Donald Trump signed an executive order on Thursday that would "minimise" the work and authority of the Department of Education, in a move that only partly delivers on a major campaign promise and long-time goal of many Republicans.

Surrounded by schoolchildren, Republican governors and other supporters, Mr Trump signed the order at the White House, instructing Education Secretary Linda McMahon to immediately begin reducing the work of the agency and hand over much of the authority over education to the states.

"The United States spends more money on education by far than any other country, and spends, likewise, by far, more money per pupil than any country, and it's not even close, yet we rank near the bottom of the list in terms of success," Mr Trump said.

"We're going to be returning education, very simply, back to the states where it belongs, and this is a very popular thing to do, but much more importantly, it's a common sense thing to do and it's going to work."

The move is part of a wider effort by Mr Trump to reduce the size and powers of the federal government, based on ideology held by many conservatives that a larger government limits civil liberties.

"As you know, the President directed Linda McMahon to greatly minimise the agency," White House press secretary Karoline Leavitt told reporters earlier on Thursday. "The Department of Education will be much smaller than it is today."

Mr Trump said he hoped Ms McMahon would be the last US education secretary and that critical measures to oversee student loans and grants programmes will be "fully preserved".

Many Republicans have identified federal programmes such as social security, unemployment, disability, food stamps and federally funded health insurance as interventionist and wasteful. They accuse the Department of Education of promoting a progressive agenda in schools, including critical race theory and “gender ideology”.

Mr Trump, who took office on January 20, has already narrowed the powers and work of the Department of Education. Its workforce has been halved and he ended funding for many of its programmes.

He also charged Elon Musk, his billionaire adviser, with making major cuts to other government agencies, including the US Agency for International Development (USAID). But this is the first attempt to dismantle a cabinet-level agency.

Public schools are already largely controlled by states and funded by taxes collected in each municipality. The federal government supplies between 7 per cent and 13 per cent of the funding, depending on the needs of each district.

The funds provide student loans, school meals, funding for disability programmes and support for homeless students. The department also oversees public universities.

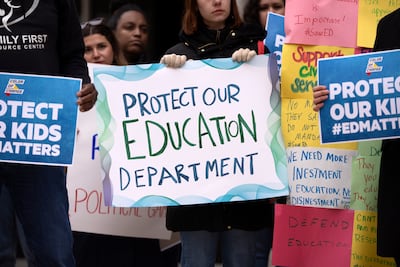

Critics say ending these programmes will disproportionately affect poorer students who are already at a disadvantage.

“Without the Department of Education, there is no guarantee that our children will receive the public education they are entitled to,” the National Parents' Union wrote in a statement.

“Eliminating this critical infrastructure weakens our nation, erodes opportunity and makes it even harder for families to advocate for the resources and support their children need.”

The Department of Education was created in 1979 in a bipartisan effort by Congress. Experts say only Congress has the authority to terminate it. Mr Trump's Republican Party has a majority in Congress but to pass such legislation in the legislature, he would need the support of several Democrats.