When history repeats itself, it is not supposed to be as a farce both times. Not according to Karl Marx, who coined the phrase, anyhow.

Yet for the second time in 24 hours, a transfer window closed amid a sense of embarrassment.

Attempts at deadline-day brinkmanship had failed.

Much as those involved tried to save face, no one came out of either situation with any credit.

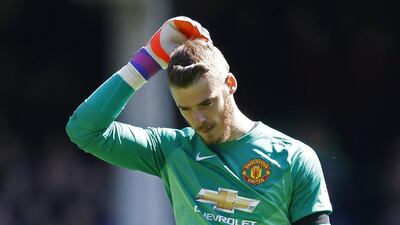

Real Madrid and Manchester United spent Tuesday blaming each other for the breakdown of David de Gea’s £29 million (Dh162.6m) move to the Bernabeu on Monday.

An unsettled player was promptly warned by Spain manager Vicente del Bosque that he has to play first-team football if he is to go to Euro 2016.

United manager Louis van Gaal, who seemed willing to dispose of the Premier League’s best goalkeeper, may have to show rather better man-management skills to bring De Gea back into the fold.

But at least the Spaniard kept his counsel. Saido Berahino did not. The striker tweeted that he would never play for West Bromwich Albion’s chairman Jeremy Peace again. Berahino was relieved of two weeks’ wages as punishment for his outburst and Albion repelled four Tottenham Hotspur bids.

GALLERY: From Darmian at Man United to Ayew at Swansea: The five best Premier League summer transfers

It means Tottenham’s sole strikers are the overworked Harry Kane and Emmanuel Adebayor, who is persona non grata.

There are plenty around The Hawthorns who would have happily seen the back of Berahino, whose attitude has been questioned for years. A refusal to sell has bemused them.

So the losers from this transfer window include Albion, Tottenham, Berahino, De Gea and Madrid.

And United, too, even though their first four signings — Memphis Depay, Morgan Schneiderlin, Bastian Schweinsteiger and Matteo Darmian — all offer cause for encouragement.

Yet events at the end brought their competence into question, and not merely because they paid over the odds in spending £36m on the untried Anthony Martial.

The lesson for all concerned is that business should not be left to the last hours of the window.

Swansea City are the best-run club in the Premier League and signed no one on Tuesday.

Their main summer acquisition, Andre Ayew, has scored three goals while others were still trying to tie up deals.

Manchester City were the biggest spenders, paying excessive fees for Raheem Sterling, Kevin de Bruyne and Nicolas Otamendi, but at they least secured some of their main targets.

The same could not be said for Chelsea, Pedro apart, and their inability to land John Stones or any other proven high-class centre-back leaves them with the feel of a failure.

The chances are that the Arsenal support would share those sentiments. The optimism after Petr Cech’s arrival dissipated as no striker or midfielder followed, leaving the London side as the only club in Europe’s top five leagues who did not recruit an outfield player.

Liverpool contrived to spend £84m and upgrade in some attacking roles but not enough defensive ones. They may be both winners and losers of the windows.

Definite success stories include Crystal Palace, propelled forward by Yohan Cabaye and Bakary Sako, and West Ham United, who followed the inspired acquisition of Dimitri Payet with four late additions that suggest that they, at least, can find players in the final hours. Newcastle United spent early and heavily, but while they remain winless there are signs they bought well.

Unless the last-day additions Fabio Borini and DeAndre Yedlin succeed, Sunderland may be deemed losers.

Certainly Norwich City fared poorly, the signing of Dieumerci Mbokani apart. They were left with the wantaway forward Lewis Grabban, failed to bring in the centre-back they needed and missed out on targets such as Jonathan Walters and Steven Naismith.

And, needless to say, such disappointment came on the dreaded deadline day.

FOLLOW US ON TWITTER @NatSportUAE