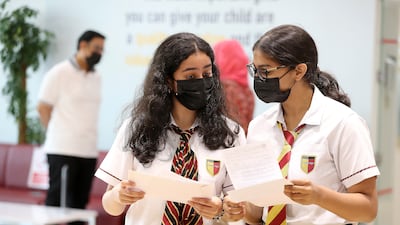

Thousands of pupils across the UAE will receive their A-Level results at about 11.30am on Tuesday morning.

Summer exams were cancelled owing to the Covid-19 pandemic. It was the second year in a row that exams could not be held because of the outbreak.

In the absence of summer exams, pupils will be awarded grades based on assessments carried out by teachers.

Teachers at schools across the Emirates have taken into consideration two years of evidence of pupils' achievements to determine their results.

These grades are based on actual assessments and mock exams, as well as coursework in some subjects and portfolio submissions in others.

External exams were not possible this year.

Gems Wellington Academy – Al Khail in Dubai had 31 A-Level pupils and 91 A-Level entries. At the school, 26 per cent of the entries achieved A* and 52 per cent received an A* to A.

“We are delighted with the exceptional A-level results our pupils have achieved this year," said Campbell Douglas, principal at the school.

“The hard work, commitment and dedication from both pupils and teachers alike have paid off in what has been an extremely challenging year."

Gems Metropole School in Motor City, Dubai, had 42 A-Level class pupils and 123 entries, of which 20 per cent scored A* and 41 per cent earned A* to A.

Nav Iqbal, principal at the school, said this year was the school’s strongest performance at A-Level.

"I am delighted to say that there has been significant improvement since the previous academic year," he said.

"This is testament to our hard-working pupils who, despite the challenges faced during the pandemic, performed exceptionally well.

“Standout subject performances were recorded in chemistry, drama, art and economics, and we have seen an increase in the number of A* to A grades this year, especially in maths (up 48 per cent) and chemistry (up 29 per cent).”

Pupils in some British-curriculum schools in the UAE sat two mock exams this year. This helped teachers gather sufficient evidence determine their grades.

Every year, pupils sit one set of mock tests under exam conditions.

Last summer, the cancellation of final year exams, including International Baccalaureate exams, A-Levels and some Indian School Certificate tests, meant pupils were graded based on mock exams or internal projects.

But some pupils felt they were unfairly represented by their results.