Fighting between Syria's government and Druze fighters in southern Sweida subsided on Wednesday after a US-brokered peace deal, although troops were still encircling the area.

The internal strife, which has drawn an Israeli military intervention and affected Jordan, broke out in Sweida in July amid resistance by Druze spiritual leader Sheikh Hikmat Al Hijri to government attempts to impose control and appoint local officials. Since then, the area has been cut off from the outside world.

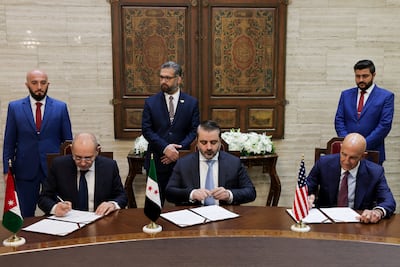

The agreement signed in Damascus on Tuesday provides for measures to calm tensions, improve humanitarian conditions and partially integrate Sweida into the post-Bashar Al Assad state. Hayat Tahrir Al Sham, a splinter group from Al Qaeda, ousted Mr Al Assad at the end of 2024.

Sources in Sweida and Jordan reported a last exchange of machinegun fire in western Sweida overnight, particularly near the village of Arneh. The rural area forms a front line between the Druze on one side and government forces and allied militia on the other.

“The clashes stopped by the morning. The ceasefire part of the deal appears to be holding,” a source in Jordan said.

The kingdom's Foreign Minister, Ayman Safadi, was in Damascus for the signing of the deal. It stipulates the withdrawal of pro-government militias to the administrative borders of Sweida, the opening of the main road from Sweida to Damascus, and the creation of a local police force with a commander appointed by Damascus.

The Druze and the Sunni-dominated government are supposed to “agree on a road map for reconciliation”, but the deal did not set any deadlines.

Suhail Thebian, a prominent civil figure in Sweida, said government roadblocks around the province showed no signs of being dismantled. He said pro-government fighters had not moved from dozens of villages west and north of Sweida city.

“It is crucial that the military and the [government] militias withdraw so that tens of thousands of the displaced can go back,” said Mr Thebian. Shortages of basic goods continue in the province, especially bread, he said. “Most bakeries are still not operating because there is no wheat."

Sweida is on the border with Jordan, which has a small Druze population as well as Bedouin tribes who extend into Syria.

The government said it sent troops to Sweida in response to clashes in July between the Druze and Sunni inhabitants of Bedouin origin. Israeli air strikes halted their advance. The thrust of the government offensive has given way to low-intensity warfare.

Hundreds of civilians, mostly Druze, were killed in the fighting. The UN said there was a humanitarian crisis in the area because of shortages of food, medicine, fuel and electricity.

More than 161,000 people have been displaced as a result of the conflict, most of them from the Druze population, the UN said last month. However, at least 30,000 Bedouin have been uprooted as a result of the conflict and are now mostly living in schools in neighbouring Deraa province.

A so-called Legal Council, comprised mainly of judges and lawyers loyal to Mr Al Hijri, runs civil affairs in Sweida province. Late on Tuesday, the council said it rejected the deal's clauses about Damascus having a say over the police in Sweida, and that Sweida should have local councils to negotiate with Damascus instead of a full-fledged political leadership.

Sweida will keep “the right of self determination … either through administration or separation from Syria”, the council said.

Axios reported this week that Israel has presented Syria with proposals for demilitarised zones south of Damascus, as part of continuing security talks between the two sides, which Washington is also brokering. It is not clear whether these zones would include front lines between the government and the Druze.