chief innovation technology officer for Expo 2020 Dubai, said the best way to book tickets to Expo's attractions is through the app.

"Whether you’re interested in boarding our Garden in the Sky observation tower 55 metres above the ground; partying at Expo Beats, our monthly music festival featuring a global cast; or experiencing the spectacular Expo Water Feature, the Expo 2020 app has everything on offer at your fingertips," said Mr Al Hashmi.

What is the Expo 2020 Business app for?

Expo 2020 Dubai is not just designed to wow visitors, it is also designed to offer the world a platform to communicate and do business.

With nearly 200 countries represented on site, all displaying their brightest and best, organisers hope Expo 2020 Dubai will be a great place to make connections.

The Expo 2020 Business App matches users with similar interests and objectives among the business community, with the objective of facilitating meaningful business to business (B2B), business to government (B2G) and government to government (G2G) interactions across geographies and industries.

Thanks to inbuilt artificial intelligence, the app suggests potential matches for users based on their profiles, expertise, goals and interaction patterns.

Where do I get the Expo 2020 Business app?

The app can be downloaded for free of charge through WebApp, App Store and Google Play.

Users then create their own unique profile, highlighting key information and contact details, and then select filters and research potential match partners.

Once a connection is made, users can start engaging, chatting and scheduling meetings with other users, businesses and entities of interest to establish relationships during and beyond Expo.

A small registration fee applies to access the app’s premium features, such as networking, connecting, chatting and scheduling meetings.

Holders of the Premium Experience can enjoy complementary access to the premium features of the Expo 2020 Business App, alongside a host of additional services.

Keep fit at Expo 2020 Dubai with the Glofox app

The Expo 2020 Sports, Fitness and Wellbeing Hub has partnered with the Glofox app to help visitors make the most of all the sport and health-related activities available at the global fair.

There will be a wide variety of sports events for all ages and physical abilities taking place during Expo 2020.

To view timetables and services, book classes and engage with other members and instructors, Expo organisers recommend downloading the Glofox app.

How do I use the Glofox app at Expo 2020 Dubai?

Download the Glofox app through App Store and Google Play

Search for "Expo 2020: Sports, Fitness and Wellbeing Hub", then sign in and start registering for sessions.