“We will be able to achieve in our bright future much more than what we were able to realise in our brief yesterday,” said Sheikh Zayed bin Sultan Al Nahyan, as if gazing at the United Arab Emirates through a looking glass.

As we mark the 50th anniversary of his accession to Ruler of Abu Dhabi, on August 6, 1966, it is from a place where it would be easy to take his accomplishments for granted, so surrounded are we by modern comforts. But looking back on that “brief yesterday”, how remarkable that bright future was to become almost instantaneously: he was less than five years away from bringing together the emirates as a country, on December 2, 1971, at which point his nation-building took on a whole new momentum.

Expanding his community-building work as the Ruler’s Representative of the Eastern Region, Sheikh Zayed laid the building blocks of the people’s future well-being: schools and hospitals, roads and ports, land plots and oil refineries, even while extending the prosperity farther from home, through his many humanitarian projects abroad.

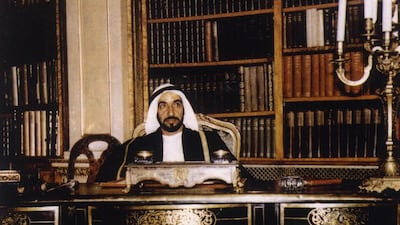

In these photographs released by the National Archives to commemorate the anniversary, the seeds of Sheikh Zayed’s legacy are apparent. So often photographed among his people, it is a wonder that he found any time to sit at a desk.

According to Jayanti Maitra in Zayed: From Challenges to Union, the accession of the new Ruler “marked the beginning of a new era”. Rulers from the Trucial States came to pay him their respects, and he assured them that his approach would be one of cooperation and friendship.

And so, while much is different about the modern Abu Dhabi 50 years on from that historic occasion, much also remains the same.